Shipping insurance high-risk products comparison: Guide

Shipping insurance high-risk products comparison: Compare coverage, costs, and compliance for regulated items to protect your WooCommerce store.

Cody Y.

Updated on Dec 2, 2025

When you're comparing shipping insurance policies for high-risk products, the real story is always in the fine print. That standard "insurance" your carrier offers? It's usually just declared value coverage. This gives you minimal protection at best and is riddled with exclusions for anything regulated.

True third-party insurance is a different beast entirely. It’s built from the ground up to cover the specific, messy risks that come with shipping products like alcohol, firearms, or pricey electronics. It's about genuine financial security, not just checking a box.

Why Standard Shipping Insurance Fails for High-Risk Products

A lot of WooCommerce merchants fall into the trap of thinking the "insurance" offered at checkout by major carriers is enough. It's a dangerous assumption that can lead to catastrophic losses when you’re moving regulated or high-value inventory.

The hard truth is that standard carrier coverage isn't insurance in the way you think of it; it's a limited liability agreement. This "declared value" coverage often maxes out at a paltry $100 per package unless you pay more. And even if you do, the fine print is a minefield of excluded items.

Common Gaps in Standard Carrier Coverage

Standard policies are designed for everyday, low-risk goods. They simply aren't equipped to handle the unique headaches of high-risk products.

- Extensive Exclusions: Most carrier policies flat-out refuse to cover items like firearms, ammo, alcohol, tobacco, and certain electronics. If you file a claim for a lost or damaged shipment of these goods, expect a denial. You'll be left holding the bag for the total loss.

- Low Liability Limits: Even if your product isn't on the exclusion list, the maximum payout might be a fraction of its actual value. This makes it useless for things like custom firearms or rare collectibles.

- No Coverage for Regulatory Issues: What if customs or another agency seizes a package because of a compliance slip-up? Standard carrier coverage won't help you. It offers zero protection against the lost goods or the fines that might follow. You can learn more about the hidden costs of non-compliance in regulated shipping in our detailed guide.

Assessing Your True Risk Profile

To really protect your business, you have to look beyond simple loss or damage. You need to perform a real risk assessment, analyzing every potential failure point in your shipping workflow. Think about how likely each event is and what the financial fallout would be.

A risk assessment matrix is a great tool for visualizing these threats. You plot out risks based on their probability and the severity of their impact.

A data breach might be a high-impact but low-likelihood event. In contrast, a carrier damaging a fragile electronics shipment could be a medium-impact, high-likelihood risk that requires immediate attention and specialized insurance.

This process forces you to prioritize. It shows you exactly which risks demand dedicated, third-party insurance. For instance, the risk of theft for a high-value jewelry shipment is high-impact and needs a policy that specifically covers it. On the other hand, you might be willing to accept the risk of damage to a durable, low-value good under the standard carrier liability.

This targeted approach ensures you’re putting your money where it counts, laying the groundwork for a smart shipping insurance high-risk products comparison.

When you’re shipping high-risk or regulated products, picking the right insurance partner is about a whole lot more than just finding the lowest premium. The policy's fine print can be the difference between a seamless claim and a catastrophic financial loss. You need a serious, structured way to compare your options.

This framework breaks down the most important criteria, pushing past surface-level costs to get at the true value and reliability of a policy. Use these benchmarks to confidently compare providers and choose a solution that actually has your back.

Coverage Limits and True Value Protection

First thing's first: you need to know what a policy will actually pay out. Don't ever confuse the carrier's declared value with a true insured value. A carrier's declared value is just their maximum liability, and it's often capped low and riddled with exclusions. Real insurance should cover the full replacement or invoice value of your products, period.

When you're vetting a provider, ask these direct questions:

- Does the policy cover the full retail or invoice value of the item?

- Are there per-package limits? How do they stack up against your average order value?

- What’s the maximum they’ll cover for a single large shipment or a full day's worth of orders?

A policy that looks cheap but only covers 50% of your product’s value isn't a bargain. It’s a liability waiting to happen.

Policy Exclusions for Regulated Products

This is, without a doubt, the most critical piece of the puzzle for high-risk merchants. Standard shipping policies are infamous for their long lists of excluded items. You absolutely must confirm that your specific products are explicitly covered.

