Your Guide to Cross-Border Restricted Goods Documentation

Master cross-border restricted goods documentation. This guide explains the licenses, permits, and forms needed to avoid customs delays and ship globally.

Cody Y.

Updated on Dec 11, 2025

Shipping internationally can feel like trying to solve a puzzle where the rules change at every border, especially when you're dealing with restricted goods. Getting your cross-border restricted goods documentation right from the very start is the only way to prevent costly delays, sidestep legal trouble, and build a sustainable global business. This guide is your map to mastering customs declarations, import licenses, and permits.

Why Documentation for Restricted Goods Is More Critical Than Ever

Think of your shipping documents as your product's passport. Without the correct paperwork, a shipment isn't going anywhere. This is doubly true for restricted items—products that aren't outright banned but need special permission and oversight to cross borders.

For e-commerce stores, the stakes are incredibly high. A simple documentation error can turn a profitable sale into a logistical nightmare, leaving your products stranded in a customs warehouse for weeks. This doesn't just eat into your profit margins with fines and storage fees; it destroys your brand's reputation with frustrated customers.

The Impact of E-commerce Growth on Customs

The explosion of global e-commerce has put immense pressure on customs agencies. In response, regulations are getting stricter and more complex. The last five years have seen a huge jump in what are called de minimis consignments—shipments valued below a certain threshold that used to require very little customs info.

To handle this flood of packages, over 85 customs administrations worldwide have overhauled their legal frameworks and gone digital. These changes have had a massive impact, slashing customs clearance times from several days down to under 24 hours. You can learn more about how customs agencies are adapting to e-commerce growth.

This shift means that while things are moving faster, the demand for accurate and complete digital documentation is now non-negotiable. For anyone selling restricted goods, there is absolutely zero room for error.

Getting your cross-border documentation right isn't just good practice anymore; it's a fundamental pillar of a successful international strategy. Properly prepared paperwork delivers:

- Smooth Customs Clearance: Accurate documents keep your shipments from being flagged for a time-consuming manual inspection.

- Cost Avoidance: You sidestep expensive fines, penalties, and storage fees that come with non-compliance.

- Enhanced Customer Trust: Reliable, on-time delivery is how you build loyalty with international buyers.

Throughout this guide, we'll break down exactly what you need to do to achieve this level of precision.

