Shipping Insurance for High-Risk Products: What E-Commerce Stores Need

Discover key insights on Shipping Insurance for High-Risk Products: What E-Commerce Stores Need to protect your business from loss, theft, or damage. Learn more!

Cody Y.

Updated on Oct 5, 2025

If you're shipping high-value or regulated products, you can't afford to gamble on standard insurance. The hard truth is that the default coverage offered by carriers is dangerously inadequate for anything considered high-risk. You absolutely need specialized, third-party shipping insurance.

This guide will walk you through exactly how to secure your shipments, protect your revenue, and keep your customers' trust intact.

The High Stakes of Shipping Valuable Goods

Imagine sending a thousand-dollar piece of electronics or a rare collectible through the mail with nothing more than a standard shipping label. It's an unnerving thought, but countless businesses do something similar every day by relying on basic carrier liability.

This is a critical mistake. Standard "insurance" from carriers like USPS or FedEx often caps out at a mere $100. Anything above that? You're on the hook for the entire loss.

Shipping high-risk products means you're up against dangers that go far beyond a simple lost package. These items are often prime targets for theft, require special handling to avoid damage, and can get tangled in complex regulatory hurdles during transit.

What Makes a Product High-Risk?

A product's risk profile isn't just about its price tag. Several factors can make an item much more vulnerable once it leaves your warehouse, turning specialized insurance from a "nice-to-have" into a necessity.

- High Monetary Value: Items like jewelry, luxury watches, and high-end electronics are magnets for theft.

- Fragility: Think glassware, antiques, and sensitive scientific equipment. These can be easily damaged without meticulous handling.

- Regulatory Scrutiny: Products such as firearms, alcohol, or certain collectibles face a maze of strict shipping rules. For instance, navigating firearms and ammunition shipping compliance requires a deep understanding of carrier policies and legal restrictions.

- Irreplaceability: Custom-made goods, original artwork, and one-of-a-kind collectibles represent losses that a simple refund can never truly fix.

When you ship valuable or restricted goods, you're not just dealing with the occasional lost box. You're up against organized theft, potential damage from improper handling, and the risk of regulatory non-compliance. Standard carrier liability was never designed to cover these scenarios, leaving a massive gap in your financial protection.

The following table breaks down the key threats you need to be aware of.

Key Risks in Shipping High-Value Products

| Risk Category | Description | Impact on Business |

|---|---|---|

| Theft & Porch Piracy | High-value items are prime targets for both internal theft within carrier networks and theft after delivery. | Direct financial loss, damaged customer trust, and negative brand reputation. |

| Damage in Transit | Fragile or sensitive items can be easily broken due to rough handling, improper stacking, or environmental factors. | Cost of replacement, unhappy customers, and potential loss of repeat business. |

| Regulatory Non-Compliance | Failing to follow strict rules for shipping items like firearms or alcohol can lead to seized shipments and legal penalties. | Fines, legal fees, loss of shipping privileges, and severe damage to your business's credibility. |

| "Mysterious Disappearance" | Packages that vanish without a clear tracking event, often falling into a black hole where carriers deny liability. | Complete financial loss with little recourse, as standard policies often exclude this scenario. |

As you can see, relying on the $100 default coverage is a recipe for disaster. These risks demand a more robust solution tailored to the unique challenges of your products.

Unfortunately, many online retailers are operating with a false sense of security. A staggering 73% of e-commerce stores use insurance policies that fail to properly cover their actual business needs, especially for high-value goods.

With an average of 1.2% of all packages being lost or damaged, the financial exposure adds up fast. You can find more data on e-commerce insurance gaps over at Claisy.com. This gap between what you think is covered and what actually is covered is where businesses face the most significant financial and reputational damage.

Comparing Your Shipping Insurance Options

When it's time to protect a high-risk shipment, you have two main paths to choose from. The first is the easy, default option carriers offer at checkout. The second is a more strategic choice: specialized, third-party insurance. Knowing the difference between them is absolutely critical for safeguarding your business.

Here's a good way to think about it: carrier insurance is like a basic first-aid kit. It’s handy for a minor scrape but you wouldn't bet your life on it for a serious injury. A third-party policy is like having a surgeon on call—a specialist with the right tools and expertise to handle high-stakes situations when things go wrong.

