A Guide to Precious Metals Bullion Shipping Restrictions Insurance

Your expert guide to precious metals bullion shipping restrictions insurance. Learn how to navigate carrier rules and secure your high-value shipments.

Cody Y.

Updated on Jan 22, 2026

Shipping precious metals like gold and silver isn’t a routine delivery—it’s a high-stakes balancing act. You’re navigating a maze of carrier rules, legal caps, and tight insurance policies, all at once. Miss a detail, and you could be staring at a multi-thousand-dollar loss.

The High-Stakes Game Of Shipping Precious Metals

Imagine dispatching a priceless artifact rather than a simple e-commerce purchase. A stray dent on a smartphone case is annoying. A missing gold bar can obliterate your profit margins—and your reputation.

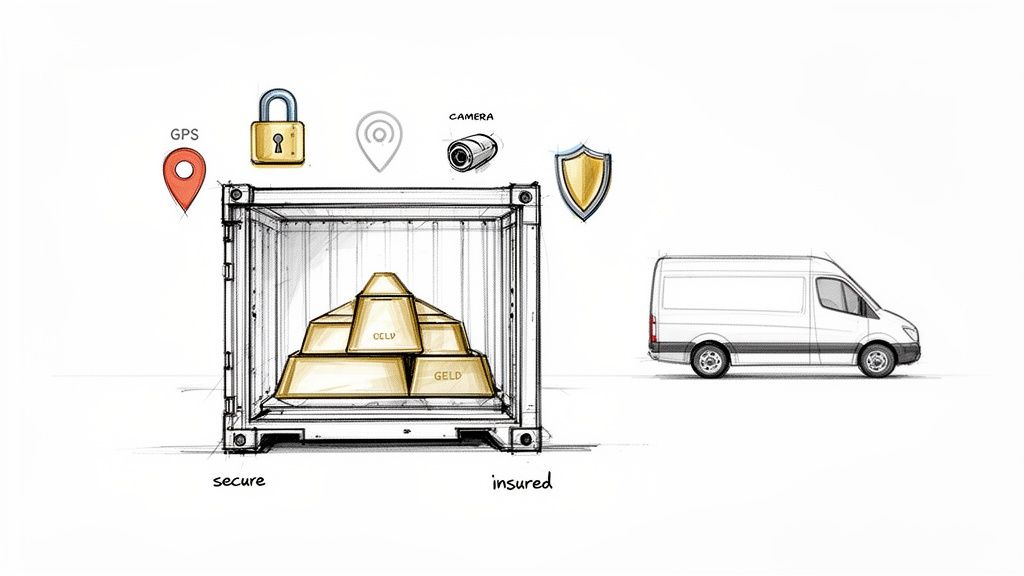

Every link in the logistics chain, from warehouse to doorstep, presents a target-rich environment for thieves. Standard parcel services and basic coverage won’t cut it. You need a fortress-like plan centered on three core pillars.

Understanding The Core Risks

To build a bulletproof shipping operation, you must master these three areas:

-

Carrier Restrictions

Major carriers enforce precise rules on weight, packaging and documentation. Miss a checkbox and your shipment is refused—or worse, uninsured if something goes wrong. -

Specialized Insurance

Declared-value add-ons from carriers are often just a refund promise, not true insurance. Precious metals need a dedicated, third-party policy that covers theft, damage, and loss from start to finish. -

Compliant Workflows

Think of discreet labeling, tamper-evident seals, and live-tracking setups as your first line of defense. Every touchpoint—from packing slip to signature—must be airtight.

Before you dive into the finer points of regulations and coverage, let’s take a quick snapshot of what you’re up against.

Key Risk Factors in Bullion Shipping at a Glance

| Risk Category | Description | Primary Mitigation Strategy |

|---|---|---|

| Carrier Refusal | Shipments rejected due to missing paperwork or prohibited item rules | Pre-shipment audits and carrier-approved labels |

| Theft In Transit | High-value target for organized criminals | GPS tracking, tamper seals, signature on delivery |

| Insurance Gaps | Inadequate coverage leaving clauses that exclude precious metals | Third-party insurance with broad coverage limits |

| Internal Handling | Mishandling or misrouting within the carrier’s network | Detailed chain-of-custody and staff training |

| Regulatory Fines | Legal penalties for non-compliance with weight, reporting, and customs laws | Automated compliance checks and up-to-date SOPs |

Every shipment carries its own blend of risks. But with the right playbook, you’ll spot vulnerabilities early and safeguard both your inventory and your bottom line.