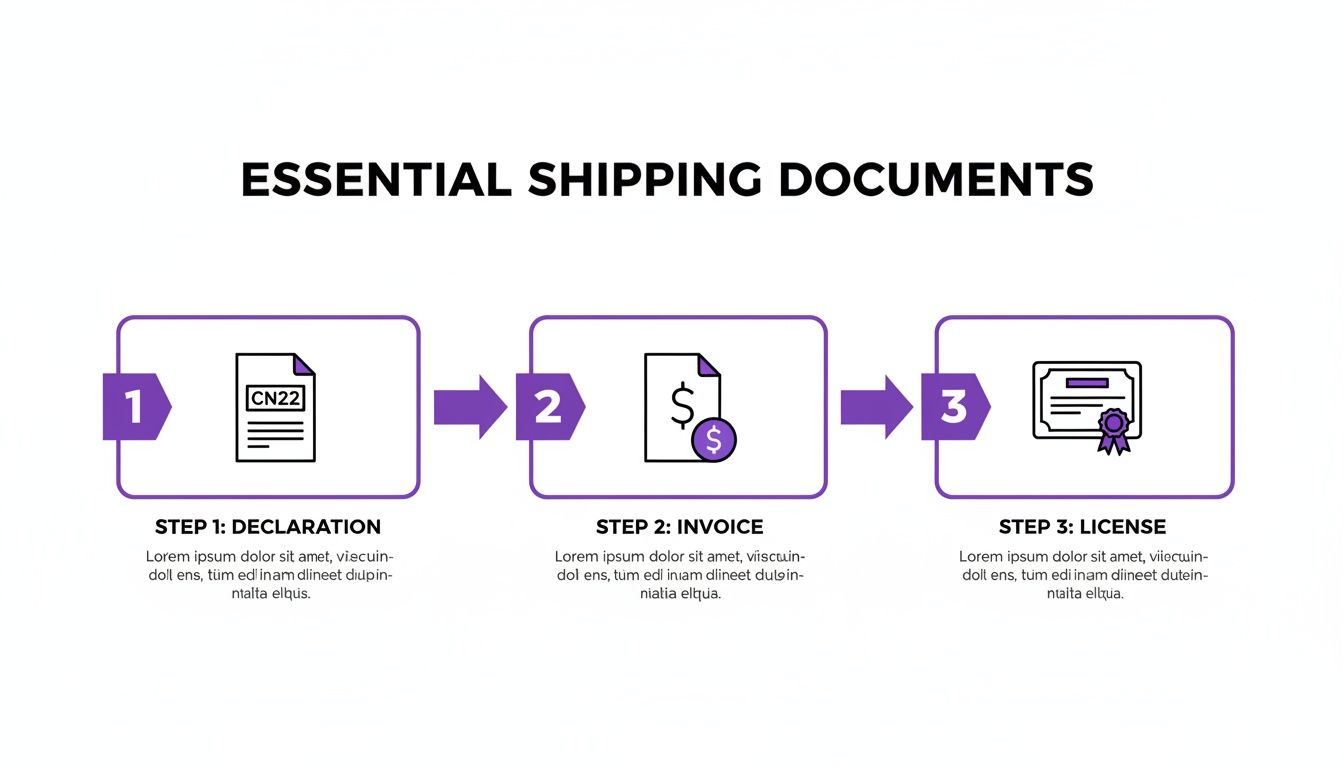

Decoding the Essential Shipping Documents

Think of your shipping paperwork as a product’s passport. For a t-shirt or a book, it’s a simple stamp and you’re through. But when you’re shipping restricted items, that passport needs a stack of special visas and supporting letters to prove its legitimacy at every single checkpoint.

Get one tiny detail wrong, and it’s like showing up at the border with an expired ID. Your shipment gets flagged, pulled aside, and stuck in customs limbo for days, or even weeks.

Proper documentation isn't just about filling out forms; it's about telling a clear, verifiable story to customs officials. Each document answers a critical question they need to know: What exactly is this? Where did it come from? How much is it worth? And, most importantly, who is the end-user? Getting these answers right isn't just a good idea—it's non-negotiable.

Let's walk through the core documents you'll be dealing with. Each one plays a unique role in getting your package from your warehouse to your customer’s doorstep without any drama.

The Foundation: Commercial Invoices and Customs Declarations

Every international shipment starts with the Commercial Invoice. It’s the official bill of sale, but to customs, it’s much more than that. It’s the master document they use to calculate duties and taxes, and it must include a painfully detailed description of the goods, their precise value, and the Harmonized System (HS) code.

Next up are the Customs Declarations, which are basically simplified summaries stuck to the outside of the package. For postal shipments, you'll mainly see the CN22 and CN23 forms.

- CN22: This is for lower-value packages, typically up to around $400 USD. It’s just a quick snapshot of the contents and value.

- CN23: Once you go over that $400 threshold, you’ll need this more detailed form, which asks for information much closer to a full commercial invoice.

Simply forgetting these forms—or worse, filling them out sloppily—is one of the most common reasons for customs delays. The value you declare here must match the commercial invoice to the penny. Any discrepancy screams "undervaluation" to a customs agent, which is a massive red flag.

A classic rookie mistake is writing something generic like "Electronics" on the declaration. Be specific. Instead, write "Lithium-ion battery pack, 10,000 mAh." That initial laziness almost guarantees a manual inspection, adding a ton of time to your delivery.

Proving Legitimacy: Origin, Licenses, and Permits

Once you have the basics down, restricted goods demand more specialized paperwork to prove they're allowed to cross the border. This is where you get into documents that certify origin and grant explicit permission to ship.

First is the Certificate of Origin (CO). This document officially certifies the country where your goods were made. This isn't just a fun fact; it's critical for taking advantage of free trade agreements that can slash or even eliminate import duties for your customer. For some restricted goods, the country of origin can be the deciding factor in whether an item is allowed in at all.

Then you have the big ones: Import/Export Licenses. These are official permits granted by a government agency that give you the green light to ship a specific type of controlled product.

