Texas Wine Spirits Shipping Laws Your Essential Compliance Guide

Master Texas wine spirits shipping laws. Your guide to TABC permits, DTC rules, and how to automate compliance for your online store to avoid costly penalties.

Cody Y.

Updated on Jan 1, 2026

Navigating Texas wine and spirits shipping laws comes down to one critical divide: you can ship wine directly to a customer's doorstep with the right permits, but shipping spirits the same way is strictly forbidden. This single difference shapes the entire eCommerce landscape for anyone selling alcohol in the Lone Star State.

Decoding the Texas Alcohol Shipping Landscape

At the heart of it all is the powerful Texas Alcoholic Beverage Commission (TABC). Think of them as the gatekeepers. The TABC is the state agency that enforces every single rule related to alcohol, and understanding their role is the first step toward compliance for any online merchant. They're the ones who issue permits, conduct audits, and hand out penalties for violations.

This means you can't just add a bottle of bourbon to your online store and ship it to a customer in Austin. The entire system is built on a foundation that keeps producers and consumers separate, with a few key exceptions.

The Three-Tier System Explained

Picture alcohol distribution in Texas as a regulated pipeline with mandatory checkpoints. This is the three-tier system, a framework most states adopted after Prohibition to prevent monopolies by keeping manufacturers from owning retail shops.

The three tiers are straightforward:

- Tier 1 Producers: Wineries, breweries, and distilleries that actually make the alcohol.

- Tier 2 Wholesalers/Distributors: The middlemen who buy from producers and sell to retailers.

- Tier 3 Retailers: Your local package stores, bars, and restaurants that sell directly to you and me.

For spirits, this path is non-negotiable. A Kentucky distillery (Tier 1) has to sell its bourbon to a Texas wholesaler (Tier 2). That wholesaler then sells it to a licensed package store in Dallas (Tier 3), where a customer can finally walk in and buy it. There are no legal shortcuts or bypasses.

The Wine Exception: A Special Bypass

Wine, however, gets a special "express lane." With the right permits, both in-state and out-of-state wineries can ship directly to Texas consumers, completely bypassing the wholesaler and retailer. This direct-to-consumer (DTC) channel is a privilege granted only to wine producers and is still heavily regulated by the TABC.

This is the core reason you can order a case of Cabernet Sauvignon from a Napa winery's website but can't do the same with a bottle of Tennessee whiskey from a Lynchburg distillery.

The roots of these laws go all the way back to the end of Prohibition. When the 21st Amendment passed in 1933, it gave states the power to regulate alcohol sales themselves. Texas responded by creating its rigid three-tier model, and that structure is why out-of-state spirits must come from a local package store in the consumer’s county—a rule the TABC firmly upholds today. You can find more of the historical backstory behind these Texas alcohol regulations on texastribune.org.

To make this crystal clear, let's break down the key differences in a simple table.

Texas Alcohol Shipping At a Glance: Wine vs. Spirits

| Rule Category | Wine Shipping Rules | Spirits Shipping Rules |

|---|---|---|

| DTC Legality | Legal with proper TABC permits. | Strictly Illegal for out-of-state producers. |

| Origin | Can be shipped from in-state or out-of-state wineries. | Must be purchased from an in-state, licensed retailer. |

| Permit Required | Winery Permit (G) and Out-of-State Winery Direct Shipper's Permit (DS). | No DTC permit exists for out-of-state distillers. |

| Path to Consumer | Producer → Consumer (DTC) | Producer → Wholesaler → Retailer → Consumer |

As you can see, the state treats these two product categories in completely different ways, which has massive implications for how you set up your online store.

Why Wine Can Ship But Spirits Cannot

If you’ve ever tried to ship alcohol in Texas, you’ve probably hit a confusing roadblock: why is it perfectly legal to get a case of wine delivered from a California vineyard, but you can’t order a bottle of single-malt scotch directly from a distillery?

It feels arbitrary, but the answer isn't random. It’s all rooted in a single, landmark Supreme Court decision that completely changed the game for wine—and left spirits behind.

