Mastering Shipping Restriction Record Keeping Requirements

Stay audit-ready with our guide to shipping restriction record keeping requirements. Learn what records to keep, for how long, and how to avoid costly fines.

Cody Y.

Updated on Dec 7, 2025

Trying to navigate shipping regulations can feel like steering a ship through a storm. One wrong move, and you could be facing hefty fines or seized shipments. This is where shipping restriction record keeping requirements become your business's first and most critical line of defense. Think of it as your ship's logbook—every entry is proof of your due diligence, protecting your brand from the storm.

Why Your Record Keeping Is Your First Line of Defense

Proper documentation is the absolute bedrock of compliance. With regulatory scrutiny getting tighter every year, you can't afford to treat your records as a reactive burden. It has to be a proactive strategy. It’s the difference between confidently handing over a detailed log during an audit and scrambling to justify decisions you made months ago.

This proactive mindset is more important than ever as governments ramp up their oversight. For instance, in August 2025, U.S. Customs and Border Protection (CBP) rolled out a new mandatory monthly reporting process for products under the Uyghur Forced Labor Prevention Act (UFLPA). This rule demands that importers submit incredibly detailed worksheets, signaling a clear trend toward tougher record-keeping standards. You can get a sense of these shifts by exploring the latest trade updates for August 2025.

The Strategic Value of Meticulous Records

When you start viewing your records as a strategic asset, the entire process shifts from a tedious cost center into a powerful tool for mitigating risk. Good documentation does more than just keep regulators happy.

- Audit Preparedness: When an auditor comes knocking, you can instantly produce a complete, timestamped history of every decision. No panic, just proof.

- Dispute Resolution: If a shipment gets held up or questioned, your records provide undeniable evidence of the rules you applied and the actions you took.

- Operational Improvement: Digging into your compliance logs can reveal patterns. Maybe you're blocking too many orders from a certain area, or a specific rule is causing friction. This data helps you fine-tune your process.

Think of your compliance records like a black box recorder for your business. If something goes wrong, it provides an objective, detailed account of exactly what happened and why, proving you followed all the established safety and compliance protocols.

Core Components of an Audit-Proof System

A truly robust record-keeping system is built on a foundation of clear, consistent data points. To be audit-proof, your logs have to tell a complete story for every single transaction involving a regulated product. The goal is to design a system that answers any potential question a regulator might have before they even ask it.

Failing to maintain this level of detail can easily be interpreted as negligence, which opens your business up to significant legal and financial risk.

To build an audit-proof system, you need to track several core components for every restricted order attempt.

Core Components of an Audit-Proof Record Keeping System

Here's a quick overview of the essential elements your business must track to meet shipping restriction requirements.

| Record Component | Why It's Critical for Compliance | Example Data Point |

|---|---|---|

| Timestamp | Proves when a decision was made, aligning it with the laws in effect at that moment. | 2025-10-26 14:35:10 UTC |

| Order Details | Links the compliance decision directly to a specific transaction. | Order ID: #12345, Customer: John Doe |

| Product(s) Involved | Shows which specific regulated items triggered the shipping restriction. | SKU: HG-1911-BLK, Product: "Model 1911 Handgun" |

| Shipping Address | Captures the exact destination that was evaluated against your rule set. | 123 Main St, Anytown, CA, 90210 |

| Restriction Rule Applied | Identifies the specific rule that was enforced, proving a systematic process. | Rule ID: CA-HANDGUN-BAN, Description: "No handgun shipments to CA" |

| Action Taken | Documents the outcome—was the order blocked, an item removed, or was it approved? | Action: BLOCK_SHIPPING_METHOD |

| System/User ID | Attributes the decision to either an automated system or a specific user. | System: ShipRestrict v2.1 or User: admin@mystore.com |

Ultimately, a system that captures these details for every transaction doesn't just satisfy compliance requirements; it creates a bulletproof history that protects your business from legal challenges and operational uncertainty.

Building Your Essential Compliance File Cabinet

When an auditor comes knocking, they aren’t looking for a handful of spreadsheets. They expect a well-organized, complete collection of documents that tells the compliance story of every single regulated sale you've made. Think of it as your business’s "compliance file cabinet"—a meticulously kept archive that proves you followed the rules, every step of the way.