The Limits of Carrier-Provided Insurance

Major carriers like UPS, FedEx, and USPS offer something they call "declared value" coverage. While it sounds like real insurance, it operates very differently and can be a trap for unprepared businesses. It's bundled right into their shipping services, but that convenience comes at a steep price.

The coverage is notoriously restrictive. Most carriers will automatically cover a shipment for up to $100 and that's it. You can pay more to declare a higher value, but the list of exclusions is long and unforgiving. Many high-risk product categories are simply not covered at all, leaving you completely exposed if something happens.

On top of that, the claims process can be an absolute nightmare. To get reimbursed, you often have to prove the carrier was directly at fault for the loss or damage—a very high bar to clear. This process can drag on for weeks, sometimes months, tying up your capital and leaving you with angry customers waiting for a resolution.

The Power of Third-Party Insurance Specialists

Third-party insurance providers aren't in the business of delivering packages; they're in the business of managing risk. This singular focus means they can offer policies built specifically for the realities of e-commerce. They understand the nuances of shipping high-risk products and create coverage that actually protects you when you need it most.

These specialized policies offer some serious advantages:

- Higher Coverage Limits: They can easily insure items worth thousands of dollars, blowing past the low caps set by carriers.

- Broader Protection: Third-party insurers often cover product categories that carriers flat-out exclude, like jewelry, electronics, and other valuable goods.

- Faster Claims Processing: Their business model depends on resolving claims efficiently. Payouts are typically handled in days, not months, so you can replace or refund customer orders without a long wait.

The real game-changer is how claims are handled. With a third-party insurer, the focus is on your policy coverage, not on proving the carrier was negligent. This shifts the dynamic in your favor and makes for a much smoother, more successful claims experience.

For businesses shipping unique or highly regulated items, like vehicles, the need for a specialist is even more obvious. For a detailed look into vehicle-specific coverage, explore these essential car shipping insurance tips.

A Head-to-Head Comparison

Let's break down the core differences so it's easy to see. This comparison makes it clear why a dedicated insurance partner is the smarter choice for protecting high-risk products.

| Feature | Standard Carrier Insurance (UPS, FedEx, USPS) | Specialized Third-Party Insurance |

|---|---|---|

| Coverage Type | Declared value; requires you to prove carrier fault. | True insurance; based on your policy terms. |

| Coverage Limits | Very low, often capped at just $100 by default. | High and flexible, tailored to your product's value. |

| Excluded Products | A long list of exclusions, especially for high-value items. | Fewer exclusions; covers a much wider range of goods. |

| Claims Process | Slow, bureaucratic, and demands extensive evidence from you. | Fast, streamlined, and designed for e-commerce sellers. |

| Cost-Effectiveness | Can get expensive for higher values, with weaker coverage. | Often more affordable, especially for high-volume shippers. |

At the end of the day, choosing carrier insurance for a high-risk product is a gamble. You're betting that nothing will go wrong, because if it does, the odds are stacked against you. Opting for a third-party provider isn't just an expense—it's an investment in certainty and financial security.

Choosing the Right High-Risk Insurance Policy

Picking the right insurance policy for your high-risk products is about so much more than just finding the lowest premium. It's about digging into the details to make sure your coverage is a real safety net, not just a piece of paper full of holes. After all, an insurance policy is only as good as its ability to pay a claim when you need it most.

Think of it like inspecting the blueprints before building a house. You need to know the foundation is solid and the structure can handle a storm. It’s the same with your insurance policy—you have to examine its core components to ensure it will hold up when things go wrong.

Seek Comprehensive All-Risk Coverage

When it comes to shipping insurance for high-risk goods, the gold standard is an "all-risk" policy. This type of coverage is incredibly powerful because of its broad scope. Instead of listing every specific disaster it covers, an all-risk policy protects your shipment against every possible danger unless it's explicitly excluded in the fine print.

This simple change flips the entire burden of proof. With weaker "named peril" policies, you'd have to prove your loss was caused by one of the specific events listed. With an all-risk policy, coverage is the default assumption unless the insurer can prove the loss was caused by something on their exclusion list.

That distinction is critical and can easily be the difference between a paid claim and a total loss. Always prioritize policies that offer this level of comprehensive protection.