The entire legal divide comes down to the 2005 Supreme Court case, Granholm v. Heald. Think of this ruling as opening a new express lane on the interstate commerce highway, but this lane was built exclusively for wine. The Court ruled that if a state lets its own wineries ship directly to consumers, it can't block out-of-state wineries from doing the same thing.

This wasn't about the alcohol itself; it was about fairness. The decision was based on the Commerce Clause of the U.S. Constitution, which is there to stop states from creating laws that unfairly favor their own local businesses. In short, the court forced a level playing field for wineries, no matter where they were located.

The Granholm Decision and Its Aftermath

Here’s the catch: the Supreme Court's ruling was incredibly specific. It only talked about wine. It said nothing about beer or—most importantly for this conversation—distilled spirits. This created an immediate legal fork in the road, leaving spirits stuck in the old, post-Prohibition three-tier system.

Because of this, wine producers suddenly had a powerful direct-to-consumer (DTC) sales channel, while spirits producers were left out in the cold. The legal path for spirits stayed exactly the same, requiring every bottle to move through the traditional producer-to-wholesaler-to-retailer pipeline. Texas, like many other states, had to update its laws to follow the Granholm decision for wine, creating the very permits that allow for direct shipment today.

The impact was huge and fast. Between 2002 and 2019, the number of states allowing DTC wine shipments jumped from just 18 to 43. Texas officially got on board with restricted out-of-state winery permits after some initial allowances in 2003 and final TABC clarifications in 2005. Meanwhile, distilled spirits are still under a total embargo for direct interstate shipping. An out-of-state liquor store simply cannot legally send products to a Texas resident without going through a local package store—a system that hasn’t changed since 1933. You can see a detailed breakdown of these direct wine shipment trends at depts.ttu.edu.

This history is critical for any eCommerce merchant. It makes it clear that the shipping restrictions aren't about what's in the bottle, but about specific legal history.

The core takeaway from Granholm v. Heald is that fairness in interstate commerce was legally mandated for wine, but this protection was never applied to spirits. This single distinction is the foundation of modern Texas wine and spirits shipping laws.

Practical Implications for Online Sellers

Knowing this legal backstory isn't just trivia; it has a direct impact on how you run your business and which shipping carriers you can use. Because wine is in a legally separate category for DTC shipping, carriers like FedEx have created specific, compliant programs to handle these shipments.

These carrier programs almost always include:

- Special contracts that any business shipping alcohol must sign.

- Mandatory labeling that clearly states the package contains alcohol.

- Adult signature requirements to guarantee the package is received by someone 21 or older.

These rules exist at the carrier level because they are a direct response to state laws passed after the Granholm ruling. You can dive deeper into these requirements in our guide on shipping wine by FedEx.

For spirits, however, no such carrier programs for DTC shipping exist from out-of-state producers for a simple reason: the underlying activity is illegal. Trying to ship spirits directly to a Texas consumer from another state puts your business, your permits, and your shipping accounts in serious jeopardy. This legal history isn’t just an academic exercise; it’s the blueprint for compliant eCommerce in Texas.

Securing the Right TABC Shipping Permits

Knowing why you can ship wine directly to Texas customers is one thing. Actually doing it legally is a whole different ballgame. To get your wine from your warehouse to a customer's doorstep, you first have to navigate the Texas Alcoholic Beverage Commission (TABC) and secure the right permits.