This file cabinet, whether it’s made of steel or sitting in the cloud, needs to hold more than just basic order info. It's your evidence locker. It houses the proof of due diligence for every shipment that leaves your warehouse. Failing to produce these specific records on demand is often seen as a direct admission that your compliance program is weak or nonexistent, even if no actual shipping violations occurred.

Key Documents Every Auditor Expects

Your compliance file needs a logical structure, one that lets you instantly pull up all the documents for a specific order, date range, or shipping rule. While the exact requirements can shift depending on your industry and location, some documents are the universal foundation of an audit-proof system.

Here are the non-negotiable records your business absolutely must maintain:

- Denied Party Screening Logs: This is way more than a simple "pass/fail" check. A defensible log includes the date and time of the screening, the customer's name and address, the specific government lists you checked (like OFAC or BIS), and the result. This creates an undeniable trail of diligence for every transaction.

- Age Verification Records: If you're selling products like alcohol, tobacco, or firearms, you have to document how and when a customer’s age was verified. This record should show the method used (e.g., a third-party service API call), a timestamp, and the verification result, tying it directly to the customer’s account or a specific order ID.

- Shipping Restriction Enforcement Logs: This is arguably the most critical file in your cabinet. It must detail every single instance a shipping rule was triggered. The log should capture the order ID, the product SKU, the shipping destination, the specific rule that blocked the shipment (e.g., "No handgun sales to Chicago, IL"), and the action taken (e.g., "Checkout Blocked").

An auditor's primary goal is to verify your process. Your records need to demonstrate that you have a systematic, repeatable, and enforceable compliance framework in place—not just a collection of ad-hoc decisions.

Specialized and International Documentation

Beyond these core logs, your industry might demand highly specific paperwork. For instance, businesses dealing with chemicals or certain electronics have to maintain detailed hazardous material (hazmat) manifests for each shipment, spelling out the contents, handling requirements, and emergency contacts. These aren't optional—they are mandated by agencies like the Department of Transportation (DOT).

International trade adds another layer of complexity. A major development in shipping restriction record keeping requirements is the Hong Kong Convention, which entered into force in June 2025. This regulation requires ships over 500 gross tons to keep a detailed inventory of hazardous materials onboard, reinforcing the global trend toward stricter documentation.

Organizing these documents is non-negotiable. You need a system where both physical and digital records are secure but also easy to find. To make sure your physical papers last, check out this ultimate guide to preserving your essential papers. For more strategies on setting this all up, our detailed guide on how to document shipping restrictions for legal compliance breaks it down even further.

Taking the time to build this cabinet is the first step toward turning a stressful audit into a simple demonstration of your commitment to compliance.

How Long You Really Need to Keep Your Records

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/vcwp-orNgIs" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>Figuring out shipping recordkeeping requirements can feel like you're staring at a map with a dozen overlapping, contradictory routes. One of the biggest headaches is knowing exactly how long you have to hang on to all that compliance paperwork. There’s no single, clean answer, which is precisely why you need a clear strategy.

Think of federal regulations as the national speed limit on the highway—they set a baseline that applies everywhere. Agencies like the Department of Transportation (DOT) or the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) lay down these foundational rules. For instance, the ATF might require you to keep firearm sales records for 20 years or more.

But just like states can slap a lower speed limit on a small town road, they can also impose much stricter record-keeping rules. A state might demand you hold onto alcohol shipment records for seven years, even if a federal guideline only suggests three. This creates a messy compliance landscape where the rules literally change with every shipping address.

The Strictest Applicable Rule Framework

The only foolproof way to stay compliant across the board is to adopt the "strictest applicable rule" framework. It’s pretty simple in concept: for any product you sell, you have to identify all the federal, state, and local retention rules that could apply and then follow the one that requires you to keep records the longest.

It's a proactive approach that saves you from getting burned by following a looser federal rule when a tougher state law is in play.

Imagine you sell a product regulated at both the federal and state level. The feds say keep the records for five years. But California, a huge market for you, demands they be kept for eight years. To stay in the clear, your company-wide policy has to be at least eight years, no matter where the shipment went. Making the longest period your standard simplifies everything and ensures you’re always covered.