Verify Product-Specific Endorsements

Let's be honest, not all high-risk products are the same. The dangers facing a shipment of fine jewelry are completely different from those for delicate electronics or rare art. That’s why you have to make sure your policy includes specific provisions, or endorsements, that explicitly name the types of items you sell.

A standard policy might have general exclusions for categories like precious metals or electronics. An endorsement is like a special amendment that overrides those general rules, confirming that your specific products are actually protected.

- For electronics: Look for coverage that includes damage from things like electrostatic discharge or simple mishandling.

- For jewelry: Make sure the policy covers the full appraised value and protects against "mysterious disappearance."

- For fragile goods: Verify that breakage from normal transit vibrations isn't excluded.

Without these specific endorsements, you could find yourself paying for a policy that legally doesn't even cover your core product line.

Scrutinize the International Coverage Details

Taking your store global is a massive opportunity, but it also dials up the risk. Cross-border shipping is exploding, with nearly 45% of merchants already shipping over 20% of their orders internationally. A staggering 82% plan to expand their global sales in the next two years. You can find more shipping statistics and future trends that highlight this growth.

But international shipments face more theft, damage, customs nightmares, and logistical headaches—all of which can magnify losses on high-value products.

When you're looking at a policy's international scope, don't just check a box. Dig deep. Does the coverage extend door-to-door, or does it stop the second the package clears customs? Are entire countries or regions blacklisted from coverage?

A policy that looks perfect for domestic shipping might be completely useless for your international customers. True global protection needs to be seamless, covering every step of the journey until that package is safely in your customer's hands.

Evaluate the Claims Process Thoroughly

Finally, we get to the most critical part of any insurance policy: the claims process. A policy with incredible coverage is worthless if filing a claim is a bureaucratic nightmare. This is where third-party insurers often blow carrier-provided insurance out of the water.

Look for a provider with a claims process that is clear, simple, and fast. The key questions to ask are:

- How is a claim filed? The best providers offer a straightforward online portal that requires minimal paperwork.

- What's the average resolution time? You want a partner who resolves claims in days, not weeks or months.

- What documentation is required? The list should be reasonable—usually just proof of value and confirmation of non-delivery or damage.

A transparent and efficient claims process means you can resolve issues for your customers quickly, protecting both your revenue and your brand's reputation without getting stuck in a lengthy battle for reimbursement.

Understanding the True Cost and ROI of Your Policy

Judging shipping insurance just by its premium is a rookie mistake. It's like picking a car based on its color while ignoring the engine completely. That monthly fee is only one small piece of a much larger financial puzzle. To really see what a policy is worth, you need to think in terms of Total Cost of Risk.

This is the key difference between reactive business owners and strategic ones. Total Cost of Risk isn't just about the premium. It also accounts for all the hidden costs that pop up when a shipment goes wrong—like the hours your team wastes fighting a denied claim or the brand damage from a single, high-profile shipping disaster. These are very real expenses that quietly chip away at your profits.

Calculating the Fallout from an Uninsured Loss

Let's walk through a real-world example. Imagine you sell luxury watches, and a $3,000 timepiece vanishes in transit. If you're relying on basic carrier coverage or have no third-party policy, the financial hit is much bigger than you think.

- Direct Product Loss: Right off the bat, you're out the $3,000 cost of the watch.

- Replacement Shipping Costs: You have to pay again to ship a new one to an already disappointed customer.

- Customer Support Hours: Your team is now tied up handling emails, investigating the loss, and processing a replacement order. That’s time they could have spent on sales.

- Lost Customer Lifetime Value: A bad delivery experience can lose you a customer for life, not to mention any friends they might have referred.

Add it all up, and the true cost of that one lost watch is far more than its $3,000 sticker price. Now, stack that massive potential loss against the small, predictable premium of a good insurance policy. The return on investment becomes glaringly obvious.

Framing Insurance as an Investment, Not an Expense

It's time for a mindset shift. For high-risk products, shipping insurance isn’t just another line item on your expense sheet; it's a high-yield investment in your company's stability and future. Every premium you pay is a strategic move to protect your assets, your reputation, and your bottom line.

This kind of protection is becoming non-negotiable as e-commerce grows. The global shipping insurance market is projected to climb from roughly $15 billion in 2025 to an estimated $25 billion by 2033. That growth is a direct reflection of businesses scrambling to safeguard shipments against the rising tide of theft and damage.