- Firearms Parts: In the U.S., you'll need specific licenses from agencies like the ATF.

- Dual-Use Goods: These are items with both civilian and military applications. They often need an Export Control Classification Number (ECCN), which determines the exact licensing requirements. You can learn more about how ECCNs impact e-commerce shipping in our detailed guide: https://shiprestrict.com/blog/shipping-restrictions/export-control-classification-numbers-eccn-woo-commerce

- Biological Samples or Agricultural Products: These require phytosanitary or health certificates to prove they are free from pests and diseases that could harm the destination country's ecosystem.

While we're focused on commercial products, it's interesting to see how the same logic applies elsewhere. For instance, the different types of pet health certificates for travel function just like these other documents. Each certificate validates that a regulated "item"—in this case, an animal—meets the destination country’s strict entry requirements to prevent potential hazards.

That core principle applies equally to plants, animal products, and certain chemicals. Without the correct, specific license or certificate, your shipment will be rejected on the spot. No exceptions.

To help you keep track, here's a quick rundown of the essential paperwork you'll encounter when shipping restricted goods.

Key Documents for Restricted Goods at a Glance

This table summarizes the most common documents, what they do, and when you’ll likely need them.

| Document Type | Primary Purpose | Commonly Required For |

|---|---|---|

| Commercial Invoice | Provides full transaction details for customs to assess duties and taxes. | All international commercial shipments. |

| Customs Declaration (CN22/23) | A summary of package contents and value for postal services. | All international postal shipments. |

| Certificate of Origin (CO) | Certifies the country where goods were manufactured. | Goods subject to trade agreements or specific import rules. |

| Export/Import License | Grants official permission to ship controlled or regulated items. | Firearms, dual-use technology, chemicals, military items. |

| End-Use Certificate | A statement from the buyer detailing the final use of the product. | Sensitive dual-use goods to ensure they won't be used for illicit purposes. |

| Phytosanitary/Health Certificate | Certifies that biological products are free from pests and diseases. | Plants, seeds, agricultural products, animal products. |

This isn't an exhaustive list, but it covers the heavy hitters. Always verify the specific requirements for both the product you're selling and the country you're shipping to.

Your Step-by-Step Documentation Workflow

Knowing which documents you need is one thing. Assembling them flawlessly when an order is on the line is a whole different beast. One tiny mistake can bring your entire shipment to a screeching halt at the border.

Let's make this less intimidating by walking through a practical, step-by-step workflow for preparing your cross-border restricted goods documentation.

Imagine you’re shipping a popular Bluetooth speaker with a built-in lithium-ion battery from the United States to a customer in Germany. This is a classic restricted item—not banned, but heavily regulated for safety. A solid workflow means you get it right every time, without the guesswork.

The paperwork might seem complicated, but it usually boils down to a few core documents that tell customs officials everything they need to know at a glance.

Think of each document as a checkpoint. Get them right, and your package sails through. Get them wrong, and you're in for a long, expensive delay.

Step 1: Classify Your Product With an HS Code

Everything starts here. The Harmonized System (HS) code is the universal language of customs. Getting this code right is the bedrock of your entire documentation package because it dictates the duties, taxes, and specific rules that apply to your product.

For our Bluetooth speaker, you can't just guess. You need the exact code. This means breaking the product down: it's an electronic device, but the lithium battery is the key restricted component.

Use official government portals like the U.S. International Trade Commission's search tool to find the correct classification. Don't rely on generic lists or outdated information.

Step 2: Gather and Verify All Required Information

With the correct HS code in hand (let's say it's 8507.60 for lithium-ion batteries), you can start pulling together the data for your forms. This isn't just a copy-paste job; it's about making sure every detail is perfectly consistent across every single document.

Create a master checklist for each restricted product you sell. For our speaker, that checklist would look something like this:

- Full Product Description: Be specific. "Portable Bluetooth Speaker with integrated 5,000mAh lithium-ion battery." is much better than "speaker."

- Country of Origin: The country where the device was actually manufactured, not where it shipped from. This is a common mistake.

- Accurate Value: The exact price the customer paid. This must match the commercial invoice down to the cent.

- Buyer and Seller Information: Full names, addresses, and contact details for both parties. No abbreviations.