A single misstep in this high-stakes game can be disastrous. The goal isn’t just to ship a product; it’s to ensure a secure, insured, and compliant transfer of significant wealth from your facility to your customer’s hands.

For more on protecting your shipments against theft and sabotage, see comprehensive theft protection strategies.

Decoding Carrier Rules for Shipping Bullion

Shipping precious metals isn't like sending a regular package. You're not just finding the fastest route; you're navigating a maze of strict, carrier-specific rules that can feel overwhelming at first. For giants like USPS, FedEx, and UPS, moving bullion isn't just about logistics—it's about managing enormous risk.

These rules aren't just arbitrary red tape. They’re born from decades of dealing with theft, loss, and liability claims. A carrier might ban gold bullion from its ground service, not because of the weight, but because that service lacks the security protocols needed for something so valuable and easy to sell. Trying to bend or ignore these precious metals bullion shipping restrictions is a recipe for disaster—think denied claims, seized assets, and a whole lot of headaches.

United States Postal Service (USPS): The Security Specialist

When it comes to shipping bullion within the U.S., many experienced dealers rely on a surprisingly old-school option: the United States Postal Service. Not just any service, though. We're talking specifically about USPS Registered Mail.

Think of it as a high-security network running completely separate from the regular mail stream. Every single Registered Mail parcel moves under lock and key, with a documented chain of custody from one secure area to the next. This obsessive process dramatically cuts down the risk of something going missing.

Of course, that level of security comes with a few trade-offs:

- Slower Transit: All those manual, secure handoffs mean it's not the fastest option. Patience is a virtue here.

- Fort Knox Packaging: They have very specific rules. Your package has to be sealed with paper tape that will instantly show any tampering. Plastic tape is a no-go.

- Value Limits: The insurance is rock-solid, but it tops out at a maximum of $50,000 per package.

For domestic shipments under that value cap, it's tough to beat the combination of security and cost that USPS Registered Mail provides. It’s a specialized service built on a foundation of trust and meticulous, old-fashioned security.

FedEx and UPS: The Private Carrier Perspective

Private carriers like FedEx and UPS play a completely different game. Dig into their service guides, and you’ll find they often explicitly refuse to knowingly handle bullion, currency, or precious metals in their standard services. Their business model is built for speed and volume, and the specialized, secure handling bullion demands just doesn't fit that system.

This doesn't mean it's impossible to use them. Both companies offer specialized divisions (like FedEx Custom Critical or UPS High Value Goods) for these kinds of shipments. But these are premium, contract-based services with much higher costs and a whole different set of requirements. They aren't for one-off shipments.

Trying to sneak bullion through their standard network by mislabeling the contents is a huge gamble. If the package gets lost or damaged and they find out what was inside, you can bet they will void any insurance. The claim will be denied, and you’ll be out of luck. Their terms of service are crystal clear on this.

A Practical Scenario: Shipping a Silver Bar

Let’s make this real. Imagine you need to ship a $15,000 silver bar.

-

USPS Registered Mail: You'd package the bar according to their strict rules, take it to the post office, fill out the forms, and pay for the service plus insurance covering the full value. The trip might take a little longer, but you’d have peace of mind knowing it's in a secure chain of custody, fully covered up to $50,000.

-

FedEx/UPS Standard Service: If you walk in and declare you’re shipping a $15,000 silver bar, they will almost certainly refuse the package. If you lie and just call it "machine parts," and that 30-pound box disappears, your claim will be dead on arrival once they figure out you shipped a prohibited item. You violated their terms, so they owe you nothing.

This difference is why knowing the carrier playbooks is so critical. The precious metals trade is a massive industry, with billions in goods moving every year—you can see the scale of the broader mineral and metals trade on the USITC website. The secret is simply using the right channels built for these high-stakes shipments.