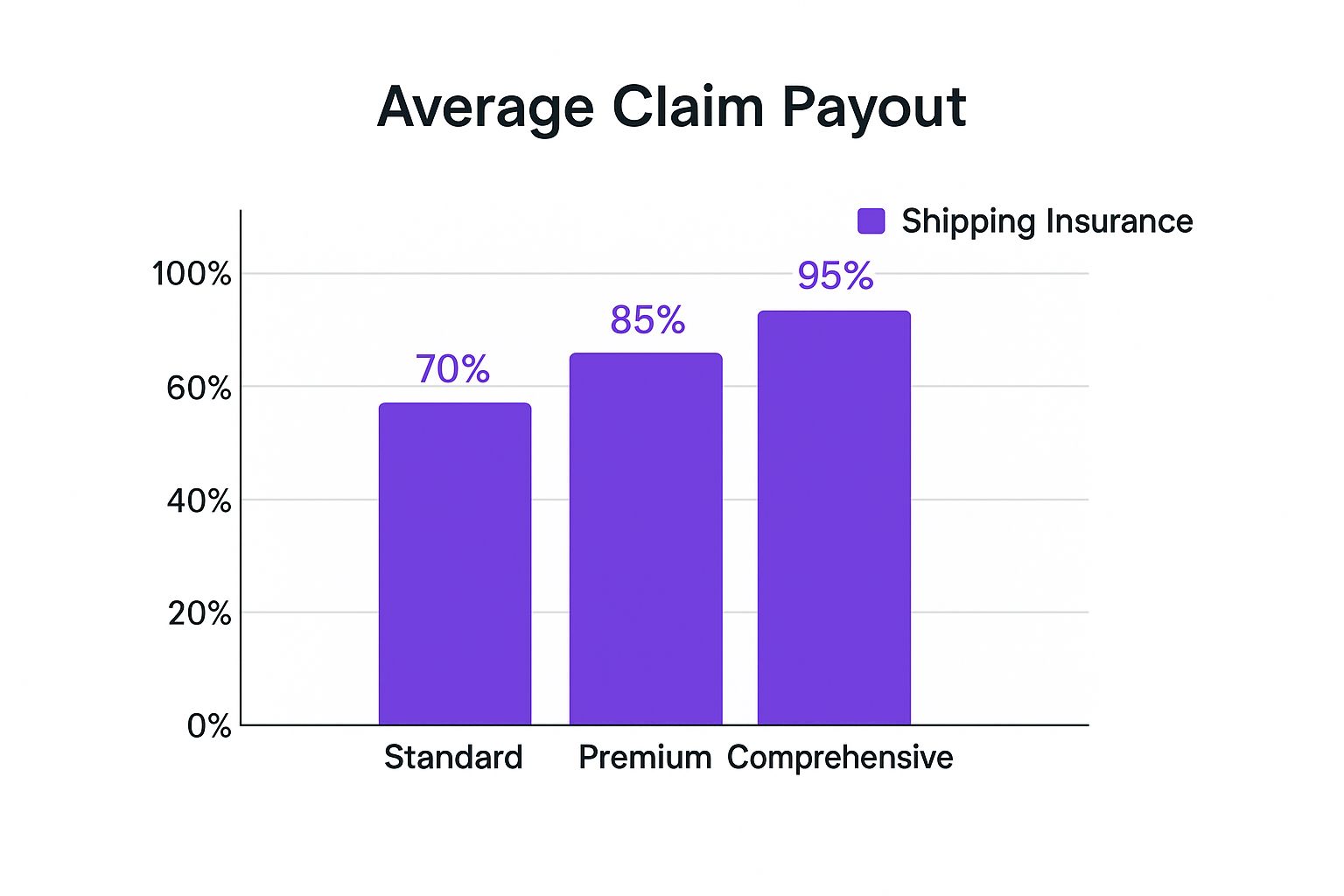

This chart breaks down how different insurance tiers directly affect your claim payout and, ultimately, your ROI.

As you can see, a comprehensive policy dramatically boosts your chances of a full payout, making sure you actually recover your losses and protect your margins.

A strong insurance policy acts as a buffer against unpredictable events, transforming a potentially catastrophic financial loss into a manageable, planned-for operational cost. It gives you the peace of mind to focus on scaling your business instead of worrying about what could go wrong with every package you send.