- Battery Specifications: Watt-hour rating, weight, and confirmation that it meets safety standards like UN 38.3.

This checklist becomes your single source of truth. It eliminates the little discrepancies that raise big red flags for customs agents.

Step 3: Complete the Core Shipping Documents

Now it's time to fill out the paperwork. Accuracy and legibility are your best friends here. Even a simple typo can cause a world of hurt.

- Commercial Invoice: This is your most important document. List the HS code, the full product description from your checklist, the value per item, and the total invoice value. Be meticulous.

- Customs Declaration (CN22/CN23): Transfer the information directly from your master checklist to this form. The description and value here must perfectly mirror what's on the commercial invoice.

- Shipper's Declaration for Dangerous Goods: Since lithium batteries are classified as dangerous goods for air transport, you'll almost certainly need this specialized form. It details the battery type, how it's packed, and confirms it follows IATA (International Air Transport Association) regulations.

Having a standardized, repeatable process is your best defense against human error. A checklist ensures no critical detail gets missed, turning a complex task into a routine operation and protecting your business from costly compliance failures.

Step 4: Assemble and Submit the Final Package

The final step is to pull it all together. Your documentation package should be organized, complete, and securely attached to your shipment. This includes both the physical papers and any digital copies required by your carrier or the destination country.

Before you seal the box, do one last check:

- Is the commercial invoice signed and dated?

- Is the customs declaration properly attached to the outside of the package?

- Are all specialized permits (like the Dangerous Goods Declaration) included?

By following this four-step workflow, you build a system that's both reliable and scalable. It transforms the daunting task of cross-border restricted goods documentation from a source of anxiety into a predictable part of your business, letting you ship globally with confidence.

Common Pitfalls That Derail Shipments

Even the most buttoned-up international shipment can get stopped in its tracks by a single, tiny mistake. When you're dealing with cross-border restricted goods documentation, these small errors can quickly spiral into customs nightmares—think weeks of delays, surprise fines, and even having your products seized.

Understanding where other businesses trip up is the first step to building a bulletproof shipping process. Learning from their mistakes can save you from wasted time, lost revenue, and some very unhappy customers.

The HS Code Guessing Game

One of the most frequent and costly errors we see is misclassifying a product with the wrong Harmonized System (HS) code. It's tempting to make a quick guess or use a generic code to save a few minutes, but the consequences can be severe. Using the wrong HS code throws off duty and tax calculations, leading to you either overpaying or, worse, underpaying and flagging your business for a full-blown audit.

Imagine you're shipping a high-tech drone. If you classify it simply as a "toy" instead of using the precise code for unmanned aerial vehicles, you’re not just making a small error—you’re misrepresenting the item to customs. That’s an easy way to get your shipment seized on the spot, along with some hefty fines for what looks like an attempt to dodge regulations.

Inconsistent and Incomplete Paperwork

Another huge red flag for customs is inconsistency across your documents. The product description, value, and quantity must be identical on the commercial invoice, the customs declaration (CN22/23), and any supporting licenses or permits. A customs agent who sees $500 on the invoice but $50 on the declaration will immediately suspect you're undervaluing your goods to evade duties.

This stuff really matters. Complexity and errors in documentation come with a serious price tag. One study found that for over 80% of businesses, the headache of cross-border compliance directly impacts their decision to expand globally. The main culprit? Misclassification, with 41% of businesses admitting they struggle to assign the right HS codes. This directly leads to shipping delays and results in nearly 60% of consumers getting hit with surprise customs fees. You can dig into how these issues hold businesses back in the full Accountancy Age report.

Honestly, even something as simple as an incomplete address or a missing signature can be enough to get your package pulled aside for a manual inspection, adding days or even weeks to the delivery time.

Ignoring Destination Country Nuances

Assuming documentation rules are the same everywhere is a recipe for disaster. Every single country has its own unique set of regulations, prohibited items, and required permits for restricted goods. What sails right through customs in the United Kingdom might be outright banned or require extensive pre-approval from a government agency in Australia.

For instance, a nutritional supplement that’s perfectly legal in the United States could be classified as a controlled substance in Japan, requiring specific import licenses and full laboratory analysis reports. Shipping it without that paperwork doesn't just delay the package; it risks the entire order being destroyed at your expense.