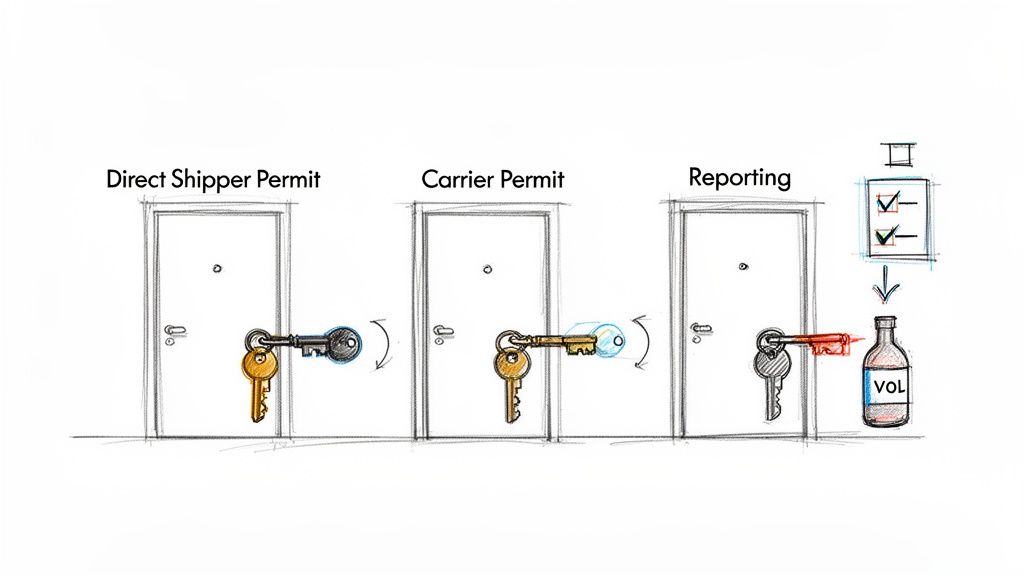

Think of it like a series of locked doors standing between you and the massive Texas market. Each permit is a specific key, and without the right set, you’re completely locked out. The TABC doesn't care about your award-winning vintage or your brilliant marketing; they care about compliance, and compliance starts with the right paperwork.

The Out-of-State Winery Direct Shipper's Permit (DS)

For any out-of-state winery, the single most important key you'll need is the Out-of-State Winery Direct Shipper's Permit, commonly known as Permit DS. This is the golden ticket. It's the specific license that legally authorizes you to bypass the traditional three-tier system and ship your wine straight to a Texas resident's home, all thanks to the Granholm v. Heald Supreme Court decision.

But this permit isn’t just a permission slip—it’s a commitment. By obtaining it, you agree to play by Texas rules. That means collecting and remitting all state and local sales taxes, filing detailed reports on every single shipment, and adhering to strict volume limits.

Speaking of which, a winery with a DS permit is capped at shipping no more than 35,000 gallons of wine to Texas consumers annually. This ceiling is designed to keep the playing field level, preventing massive producers from flooding the DTC market while still allowing smaller wineries to thrive.

The Carrier Permit (E)

Once you have the key to sell (your DS permit), you need another key to actually transport the product. This is where the Carrier Permit (E) comes in. Now, you don't get this permit yourself. Instead, you are legally required to use a shipping company—like FedEx or UPS—that holds one.

This is a non-negotiable part of the process. The TABC mandates that any common carrier physically moving alcohol within the state must have its own active permit. This ensures that everyone in the supply chain, from the winery to the delivery driver, is accountable to Texas regulators.

Crucial Tip: Before you sign a contract with any shipper, you must verify they hold a valid Texas Carrier Permit. Partnering with a non-permitted carrier is a serious violation that can put your own Direct Shipper's Permit at risk and open you up to hefty fines.

Comparing Essential TABC Shipping Permits

To run a compliant eCommerce business in Texas, you have to understand how these different permits work together. The table below breaks down the must-have licenses for shipping wine into the state.