Federal vs State Geo-Aware Retention

To pull this off, your system has to be smart enough to know not only what you’re shipping but where it’s headed. This is where a geo-aware strategy becomes essential for applying the right retention policy. Let's break down how this works with a few real-world examples.

This handy table shows just how much retention periods can vary and why you need a clear, conservative policy.

Federal vs State Record Retention At a Glance

| Product Category | Typical Federal Requirement | Example State-Specific Requirement | Compliance Recommendation |

|---|---|---|---|

| Firearms | 20 years (ATF) | May include additional state-level reporting mandates. | Follow the 20-year ATF rule as the absolute minimum. |

| Alcohol | 3 years (TTB for certain records) | 7+ years in states like New York for specific permits. | Adopt the 7-year retention period for all alcohol sales records. |

| Tobacco/Vape | 4 years (FDA/PACT Act) | 5+ years in states like Washington for tax purposes. | Set your policy to 5 years to cover stricter state tax laws. |

| Sanctioned Goods | 5 years (Standard) | OFAC can extend this based on enforcement priorities. | Default to the longest period, which can be 10 years or more. |

Adopting the longest retention period as your standard is the safest bet to avoid compliance gaps between different jurisdictions.

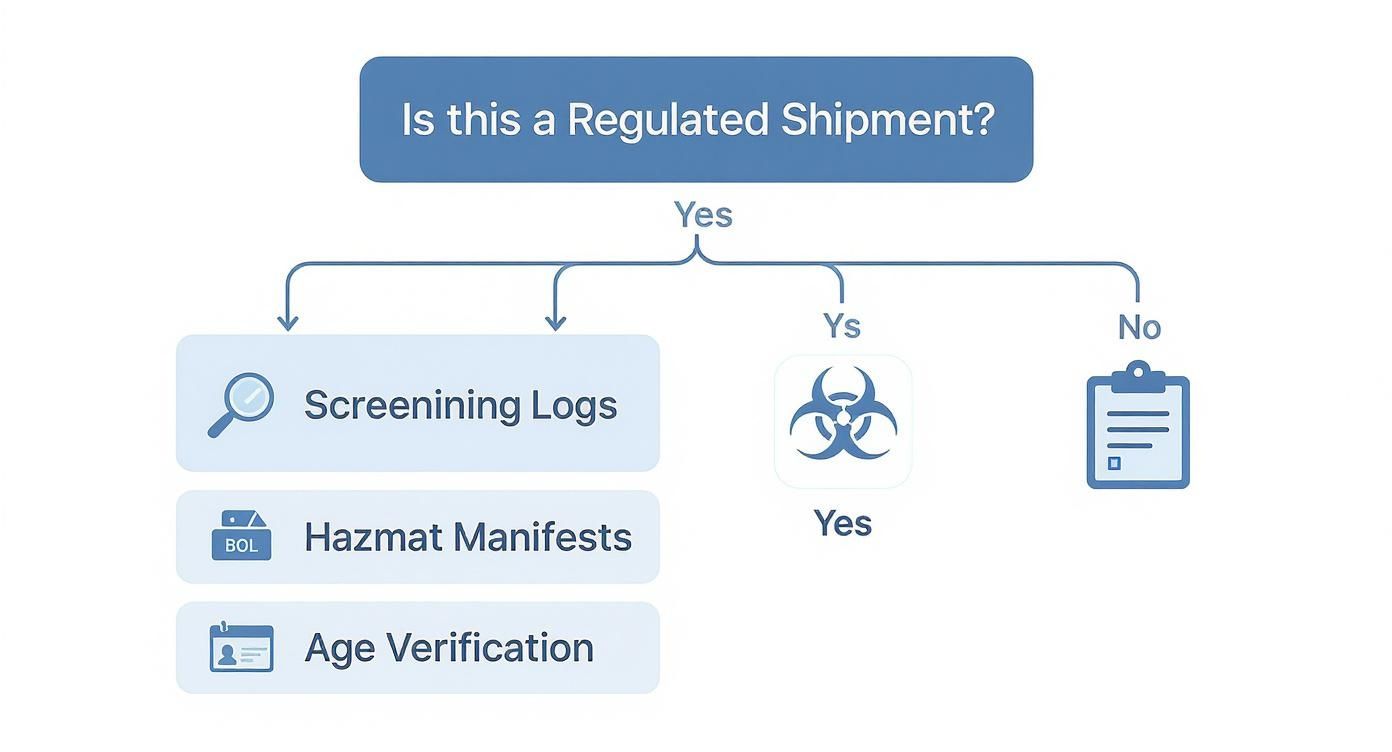

This flowchart helps visualize how that initial decision-making process should look when a regulated product enters your workflow.