To get ahead of these common traps and keep your cross-border operations running smoothly, you need solid supply chain risk management strategies. Proactively spotting these documentation risks is a core part of building a resilient international shipping operation that can handle changing rules and prevent costly errors before they ever happen. Getting this right protects your bottom line and, just as importantly, the trust of your international customers.

Navigating Country-Specific Documentation Rules

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/B3gvE1mxfOY" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>When you're selling across borders, thinking the same paperwork works for every country is a recipe for disaster. It's a surefire way to get your shipments seized, leaving you with angry customers and lost revenue. Each nation is its own gatekeeper with a unique and ever-changing rulebook.

Let's say you're selling a popular cosmetic cream. Shipping it within the United States might only require basic consumer safety compliance. But the moment you send that exact same product to the European Union, you’re in a different league. Now, it has to meet the EU’s strict Cosmetic Products Regulation, which demands a detailed Product Information File (PIF) and registration on a central portal.

This is where a lot of businesses stumble. A product that’s perfectly legal in one country can be classified as restricted or even prohibited in another. Suddenly, you're faced with requirements for pre-market approvals, special licenses, or detailed ingredient lists you never needed before. The only way forward is to treat each country as its own distinct compliance puzzle.

Major Markets and Their Nuances

Different countries and economic blocs have their own priorities, and that directly shapes the kind of documentation they demand. Getting a handle on these regional differences is non-negotiable for smooth international sales.

Take the European Union, for example. Their focus is heavily on consumer safety, environmental standards, and tax collection. This means you’ll run into specific documentation needs:

- CE Marking: If you're selling electronics, toys, or a host of other products, you need to prove they meet EU standards for health, safety, and environmental protection. No CE mark, no entry.

- VAT and IOSS: Since 2021, Value Added Tax (VAT) is collected on all commercial goods imported into the EU, regardless of their value. Using the Import One-Stop Shop (IOSS) system can make this easier, but it requires precise data on your customs forms.

Shipping to the United States, on the other hand, presents a totally different set of hurdles. Agencies like the Food and Drug Administration (FDA) or the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) have ironclad import rules for products they oversee. This often means filling out specific government forms and getting pre-approvals long before your shipment ever leaves your warehouse.

Getting trade documents right is a massive headache for businesses everywhere. The World Bank singles it out as one of the most time-consuming parts of international trade. With global sanctions in constant flux, exporters have to be vigilant to avoid penalties. A massive study of 15.6 million international shipments revealed that nearly 73% of product categories had tariff issues tied directly to documentation errors. You can explore more of the data on these trade challenges here.

The Critical Role of Trade Agreements and Sanctions

On top of individual country rules, you’ve got to keep an eye on international trade agreements and sanctions. An agreement might slash or even eliminate tariffs on your goods, but only if you provide the correct Certificate of Origin to prove they qualify.

Conversely, sanctions can pop up overnight, banning you from shipping certain products—or any products—to specific countries, companies, or people. This gets especially tricky with "dual-use" goods that have potential military applications. One wrong move here can bring severe penalties. For a much deeper dive, check out our guide on ITAR compliance for military-grade equipment.

Successfully managing cross-border restricted goods documentation means you can’t afford to be reactive. You have to be proactive. Make it a habit to check the official customs websites for your key markets, subscribe to industry trade alerts, and seriously consider talking to a customs broker. This kind of diligence is what keeps your shipments moving and your global business growing.

Automating Compliance in Your E-commerce Store

Let's be honest: manually checking every international order for cross-border restricted goods documentation is a nightmare. It’s slow, tedious, and the stakes are incredibly high. One little mistake can get a shipment seized, leaving you with an angry customer and a major headache. The good news is, you don't have to live with manual checklists forever. You can build an automated, scalable workflow right inside your store.

Modern e-commerce tools are built to wrangle these complexities for you. Instead of your fulfillment team playing detective with every order, you can set up a system that automatically flags restricted products at checkout based on the customer’s shipping address. This stops a non-compliant order dead in its tracks, before it ever becomes a problem.