Your Guide to Bulletproof Bullion Shipping Insurance

Relying solely on a carrier's "Declared Value" is one of the biggest—and most common—gambles you can take when shipping bullion. It feels like insurance, it's offered like insurance, but it absolutely is not.

This add-on just creates a false sense of security. It's simply the carrier's statement of their maximum liability if—and this is the key part—they are proven to be at fault for a loss. Their contracts are packed with clauses that can easily invalidate your claim, especially for something as high-value as precious metals.

Think of Declared Value like a car manufacturer's warranty. It only covers very specific failures under very specific conditions. What you actually need is a comprehensive auto policy—something designed to protect you from the messy, real-world scenarios of theft and accidents. The difference is critical when a $20,000 package vanishes.

The Superior Protection of Third-Party Insurance

To properly protect your shipments, you need third-party parcel insurance. Unlike a carrier's liability limit, these policies are underwritten by actual insurance companies. Their entire business model is based on assessing risk and paying out legitimate claims, not finding loopholes to deny them.

These specialized policies are designed to cover the very gaps left by carriers. Where a carrier's rules might prohibit bullion outright or cap its value, a third-party insurer understands the market and provides real coverage. It's a non-negotiable part of any serious risk management strategy. If you want to dive deeper into protecting high-risk shipments, our guide on shipping insurance for high-risk products offers valuable context.

For the highest level of confidence, look for policies from globally recognized institutions like reputable insurers like Lloyd's of London.

Declared value protects the carrier. Third-party insurance protects you, the shipper. Mistaking one for the other is a financially devastating error that countless merchants have learned the hard way.

How to Read Your Insurance Policy

Don't just skim the policy document. Taking a few minutes to understand the key terms will empower you to pick the right coverage and save you from nasty surprises when you file a claim.

Look for these critical details:

- Coverage Limits: This is the absolute maximum the insurer will pay for a single lost or damaged package. Make sure this number is comfortably higher than the value of your most expensive shipments.

- Deductibles: This is what you have to pay out-of-pocket before the insurance kicks in. A $0 deductible policy might have a slightly higher premium, but it means you get a full reimbursement on a covered loss. No fuss.

- Exclusions: This is the fine print that really matters. Look for specific rules about how you must package items (e.g., must be double-boxed), what you can't put on the label (e.g., no mention of contents), or destinations they won't cover.

A quick side-by-side comparison makes the choice pretty obvious.

Carrier Declared Value vs Third-Party Insurance for Bullion

This table breaks down the fundamental differences between what your carrier offers and what a real insurance policy provides.

| Feature | Carrier Declared Value | Third-Party Parcel Insurance |

|---|---|---|

| Primary Purpose | Limits the carrier's financial liability | Transfers your financial risk to an insurer |

| Coverage Basis | Contractual liability; you must prove carrier fault | All-risk coverage for specified perils (theft, loss, damage) |

| Claim Process | Often slow, with a notoriously high denial rate for bullion | Streamlined process designed to pay valid claims quickly |

| Cost | Usually more expensive for very limited protection | More cost-effective for comprehensive, real-world coverage |

As you can see, one is a tool for the carrier, and the other is a tool for you.

Navigating the Claims Process Successfully

If a package goes missing or arrives damaged, you need to act fast. A well-documented claim is a successful claim. Being prepared makes all the difference and shows the insurer you're a professional.

Follow these steps the moment you suspect an issue:

- Notify the Insurer Immediately: Don't wait. Most policies have a strict reporting window, sometimes as short as 24-48 hours after the expected delivery.

- Contact the Carrier: File a tracer or missing package report with USPS, FedEx, or whichever carrier you used. Get an official case number—your insurer will almost certainly require it.

- Gather Your Documentation: Your claim lives or dies by your proof. You cannot have too much documentation.

Your Essential Claims Documentation Checklist

Having these items ready to go will dramatically speed up the process and maximize your chances of getting a full payout.

- Proof of Value: The original invoice or purchase order showing what the item is worth.

- Proof of Shipment: The shipping label and the carrier receipt.

- Proof of Loss: A written statement from your customer confirming they never got it, or clear photos of the damaged item and all the packaging.

- Police Report: For any suspected theft, filing a police report is non-negotiable. This is a standard requirement for nearly all insurance claims involving stolen goods.