As you can see, the moment a shipment is identified as "regulated," it triggers a cascade of documentation needs, from screening logs to specific manifests.

The Shifting Sands of Retention Periods

Here's the kicker: these rules aren't set in stone. Geopolitical events or new domestic policies can change retention requirements overnight. A perfect example is when the Office of Foreign Assets Control (OFAC) doubled its mandated record retention period from five to ten years for businesses dealing with U.S. sanctions, a direct response to a tougher enforcement climate. You can read more about these kinds of shifts in the Chambers 2025 practice guide.

The key takeaway is simple: your record retention policy cannot be a "set it and forget it" document. It must be a living process, regularly reviewed and updated to reflect the most current and strictest applicable regulations.

By building a flexible, geo-aware retention strategy, you can turn a confusing mess of rules into a clear, defensible compliance system. That diligence is what protects your business from fines and legal headaches, keeping your operations humming no matter how the regulatory landscape changes.

Designing Your Logs to Withstand Scrutiny

When an auditor comes knocking, a messy spreadsheet just isn't going to fly. The real goal isn't just to have data, but to present a crystal-clear, unshakeable story of your compliance efforts. A well-designed log can turn a high-stress audit into a simple, straightforward review of your good work.

Think of your compliance log like a bank's financial ledger. Every single entry needs to be permanent, instantly searchable, and tied directly to one specific transaction. Anything less opens the door to suspicion, making it look like your process is sloppy or, even worse, negligent. The foundation of solid shipping restriction record keeping requirements is proving why a decision was made at a specific point in time.

The Anatomy of an Audit-Proof Log Entry

To hold up under intense regulatory scrutiny, every single log entry must answer the key questions an auditor will have. Your records need to paint a complete picture of each compliance check, leaving zero room for doubt. At the very least, each entry has to include a few non-negotiable pieces of information.

These fields work together to create a coherent, defensible record of your actions for every regulated order.

- Precise Timestamp: This documents the exact date and time (down to the second) a compliance check happened. It proves the decision was based on the rules in effect at that exact moment.

- Unique Order Identifier: This directly connects the compliance decision to a specific customer transaction, like an order ID or cart number.

- Specific Rule Applied: This records the exact restriction that was triggered—for example, "Rule ID:

NY-MAG-CAP-BAN- No high-capacity magazines to New York." It shows your system isn't just blocking things randomly. - Action Taken (The Outcome): This clearly states what happened next. Did you block the entire order? Prevent a certain shipping method? Maybe you just removed one item from the cart?

Without these core elements, your log is just a bunch of incomplete notes that fail to show a systematic, repeatable process.

An audit-proof log is your objective witness. It provides an impartial, step-by-step account of your compliance process, proving that every decision was made based on established rules, not guesswork.

Structuring for Searchability and Clarity

Beyond just capturing the right data, how you structure your logs is critical. An auditor needs to be able to find and verify information fast. A massive, unsorted data dump is almost as bad as having no records at all. Your system should let you instantly filter and pull a complete compliance history for any given order.

For example, if an auditor asks about order #54321 from June 15th, you should be able to pull up a report in seconds. It needs to show the timestamp, the destination address checked, the specific state law that was applied, and what your system did about it. That level of organization screams competence and control. For businesses on WooCommerce, getting ready for this level of detail is a must; you can find more practical steps in our WooCommerce shipping compliance audit checklist.

This structured approach is what separates businesses that just react to regulations from those that proactively manage their compliance. By designing logs that are both comprehensive and easy to navigate, you build a powerful defensive asset that shields your business from scrutiny and expensive penalties.