Setting Up Automated Restriction Rules

The magic behind this automation is creating smart, granular rules that mirror real-world shipping laws. Picture a customer in California trying to buy a product that's banned in their state but perfectly legal everywhere else. An automated system instantly blocks the sale and displays a clear message explaining why.

This is where a specialized plugin like Ship Restrict becomes essential for WooCommerce stores. It gives you the power to build a sophisticated compliance engine without touching a single line of code.

Here’s how it transforms your day-to-day operations:

- Flags Restricted Items: The system knows which of your products have shipping limitations.

- Checks the Customer's Location: It instantly compares the shipping address against your rules—whether they're set by country, state, or even down to the ZIP code.

- Enforces Rules at Checkout: If there's a conflict, the system simply prevents the order from going through, stopping the issue at the source.

This doesn't just save countless hours of manual review; it creates a much smoother experience for your customers by giving them immediate, clear feedback.

As you can see, you can build a whole library of rules that automatically govern where your products can and cannot ship.

Attaching Documents and Communicating with Your Team

Automation goes beyond just blocking bad orders; it also helps prepare the paperwork for the good ones. When a valid international order for a restricted item comes through, the system can automatically attach the required digital documents—like a pre-filled customs form or an end-user certificate—right into the order notes.

By building compliance logic directly into your sales process, you create a bulletproof system of record. Every order gets checked automatically, and your fulfillment team gets clear, actionable instructions. This slashes the risk of the human error that always creeps into manual workflows.

Your fulfillment team no longer has to guess which forms are needed. They just follow the automated instructions attached to the order, making sure every single package goes out with the correct cross-border restricted goods documentation. For stores on a platform like WooCommerce, this kind of integration is a complete game-changer. We dive deeper into setting this up in our guide on automated shipping compliance for WooCommerce stores.

At the end of the day, automation turns a reactive, error-prone process into a proactive and efficient machine. It gives you the confidence to scale your international sales, knowing you have a robust compliance framework working for you around the clock.

Frequently Asked Questions

Jumping into international shipping brings up a ton of questions, especially when you’re dealing with products that have extra rules attached. Let's clear up a few of the most common ones we hear about cross-border restricted goods documentation.

What Is the Difference Between a Customs Declaration and a Commercial Invoice?

It helps to think of it this way: a commercial invoice is the story of the sale between you and your customer, while a customs declaration is the official, government-required summary of what's inside the box.

The commercial invoice is basically the bill of sale. Customs officials use it to see the nitty-gritty details—like product values and terms of sale—so they can figure out the right duties and taxes to charge.

A customs declaration (like a CN22 or CN23 form) is a standardized form for the government. It gives them a quick snapshot of your shipment’s contents for security screening and customs clearance. You absolutely need both, and the information on them has to match perfectly. Any discrepancy is a red flag that can get your package stuck.

How Do I Find the Correct HS Code for My Products?

Nailing down the right Harmonized System (HS) code is one of the first and most critical steps. A good starting point is your government's official online tariff tool, like the U.S. International Trade Commission's search portal. You can usually find the right classification by searching for keywords related to your product.

But let's be honest, for complex or highly regulated items, it can get tricky fast.

When you're not 100% sure, bring in a professional customs broker. Their whole job is to know this stuff inside and out. Paying for their expertise is your best defense against the massive fines and shipping delays that a misclassification can trigger. An incorrect HS code is one of the biggest red flags for customs agencies worldwide.

What Happens If I Ship a Restricted Item Without the Proper Documents?

The consequences run the gamut from inconvenient to business-ending. In the best-case scenario, your shipment just gets delayed, which is still enough to ruin a customer's experience and hurt your brand's reputation.

More likely, though, customs authorities will hold or seize the package. That can lead to some seriously steep fines and penalties. And in the worst cases involving highly controlled items, you could find yourself blacklisted from shipping to that country ever again. Proper documentation isn't just a good idea—it's a legal requirement that protects your entire business.

Ready to stop gambling on compliance and start automating your shipping rules? Ship Restrict for WooCommerce replaces manual guesswork with a powerful, automated system. Learn how Ship Restrict can save you time and prevent costly mistakes.

Cody Yurk

Founder and Lead Developer of ShipRestrict, helping e-commerce businesses navigate complex shipping regulations for regulated products. Ecommerce store owner turned developer.