Keep digital copies of everything organized in a dedicated folder. When you present a clean, complete file to the claims adjuster, you make their job easier, which makes the entire experience smoother and far more likely to end in your favor.

Navigating International Bullion Shipments

Sending precious metals across borders isn't just a longer journey—it's a whole new ballgame. Suddenly, you're dealing with customs, tariffs, and a maze of international compliance rules. A single mistake on a form can get your high-value shipment seized, delayed, or slapped with unexpected fees that instantly vaporize your profit margins.

Success in international bullion shipping comes down to meticulous documentation. Every country has its own quirks, but a few documents are universally required. Getting these right isn't optional; it's the only way to avoid costly holds and ensure your package clears customs without a hitch.

Think of customs paperwork as your shipment's passport. Without it, your package is going nowhere fast. Just like a traveler needs the right visa, your bullion needs precise, accurate, and complete documentation to legally enter another country. This is where many businesses run into precious metals bullion shipping restrictions that can grind operations to a halt.

Understanding Essential Customs Paperwork

The single most important document is the Commercial Invoice. This is far more than a simple receipt. It’s a formal declaration to customs officials detailing exactly what's inside, its precise value, and who the sender and receiver are. Any inaccuracies, no matter how small, can be flagged as an attempt to undervalue the goods, leading to serious penalties.

Another critical form is the Certificate of Origin (COO), which verifies where the bullion was produced. This matters because many countries have specific trade agreements or tariffs based on a product's origin. For example, a Canadian Maple Leaf coin might face different import duties in the UK than an American Gold Eagle. For a deeper dive, check out our guide on preparing your cross-border restricted goods documentation.