Common Record Keeping Mistakes and How to Fix Them

Even businesses with the best intentions can stumble over the nitty-gritty details of shipping restriction record keeping. It's easy to do. But simple oversights in how you document blocked orders can quickly snowball into serious liabilities during an audit. Understanding these common pitfalls is the first step toward building a compliance system that’s actually resilient.

Think of your compliance log as a detective's case file. If any piece of evidence is missing, the entire case can fall apart under questioning. These mistakes create gaps in your story, making it tough to prove you were diligent when it really counts.

Mistake 1: Incomplete or Vague Log Entries

One of the most frequent errors we see is logging that a shipment was blocked without documenting why. An entry that just says "Order #12345 Blocked" is pretty much useless to an auditor. It gives them zero context and fails to prove you applied a specific, valid rule.

The Audit Risk: An auditor looking at that log is going to have questions. "Why was it blocked? Was it an arbitrary decision? Was your system just glitching out?" Without a clear reason, the block could be interpreted as a discriminatory business practice instead of a required compliance action. That's a legal nightmare you don't want.

The Fix: Every log entry needs to tell a complete story. It should explicitly state the rule triggered, the location it applied to, and the product involved. A rock-solid entry looks something like this: "Order #12345 blocked due to Rule ID IL-COOK-COUNTY-BAN for SKU AR-LOWER-XYZ shipping to ZIP code 60601."

Mistake 2: Inconsistent Data Formats

Here's another classic problem, especially in manual logs like spreadsheets. One employee enters a state as "California," another types "CA," and a third writes "Calif." It seems like a minor detail, but this kind of inconsistency makes your records nearly impossible to search, filter, or analyze when you need to.

The Audit Risk: Imagine an auditor asks you to pull all records for shipments blocked to California. If your data is a mess, you're stuck manually hunting through files. Not only does this look unprofessional, but it also raises the odds you’ll miss relevant entries. Your report will be incomplete, and the auditor's confidence in your whole process will plummet.

The Fix: Standardize all your data inputs. It’s non-negotiable.

- Use two-letter state abbreviations (e.g., CA, NY, TX).

- Stick to a consistent date and time format (e.g., YYYY-MM-DD HH:MM:SS UTC).

- Use dropdown menus or preset fields wherever you can to eliminate free-text entry.

This forces data uniformity, making your records easy to query and audit-proof.

Mistake 3: Failing to Capture Automated Decisions

As more businesses adopt automated restriction tools, a new mistake has popped up: forgetting to log the decisions these systems make. If your eCommerce platform automatically blocks a sale at checkout, but there’s no matching entry in a compliance log, you have a critical blind spot. It’s as if the event never happened.

Your compliance log must be the single source of truth for every decision, whether it was made by a person or a piece of software. If an automated system takes an action, it must be documented with the same level of detail as a manual check.

The Audit Risk: An auditor will want to see proof that your automated system is working correctly and consistently. Without a log, you can't prove the system applied the right rule at the right time. All you can say is, "we think it worked," which offers precisely zero legal protection.

The Fix: Make sure your compliance software, like Ship Restrict, automatically generates a detailed, unchangeable log for every single action it takes. This creates a defensible audit trail that shows who (or what) made a decision, when it happened, and exactly why, tying your automated enforcement directly to your record keeping requirements.

Automating Your Compliance and Record Keeping

Trying to manage compliance records manually is like having a single security guard patrol a massive warehouse. It’s impossible to be everywhere at once, and things will inevitably slip through the cracks. For any modern eCommerce business, relying on manual checks and spreadsheet logs to meet shipping restriction requirements is a high-risk gamble.

This is where automation flips the script, transforming compliance from a reactive chore into a proactive, built-in part of your operations.

Purpose-built software bridges the gap between complex regulations and flawless execution day-to-day. Think of it as a tireless, digital compliance officer that consistently enforces your entire rule set on every single transaction, 24/7. This almost completely eliminates the biggest source of compliance failures: human error. No one forgets to check a rule, misreads a state law, or makes a typo in a ZIP code.

From Enforcement to Evidence

The real power of automation goes way beyond just blocking prohibited shipments. Its greatest strength is its ability to simultaneously generate a perfect, audit-ready log of every single decision it makes. This creates an undeniable, timestamped record of your company's due diligence for every order that comes through your store.