Essential TABC Permits for Alcohol Shipping

| Permit Name | Who Needs It | What It Allows | Key Limitations |

|---|---|---|---|

| Out-of-State Winery Direct Shipper's Permit (DS) | Any out-of-state winery shipping DTC to Texas consumers. | The legal sale and shipment of wine directly to Texas residents. | 35,000-gallon annual limit per winery; strict tax and reporting duties. |

| Carrier Permit (E) | The third-party shipping company (e.g., FedEx, UPS). | The legal transportation and delivery of alcoholic beverages within Texas. | Must perform adult signature verification (21+) at delivery; cannot deliver to P.O. boxes. |

| Winery Permit (G) | In-state Texas wineries. | Manufacturing wine within Texas and allows for DTC shipping to Texas consumers. | Different rules and reporting requirements apply compared to out-of-state shippers. |

As you can see, compliance isn't about getting one license and calling it a day. It’s an interconnected system. Your DS permit is useless without a carrier that holds an E permit, and that carrier can’t legally touch your wine unless you have a valid DS permit. The TABC expects every link in the chain to be secure, from the moment a customer clicks "buy" to the final delivery.

Putting Compliance Into Practice

Getting your TABC permits is just the first step. The real challenge—and the real test of your business—is what happens every single time a package leaves your warehouse. Following Texas wine and spirits shipping laws isn't about the paperwork you filed; it’s about the precise, repeatable process you follow for every single shipment.

Think of it as the final, most critical stage of quality control. You’re not just checking the product; you’re making sure the delivery itself is legally airtight. This means getting the labeling right, enforcing strict age verification, and only working with carriers approved by the state. Dropping the ball on any of these isn't a minor slip-up—it's a direct violation of the permit you worked so hard to get.

The Anatomy of a Compliant Label

The outside of your shipping box is your first line of defense. It needs to tell everyone who handles it exactly what’s inside and what rules apply. The TABC is crystal clear on this: the label must prevent any chance of the package ending up in the wrong hands, especially a minor's.

Every single box you ship must have this exact text printed clearly on the label:

“Contains Alcohol: Signature of Person 21 Years of Age or Older Required for Delivery.”

This statement is non-negotiable. It does two crucial things: first, it flags the package for the carrier's employees, letting them know it requires special handling. Second, it tells the customer that an adult with a valid, government-issued ID has to be physically present to sign for it. There are no workarounds—no leaving it on the porch or with a teenager.

Mandating Adult Signature Verification

That adult signature is the lynchpin of the entire delivery process. It’s the moment where all the legal safeguards become real. Your shipping partner isn’t just dropping off a box; they are acting as your compliance agent at the customer's front door.

Here’s what must happen for the delivery to be legal:

- Physical Presence: Someone has to be there in person.

- ID Check: The driver must visually inspect a valid government-issued photo ID and confirm the person is 21 or older.

- Signature Capture: A signature must be collected to create a legal record that you did everything right.

If this final step fails, the entire shipment is legally invalid. This is exactly why you can't ship alcohol to a P.O. box or any other address where a face-to-face handoff isn't possible.

Choosing a TABC-Approved Carrier

Who you trust to deliver your products is one of the most important decisions you'll make. You can’t just pick the cheapest or fastest option. In Texas, only carriers that hold their own TABC Carrier Permit (Permit E) are legally allowed to transport and deliver alcohol.

Big names like FedEx and UPS have this permit, and it means they've built specific protocols for handling alcohol. Their drivers are trained on the signature and ID verification rules, and they understand the serious consequences of messing it up. Using an unpermitted carrier is a major violation that could easily cost you your own Direct Shipper's Permit.

Beyond just Texas alcohol rules, the broader challenge of implementing compliance frameworks is a reality for any business in a regulated field. At the end of the day, your shipping carrier is an extension of your brand. Their ability to follow the law is a direct reflection of your own commitment to running a responsible business.

How to Automate Texas Shipping Compliance

Let's be honest. Manually checking every single order against the tangled web of Texas wine and spirits shipping laws is more than just a headache—it’s a recipe for disaster. Texas has 254 counties, and each one can have its own wet-or-dry status. The risk of one wrong shipment slipping through is sky-high. That single mistake could trigger hefty fines or, even worse, put your hard-won TABC permits on the line.

This is where smart business owners stop relying on spreadsheets and manual address lookups. Instead, they use automation to build a digital fortress around their checkout process. This isn't about convenience; it's about survival. It's about protecting your business from the ground up before a costly mistake can ever happen.