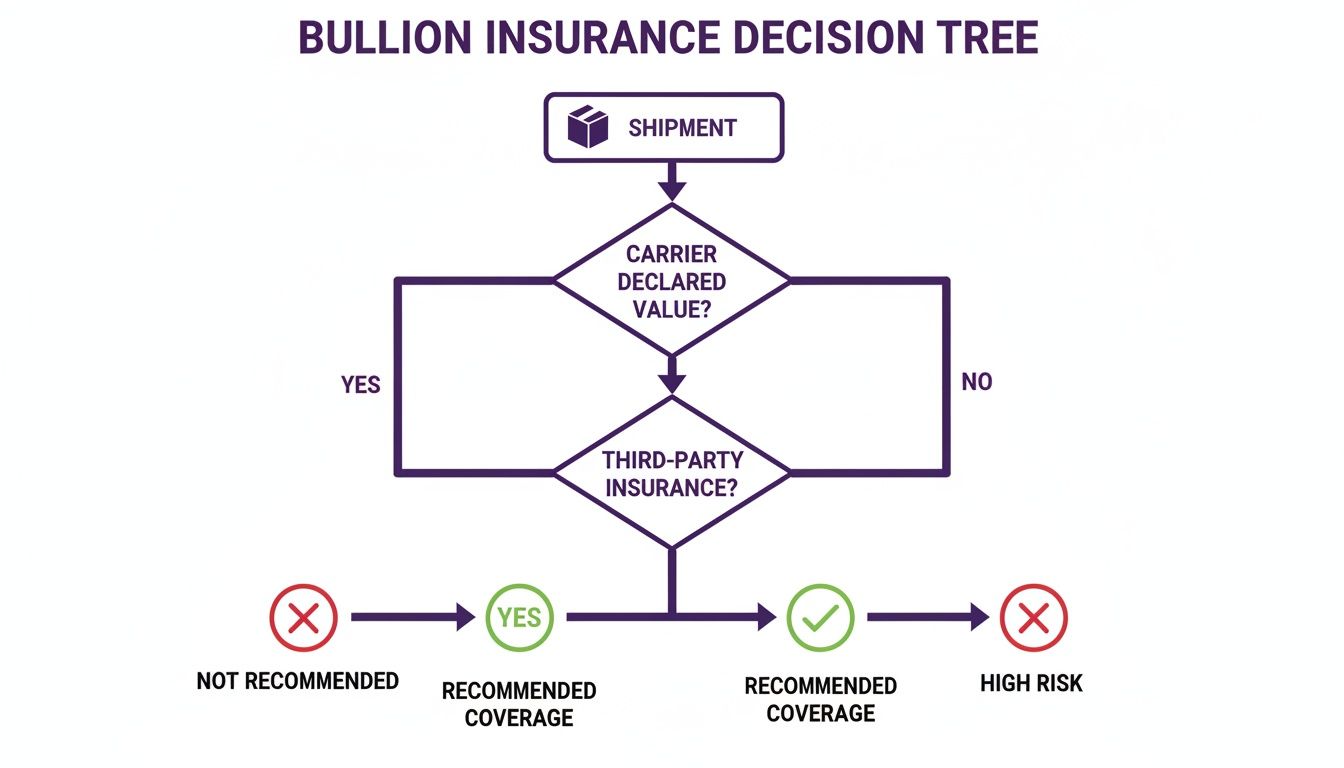

Making the right call on how to protect these shipments is crucial, as you can see in the chart below.

This flowchart lays out the choice between relying on limited carrier declared value and opting for comprehensive third-party insurance—the clear winner for high-value international shipments.

Calculating Duties and Managing Taxes

Duties and taxes are often the most confusing part of shipping internationally. These fees are calculated based on the product’s Harmonized System (HS) code and the destination country's import laws. Bullion usually has specific HS codes with varying tax implications. For instance, investment-grade gold might be exempt from Value Added Tax (VAT) in some European countries, while silver is fully taxed.

You also have to decide on the shipping terms, which determines who pays these fees. The two most common options are:

- Delivery Duty Unpaid (DDU): The customer is on the hook for all import duties and taxes when the package arrives. This can lead to a nasty surprise for your buyer and a poor customer experience.

- Delivery Duty Paid (DDP): You, the seller, pay all duties and taxes upfront. This creates a seamless, Amazon-like experience for the buyer but requires you to calculate these costs accurately ahead of time.

Getting these terms straight is essential for setting clear expectations and keeping your customers happy.

Navigating international shipping is like being the captain of a ship in foreign waters. You need the right charts (documentation), an understanding of local laws (tariffs), and a plan to handle any storms (customs inspections) to ensure your cargo arrives safely.

Country-Specific Regulations and Prohibitions

Finally, always remember that every country plays by its own rules. Some nations have outright bans on importing bullion, while others impose strict limits on quantity or value. Political winds can also shift regulations overnight.

Before you ship to a new country, always research its specific rules for precious metals. A few minutes of due diligence can prevent a multi-thousand-dollar package from being seized and forfeited. This proactive approach isn't just good practice—it's the cornerstone of a successful and secure international bullion business.

Packaging and Labeling for Maximum Security

Your first and most effective line of defense against theft happens long before a package ever leaves your warehouse. Proper packaging isn't just a best practice; it's the core of your risk mitigation strategy.

Think of your package as a chameleon—its only job is to blend in and look as boring and uninteresting as possible. The way you pack a shipment can either scream "valuable contents inside!" or ensure it glides through the logistics network completely unnoticed. For high-value items like bullion, anonymity is everything.