Exploring ways of achieving instant access to security documentation can dramatically improve your efficiency, especially when these systems capture the critical "who, what, when, and why" for every compliance check. It’s what creates a truly defensible paper trail.

An automated log is your strongest asset in an investigation. It provides irrefutable proof that a systematic, unbiased, and compliant process was followed every single time, shifting the conversation from "Did you make a mistake?" to "Here is the evidence of our diligence."

The screenshot below gives you a feel for how a compliance system's dashboard can provide a clear, high-level view of its automated enforcement actions.

This kind of visual data gives you an immediate, at-a-glance confirmation that your rules are actively working to protect your business from illegal shipments.

Implementing a Bulletproof Automated System

Platforms like Ship Restrict were designed from the ground up to solve this exact problem for eCommerce stores. It isn't just a simple blocking tool; it’s both an enforcement engine and a record-keeping system rolled into one. That integration is what makes it so powerful for businesses selling regulated products.

Here’s how this approach directly crushes the pitfalls of manual compliance:

- Instant Rule Enforcement: The moment a customer enters their shipping address, the system checks it against all relevant state, county, and ZIP code rules you have in place.

- Automatic Log Generation: If a rule is triggered, the system doesn't just block the order—it immediately creates a detailed log entry. This record includes the order details, the specific rule that was triggered, and a timestamp.

- Audit-Ready Documentation: That automated log becomes your compliance file. When an auditor asks for records, you can export a complete, searchable history in minutes, not days. That level of preparedness screams "we take this seriously."

By connecting enforcement directly to documentation, you create a closed-loop system where compliance isn't an afterthought—it's a core, automated part of your sales process.

For businesses running on WooCommerce, getting a handle on this is crucial. You can learn more about how to set this up by checking out our guide on automated shipping compliance for WooCommerce stores. In the end, automation turns your record-keeping requirements from a source of anxiety into a source of confidence.

Frequently Asked Questions

Once you get the basics down, the real-world questions start popping up. Let's tackle some of the most common ones that come up when merchants start putting these recordkeeping rules into practice.

What Is the Single Most Important Record to Keep?

If you could only keep one thing, it would be the log that shows your decision-making process for every single regulated order. This is the record that proves why you either blocked or shipped an order. A simple "approved" or "denied" note just won't cut it.

Think of this log as your primary defense in an audit. Without a detailed record explaining your actions, an auditor has no way of knowing if you were following established rules or just making arbitrary calls.

The gold standard for a log entry includes the specific rule that was triggered (e.g., 'State law prohibits shipping X to California'), the customer data you checked against, a precise timestamp, and the final action taken. That combination creates an airtight, undeniable record of compliance for that transaction.

Are Digital Records as Valid as Paper Records?

Absolutely. In fact, auditors often prefer digital records because they're organized and searchable. But there's a huge catch: your digital records must be secure, unchangeable, and easy to pull up when asked. An auditor needs to be 100% confident that the records couldn't have been tweaked after the fact.

This is exactly why a dedicated compliance system is light-years ahead of a simple spreadsheet. Spreadsheets are easy to edit, which immediately makes them suspect. An auditor might wonder if you "cleaned up" the data before they arrived. Secure, automated logs from a real system remove that doubt entirely.

How Long Do I Actually Need to Keep My Shipping Records?

Here’s where it gets tricky, but the guiding principle is simple: find the longest applicable retention period for any product you sell, anywhere you sell it, and make that your company-wide policy.

The requirements are all over the map. For instance, OFAC might require a 10-year retention for certain records, while the ATF could require 20 years or even more for others. On top of that, states often have their own rules for products like alcohol or tobacco that can be even stricter than federal minimums.

Trying to track each one separately is a recipe for disaster. The safest move is to identify the single strictest requirement that applies to your business and adopt it for everything. This approach simplifies a complex mess of regulations into one clear, defensible standard for your entire operation.

Ready to stop worrying about manual logs and human error? Ship Restrict automates your shipping rules and generates the detailed, audit-proof records you need to stay compliant. See how Ship Restrict can protect your business.

Cody Yurk

Founder and Lead Developer of ShipRestrict, helping e-commerce businesses navigate complex shipping regulations for regulated products. Ecommerce store owner turned developer.