To get a realistic handle on your true costs and potential ROI, you have to factor in all your shipping expenses. Using a tool like the Logistics Shipping Cost Predictor can give you a much clearer picture of your total financial outlay. And don't forget, these costs go beyond just carrier fees—they also include the potential fallout from non-compliance. You can learn more in our guide on the true cost of shipping compliance violations. By understanding the complete financial scope, you can make a smarter decision that truly protects your business's future.

Implementing Best Practices to Mitigate Shipping Risks

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/QXFXk0Apofk" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>While having a solid shipping insurance policy for high-risk products is your ultimate safety net, the best outcome is never needing to file a claim in the first place. Proactive risk mitigation is your first and most powerful line of defense. By putting smart strategies in place before a package even leaves your warehouse, you can dramatically cut down the chances of theft, damage, or loss.

Think of it like this: insurance is the world-class surgeon you have on call. Your best practices, on the other hand, are the daily habits that keep you healthy and out of the operating room entirely. These are practical, field-tested tactics that build a tougher, more secure fulfillment process from the ground up.

Fortify Your Physical Packaging

The first step is simple: make your packages as boring and difficult to mess with as possible. Thieves target parcels that look like they contain something valuable, so your goal should be total discretion and security. A few small tweaks can make a huge difference.

Here are a few foundational tactics you can start using immediately:

- Use Discreet, Unbranded Boxes: Ditch the custom-branded packaging that screams "expensive item inside!" A plain brown box is far less tempting to a thief than one covered in the logo of a luxury electronics or jewelry company.

- Secure with Tamper-Evident Tape: Standard packing tape is easy to slice open and reseal without leaving a trace. Tamper-evident tape, however, leaves behind obvious proof if the seal is broken—like a "VOID" message—alerting you and your customer that something is wrong.

- Reinforce Box Structure: For fragile or heavy items, always use high-quality, corrugated boxes and reinforce the seams. This simple step helps prevent boxes from bursting open or getting crushed in transit, which is a leading cause of damage claims.

Enhance Your Shipping and Delivery Protocols

Beyond the box itself, your shipping procedures are critical for getting a package to its destination safely. For high-value goods, requiring extra verification and control during the final leg of the delivery is non-negotiable. This is your chance to stop "porch piracy" before it ever happens.

The final mile of delivery is often the most vulnerable point in the shipping journey. By requiring a direct handoff to an authorized recipient, you eliminate the massive risk of a valuable package being left unattended on a doorstep, where it becomes an easy target for theft.

The most effective tool here is requiring a signature upon delivery. For especially sensitive or expensive items, specifying "Adult Signature Required" ensures the package is handed directly to a responsible person at the correct address. This creates an unbroken chain of custody and gives you documented proof of a successful delivery.

Automate Your Rules with Integrated Technology

Trying to apply these best practices manually to every single order is tedious and leaves room for human error. As your business scales, it becomes completely unmanageable. This is where integrated technology becomes your secret weapon, letting you enforce your security rules automatically and without fail.

Tools like Ship Restrict are built for this exact scenario. Instead of relying on a human with a checklist, you can create a system of automated rules that applies the right protections to the right orders, every single time. It transforms risk mitigation from a manual chore into a seamless part of your workflow.

For instance, you can set up rules that:

- Automatically add insurance to any order over a specific value, like $500.

- Require an "Adult Signature" for all shipments containing regulated products.

- Restrict specific shipping methods for fragile items to guarantee they get the right handling.

This kind of automation ensures every high-risk shipment is protected exactly how you want it to be, without anyone having to remember to do it. You can see how this works in our deep dive on automated shipping compliance for Woo Commerce stores. By combining smart packaging, strict delivery protocols, and powerful automation, you create a multi-layered defense that minimizes risk and protects your bottom line.

Don't Gamble With Your Bottom Line

If you're shipping high-risk products, solid insurance isn't just another line item on your expense report—it's the bedrock of a healthy, scalable business. The whole process can feel like a minefield, but there's a clear path forward if you're willing to get proactive. Just relying on the default coverage carriers offer is a bet you can’t afford to make, not when your revenue and reputation are on the line.