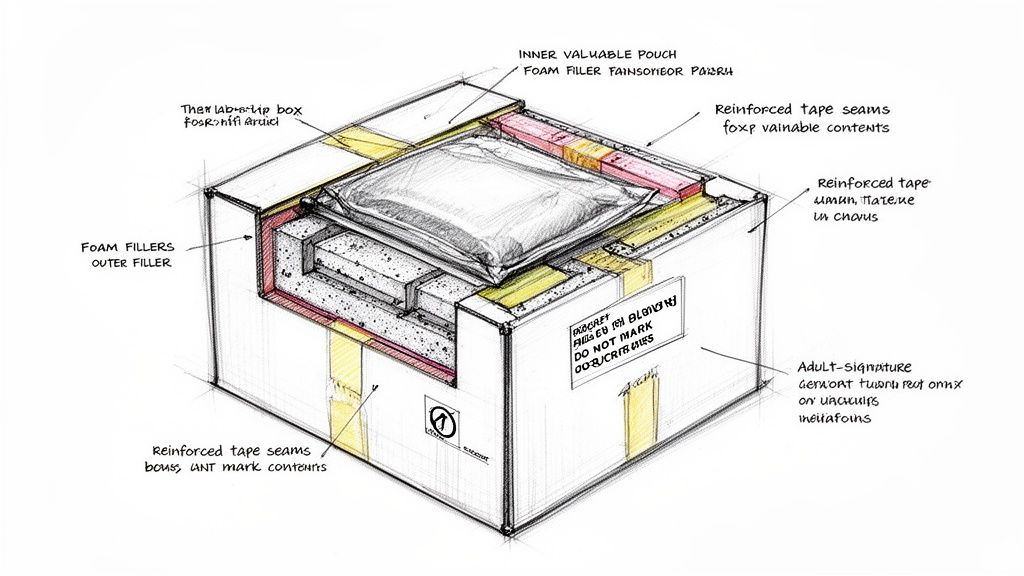

The Box-Within-A-Box Method

The gold standard for shipping precious metals is the "box-within-a-box" method. This simple technique adds critical layers of protection against both transit damage and theft. It’s exactly what it sounds like: you place your securely wrapped bullion inside a small box, which then goes inside a slightly larger, plain shipping box.

This double-boxing approach accomplishes two key things. First, it creates a buffer zone that absorbs shocks and prevents anyone from identifying the contents by feel. Second, it makes the package much harder and more time-consuming for a would-be thief to get into.

Here’s how to do it right:

- Inner Box: Pack the bullion tightly inside the smaller box using dense filler like foam blocks. The goal is zero movement—nothing should rattle, slide, or shift.

- Outer Box: Place that sealed inner box into the larger shipping box.

- Fill the Void: Tightly pack the empty space between the two boxes with filler like crumpled packing paper or bubble wrap. This stops the inner box from moving around at all.

Sealing the Deal with the Right Tape

Once everything is packed, how you seal the box is the next critical step. Don't even think about using standard cellophane or duct tape. They're easy to slice open and replace without leaving obvious signs of tampering.

Instead, you need to use pressure-sensitive, reinforced packing tape to seal every single seam and corner of the outer box. This kind of tape makes it almost impossible to open the package without causing visible, undeniable damage—a key requirement for most precious metals bullion shipping restrictions insurance policies.

Your package should look boring from the outside but be a fortress on the inside. Every layer of packaging, padding, and tape adds a barrier that deters opportunistic theft and protects the contents from the rigors of transit.

The Art of Discreet Labeling

Discreet labeling is completely non-negotiable. Your shipping label needs to be as generic and uninteresting as the box itself to avoid attracting the wrong kind of attention.

The return address should use a generic business name or an acronym, steering clear of anything that suggests wealth or high-value goods.

Most importantly, never use words that hint at the contents. Putting terms like "Gold," "Silver," "Coins," "Jewelry," or "Bullion" on the label is like painting a giant target on the box. It immediately violates the terms of nearly every insurance policy and skyrockets the risk of theft.

Finally, always require Adult Signature Required upon delivery. This creates an unbroken chain of custody and gives you definitive proof of who received the package and when. This one step is often the lynchpin for filing a successful insurance claim if a delivery is ever disputed.

Automating Shipping Compliance to Prevent Errors

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/CtKHTTgblwo" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>Trying to manually check every single order against an ever-growing list of carrier rules, insurance policy limits, and state laws isn't just a hassle—it's a recipe for expensive mistakes. One slip-up, like sending a high-value package with the wrong service, can get an insurance claim denied and instantly turn into a five-figure loss.

This constant manual oversight creates a massive bottleneck in your operations. It yanks you away from growing your business and shoves you into the role of a compliance officer, stuck double-checking addresses and cart values. As you scale, this approach just isn't sustainable.

Implementing an Automated Solution

The only truly effective way to manage precious metals bullion shipping restrictions insurance is to take human error out of the equation. Automation acts as a digital gatekeeper, making sure a non-compliant order can never slip through the cracks.

Imagine a system working silently in the background of your e-commerce store. It automatically cross-references every customer's cart against a set of rules you've defined, stopping costly errors before they ever happen. This system could:

- Block Prohibited Carriers: Automatically hide FedEx or UPS as shipping options when an order contains bullion over their stated limit.