Building an Automated Compliance Engine

The real trick is to stop a non-compliant order dead in its tracks, before it's even placed. For anyone running a WooCommerce store, a tool like Ship Restrict acts as your automated compliance engine. It gives you the power to create intelligent, granular rules that instantly vet a customer's shipping address against your specific legal obligations.

Think of it as the bouncer at your checkout's front door. If a customer from a dry county tries to buy a bottle, the system politely stops them. If someone from out of state tries to add bourbon to their cart, the checkout simply won't let them proceed. This proactive defense saves you countless hours and completely sidesteps the human error that leads to violations.

This flowchart maps out the journey of a compliant Texas wine shipment, from the moment it leaves your warehouse to the final delivery.

As you can see, every step—from proper labeling and using a permitted carrier to securing that all-important adult signature—is a critical checkpoint. Automation is what ensures these rules are followed every single time, without fail.

Creating Granular Shipping Rules

The true power of automation is in its precision. You can configure rules that target hyper-specific conditions, making sure you're buttoned up on both state and local laws. This is absolutely essential in Texas, where a single ZIP code can be the difference between a legal sale and a serious infraction.

Here’s a practical look at how you could use a plugin like Ship Restrict to enforce Texas laws on your store:

- Block All Out-of-State Spirits: You can create one simple but powerful rule: block any product categorized as "spirits" from being shipped to any state other than Texas. Assuming you're an in-state retailer, this single rule instantly handles one of the state’s biggest restrictions.

- Restrict by ZIP Code for Dry Areas: Keep a list of ZIP codes that fall within dry counties or precincts. From there, you can build a rule that blocks all alcohol shipments to those specific locations, protecting you from local-level violations.

- Manage Product-Specific Rules: Set up rules that only apply to wine. This allows you to legally fulfill DTC wine shipments to Texas addresses while blocking everything else, perfectly mirroring the state's nuanced legal landscape.

Beyond Blocking Orders: The Customer Experience

Great compliance automation isn't just about saying "no." It's about communicating clearly and creating a transparent checkout experience that doesn't leave customers frustrated. When a restriction kicks in, you can show a custom message that explains exactly why the order can't be completed.

For instance, instead of a vague error, a customer might see this:

"We're sorry, but due to Texas state law, we are unable to ship distilled spirits to your location. We can only ship wine directly to Texas residents."

This simple message transforms a potential dead-end into an educational moment. It builds trust, cuts down on confused customer service emails, and shows that you’re a responsible, law-abiding business. To see how to get these intelligent filters running, check out our deep dive on setting up https://shiprestrict.com/blog/shipping-restrictions/woo-commerce-alcohol-shipping-restrictions.

Automating your shipping rules does more than save time—it creates a reliable, scalable system for managing risk. For businesses looking to move beyond manual checks, exploring legal document automation is a critical step for mastering Texas shipping compliance. By turning complex laws into a set of automated checks and balances, you can get back to growing your business with the confidence that your compliance is handled.

The High Cost of Non-Compliance

It's one thing to understand the rules of shipping alcohol in Texas, but it’s another to know what happens when you break them. That’s what really drives home the importance of getting compliance right. A violation of Texas wine and spirits shipping laws isn't just a simple customer service issue or a returned package. A single mistake creates a serious legal and financial liability that can put your entire business on the line.

The Texas Alcoholic Beverage Commission (TABC) doesn't mess around. Their penalties are designed to be a powerful deterrent, escalating quickly from eye-watering fines to sanctions that can shut you down for good. For an online merchant, this means every single shipment has to be perfect. The stakes are just that high.

Penalties You Cannot Afford to Ignore

Failing to follow TABC regulations can set off a chain reaction of devastating consequences. These aren't slaps on the wrist; they're structured to make sure that non-compliance is never worth the risk.

The penalties you could face include:

- Massive Fines: Financial penalties can hit thousands of dollars for a single screw-up, like shipping to a dry county or using a carrier that isn't on the approved list. If you make the same mistake twice, those fines can compound until they’re impossible to pay.