The difference between stores that make it and those that don't often boils down to one simple thing: proactive risk management. Taking control of your shipping means you stop hoping packages arrive safely and start ensuring they do. That starts with accepting that standard carrier liability won't cut it for valuable or regulated goods. You need specialized, third-party insurance.

Your Path to a Secure Fulfillment Strategy

Building a bulletproof fulfillment process is more than possible. It all starts with a hard look at what you’re doing now and committing to the right tools and partners to protect every single package that leaves your warehouse. Real security is a mix of smart physical practices and even smarter automation.

Here's your immediate action plan:

- Audit Your Current Insurance: Pull up your existing policies. Are there gaps? Do they explicitly cover the specific products you sell? Don't wait for a customer to report a missing package to discover your coverage is full of holes.

- Explore Specialized Providers: Start researching third-party insurers who actually get e-commerce. Compare their coverage limits, how they handle claims, and any product-specific options to find a partner who fits your business.

- Lean on Automation: Bring in tools that enforce your shipping rules without you having to think about it. This is how you kill human error and make sure every high-value shipment gets the right protection by default—from mandatory insurance to signature confirmation.

When you take these steps, shipping insurance stops being a reactive headache and becomes a strategic asset. It’s an investment that protects your revenue, builds customer trust, and gives you the peace of mind to grow your business without constantly looking over your shoulder.

Ultimately, getting a handle on your shipping risk is the key to sustainable, long-term growth. The strategies and tools are out there; now’s the time to put them to work. Secure your shipments today to protect your business tomorrow.

Frequently Asked Questions

When it comes to insuring high-risk products, a few key questions always pop up. Let's tackle the most common ones so you can make the right call for your e-commerce store with total confidence.

Is Carrier-Provided Insurance Ever Enough for High-Risk Items?

In almost every case, the answer is a hard no. What carriers like USPS or FedEx offer isn't really insurance in the traditional sense; it's a very limited liability coverage often called "declared value." It’s almost always a poor fit for high-value goods.

First off, the coverage caps are incredibly low, typically maxing out at just $100. On top of that, their list of excluded items is long and often includes things like jewelry, art, and premium electronics—the very products that need protection most.

But the biggest problem is the claims process. With declared value, the burden is on you to prove the carrier was directly at fault for the loss or damage. That can be a tough, time-consuming fight. With a real insurance policy, you just have to prove the loss happened.

Choosing a third-party insurer shifts the entire conversation. Instead of having to prove carrier negligence, you simply need to validate your coverage. This is a game-changer and exactly why specialized insurance is the smarter investment for protecting valuable products.

How Do I File a Claim with a Third-Party Insurer?

This is where you’ll really appreciate the difference. The process is designed to be much simpler and faster than wrestling with a shipping carrier. Most modern third-party insurers have a slick online portal where you can get a claim started in just a few minutes.

You’ll typically need to provide a few key details:

- The package tracking number to show its shipping history.

- Proof of the item's value, like the customer’s invoice.

- Confirmation from the customer that the package was damaged or never arrived.

Because these companies live and breathe e-commerce claims, they’re built for speed. They aim to get cases resolved in a matter of days, a world away from the weeks or even months it can take when filing directly with a carrier.

Does Shipping Insurance Cover Porch Piracy?

This is a critical detail, and the answer varies wildly between policies, so you have to check the fine print. Many standard insurance policies—and all carrier-declared value options—end their coverage the exact moment a package is scanned as "delivered."

That creates a massive blind spot. If a thief swipes the package off your customer's doorstep, you're completely unprotected.

However, the best third-party insurers who focus on e-commerce know how big this risk is and often offer specific coverage for porch piracy. Sometimes, this protection requires you to add a "signature required" service to the delivery, but it’s worth it. When you’re vetting insurance options, ask them directly: "Is porch piracy covered?" In today’s world, it’s a non-negotiable feature for anyone shipping high-risk goods.

Protecting your high-risk shipments shouldn't be a manual, error-prone headache. Ship Restrict automates your shipping and insurance rules, ensuring every valuable order gets the right protection by default. Learn how Ship Restrict can secure your fulfillment process and save you time.

Cody Yurk

Founder and Lead Developer of ShipRestrict, helping e-commerce businesses navigate complex shipping regulations for regulated products. Ecommerce store owner turned developer.