- Enforce Value Limits: Stop any shipment that exceeds the USPS Registered Mail $50,000 insurance cap from being processed.

- Restrict High-Risk Locations: Block orders going to specific ZIP codes or regions known for higher rates of theft or delivery problems.

This is a screenshot from the Ship Restrict website, showing how you can build these kinds of specific, conditional rules right inside your store.

The interface lets you build precise "if-then" logic, so your store automatically enforces your shipping policies without you having to lift a finger.

Freeing Up Your Time to Focus on Growth

Putting an automated compliance tool in place is about more than just preventing losses; it’s about reclaiming your time and mental energy. Instead of spending hours policing individual orders, you can get back to marketing, customer service, and sourcing new inventory.

Automation transforms your shipping strategy from a reactive, manual process into a proactive, error-proof system. It’s the final, critical piece in building a secure and scalable bullion shipping operation.

This proactive approach ensures every single package that leaves your facility is perfectly aligned with your carrier agreements and insurance policies. You get the peace of mind that comes from knowing your business is protected from expensive compliance mistakes. For merchants on a specific platform, learning about automated shipping compliance for Woo-Commerce stores offers a practical guide to getting it done.

By setting up these rules just once, you create a reliable framework that protects your business 24/7. This lets you scale your operations with confidence, knowing your shipping logic will adapt to any order, no matter how complex. It’s the smart way to manage risk and build a more resilient business.

Got Questions About Shipping Bullion?

Shipping precious metals can feel like walking through a minefield of rules and risks. Let’s clear up some of the most common questions we hear from merchants to help you nail down your process and avoid expensive mistakes.

Can I Ship Gold Bullion Through USPS?

You can, but you have to play by their very specific rules. The United States Postal Service insists that all gold bullion must go out via USPS Registered Mail. This isn't just regular mail; it's a high-security service that provides a documented chain of custody from your door to your customer's.

Keep in mind, though, their packaging requirements are notoriously strict, and you can expect transit times to be a bit slower. The most critical detail? Their included indemnity maxes out at $50,000. If your shipment is worth more, you absolutely must have a supplemental third-party insurance policy to cover the rest of the value.

Is Carrier "Declared Value" the Same as Insurance?

Not at all, and thinking they're the same is one of the quickest ways to lose a lot of money. Declared Value is not an insurance policy. It's simply the carrier's maximum liability if—and it’s a big "if"—they are found 100% at fault for losing or damaging your package.

Carriers often bury clauses in their terms of service that specifically exclude liability for bullion shipments. This makes winning a claim next to impossible. Real financial protection only comes from a dedicated, third-party parcel insurance policy built for high-value goods.

What's the Single Biggest Mistake When Shipping Bullion?

Hands down, the most common and damaging mistake is being too obvious. A lack of discretion in your packaging and labeling paints a giant target on your box for thieves. The goal is to make your package look as boring and unimportant as possible.

Never use branded boxes from mints or refineries, and don't plaster your company name everywhere if it hints at what's inside. Most importantly, words like "gold," "silver," "coins," or "bullion" should never appear anywhere on the outer packaging or shipping label. This practice is called "discreet shipping," and it’s not just a good idea—it’s a non-negotiable requirement for most insurance policies.

How Can I Automate All These Complex Shipping Rules?

Trying to manage this manually is a recipe for disaster. The best way to enforce complex shipping rules without human error is to use a specialized e-commerce plugin. If you're running a store on a platform like WooCommerce, a tool can be your automated gatekeeper at checkout.

You can set up rules to automatically handle your precious metals bullion shipping restrictions and insurance needs. For example, you could create a rule that blocks FedEx as an option for any order containing gold, or another that prevents high-value shipments from going to known high-risk ZIP codes. It takes the guesswork out of compliance and ensures every single order is shipped correctly.

Ready to stop worrying about shipping errors and start protecting your bottom line? Ship Restrict automates your most complex shipping rules, giving you the peace of mind to focus on growing your business. Learn more and get started today.

Cody Yurk

Founder and Lead Developer of ShipRestrict, helping e-commerce businesses navigate complex shipping regulations for regulated products. Ecommerce store owner turned developer.