- Permit Suspension: The TABC can temporarily suspend your Direct Shipper's Permit, which instantly cuts off all your sales to the huge Texas market. This doesn't just freeze a major revenue stream; it damages your business's reputation.

- Complete Permit Revocation: For serious or repeated violations, the TABC has the power to permanently revoke your shipping permits. This is the business equivalent of a death sentence—a permanent ban from selling in the state.

In the most extreme cases, like knowingly shipping large quantities of spirits illegally or selling to a minor, a violation can even escalate to felony charges. Suddenly, a business mistake becomes a criminal matter with potentially life-altering consequences for you as the owner.

The TABC doesn't see an illegal shipment as a simple error. They see it as a direct challenge to their authority, and the penalties reflect that. Proactive compliance is the only way to operate.

It's Not Just Fines: Taxes and Reporting Are a Big Deal, Too

The legal risks don't stop with fines and losing your permit. When you hold a Direct Shipper's Permit, you also become a tax collector for the state of Texas. You are legally required to collect and hand over all state and local sales and excise taxes on every bottle sold, just as if you were a brick-and-mortar shop in downtown Austin.

Forgetting to do this is considered tax evasion, which comes with its own set of brutal penalties from the Texas Comptroller's office, including back taxes, interest, and even more fines. Keeping meticulous records and filing on time isn't optional—it's a core requirement of your permit. The true cost of shipping compliance violations isn’t just about the initial penalty; it’s about the mountain of administrative work from audits and legal fights that follow.

When you look at it this way, the high cost of non-compliance makes a powerful argument for automation. Trying to track every rule by hand is a gamble you simply can't afford to lose. An automated system turns compliance from a daily risk into a reliable, built-in safeguard, protecting your business from the severe penalties waiting for those who fall short.

Even after you get the hang of the main rules, some of the trickier situations can leave you guessing. Let's clear up some of the most common questions we hear from merchants shipping alcohol into Texas.

Can I Ship Beer or Other Malt Beverages to Texas Customers?

Unfortunately, no. If you're an out-of-state seller, you cannot ship beer directly to a consumer in Texas. Just like with spirits, beer is locked into the state's three-tier system. That means any beer sold in Texas has to come from a licensed Texas retailer, not directly from an out-of-state producer.

What Happens If a Customer Lives in a Dry County?

This is a big one. It is absolutely illegal to ship alcohol to any address in a "dry" county or precinct where local laws ban alcohol sales. And the state makes it crystal clear who's on the hook: you, the merchant, bear 100% of the responsibility for knowing and following these hyper-local rules. This is where an automated shipping tool becomes a business-saver, as it can block orders to specific ZIP codes and prevent you from making a costly mistake.

The TABC doesn't give you a pass for not knowing local laws. A single shipment into a dry area is a direct violation that puts your permits on the line.

Can I Ship Wine to a PO Box in Texas?

Never. Shipping alcohol to a P.O. Box is prohibited everywhere, and Texas is no exception. TABC rules are strict on this point: all alcohol deliveries must go to a physical address where someone 21 or older can show a valid ID and sign for the package. It's a non-negotiable part of the age verification process.

Are Gift Baskets with Alcohol Subject to These Laws?

Yes, they absolutely are. Slapping a "gift basket" label on a package doesn't change what's inside. If the basket contains any alcohol at all, it's fully regulated by the TABC. The exact same rules apply—spirits are a no-go for out-of-state DTC shipping, and wine needs the proper Direct Shipper's Permit. Adding cheese and crackers to the box doesn't create a loophole.

Trying to manage all these complex rules by hand is a recipe for disaster. Ship Restrict for WooCommerce automates your compliance by letting you create precise shipping rules that block illegal orders before they become expensive problems. Protect your business and streamline your shipping—learn more at ShipRestrict.com.

Cody Yurk

Founder and Lead Developer of ShipRestrict, helping e-commerce businesses navigate complex shipping regulations for regulated products. Ecommerce store owner turned developer.