Get a copy of the full policy terms and hunt for language that mentions your inventory by name. If you sell firearms, for example, the policy needs to say "firearms," not just "general merchandise." Any ambiguity here is a massive red flag.

A provider’s willingness to clearly list what they do cover is a strong indicator of their expertise in your industry. If they can’t give you a straight "yes" or "no" on your product category, they probably don't have the experience to handle a claim when things go wrong.

Claims Process Efficiency and Success Rate

A great policy is completely useless if the claims process is designed to wear you down. The best providers make filing a claim simple and pay out fast. This is a major differentiator you should focus on when comparing your options.

Dig into the specifics of their claims process:

- Simplicity: Is filing a claim an easy online portal, or are you stuck with cumbersome paperwork?

- Speed: What is their average payout time? Look for providers who promise payment in days, not weeks or months.

- Documentation: What proof do they require? Overly burdensome documentation can be a tactic to delay or deny claims.

Support for Regulatory Compliance

A truly forward-thinking insurance partner gets that compliance and risk are two sides of the same coin. Their policy shouldn't penalize you for regulatory events like a customs seizure, as long as you've acted in good faith. Some of the best specialized insurers even offer guidance to help you navigate tricky shipping laws.

This all ties into the bigger picture of shipping risk. We're seeing cargo theft surge—up 27%, with the average loss now over $202,000—but insurers also see that good risk management pays off. A provider who understands these market dynamics is better equipped to support your business. You can learn more about these trends in the State of the Insurance Market 2025 Outlook from Risk Strategies.

Geographic and Carrier Restrictions

Finally, make sure the policy actually fits how you operate. Does the insurer cover every domestic and international destination you ship to? Do they force you to use certain carriers? A policy that limits you to a single, more expensive carrier can wipe out any premium savings in a hurry. Your insurance should create flexibility, not logistical bottlenecks.

To bring this all together, a structured scoring matrix can help you compare potential partners objectively. This isn't just about picking a winner; it's about methodically documenting why one provider is a better fit for your specific business needs than another.

Insurance Evaluation Framework for High-Risk Products

| Evaluation Criterion | Description | Provider A Score (1-5) | Provider B Score (1-5) | Notes/Justification |

|---|---|---|---|---|

| Coverage Limits | Does the policy cover the full invoice/retail value? Are per-package and aggregate limits sufficient for your average order value and shipment volume? | Example: Provider A covers full retail value up to $10k per package. Provider B caps at 80% of invoice value. | ||

| Product Exclusions | Does the policy explicitly and clearly cover your specific high-risk products without ambiguity? Are exclusions reasonable? | Example: Provider A lists our exact product category as covered. Provider B uses vague "general merchandise" language. | ||

| Claims Process | How simple and fast is the claims process? What is the average payout time? Are documentation requirements manageable? | Example: Provider A has an online portal and pays in 7 days. Provider B requires paper forms and averages 30+ days. | ||

| Compliance Support | Does the policy offer protection against regulatory issues (e.g., customs seizure)? Does the provider show expertise in your vertical? | Example: Provider B has a dedicated team for regulated goods and offers compliance resources. | ||

| Cost & Value | How do the premiums, deductibles, and fees compare? Does the cost reflect the true value and protection offered? | Example: Provider A is 10% more expensive but offers 100% value coverage and a faster claims process. | ||

| Geographic Scope | Does the coverage extend to all domestic and international destinations you serve? | Example: Both providers cover our key markets, but Provider A has fewer restrictions in South America. | ||

| Carrier Flexibility | Are you free to use your preferred shipping carriers, or are you locked into a specific network? | Example: Provider B requires using their preferred (and more expensive) carrier for international shipments. |

Using a framework like this transforms your decision from a gut feeling into a data-backed choice. It forces you to look beyond the monthly premium and evaluate which partner truly offers the most robust, reliable, and valuable protection for your business.

Diving Into the Top Insurance Providers: A Comparative Analysis

Picking the right insurance provider is about more than just comparing quotes. You need to dig deep and figure out how each option will actually perform when things go wrong. When you're selling high-risk products, the insurance landscape really breaks down into three camps: the carrier's in-house coverage, specialized third-party parcel insurers, and the heavy-hitting comprehensive freight insurers.

Each one has its place. The best fit for your store depends entirely on what you sell, your tolerance for risk, and how you run your operations.

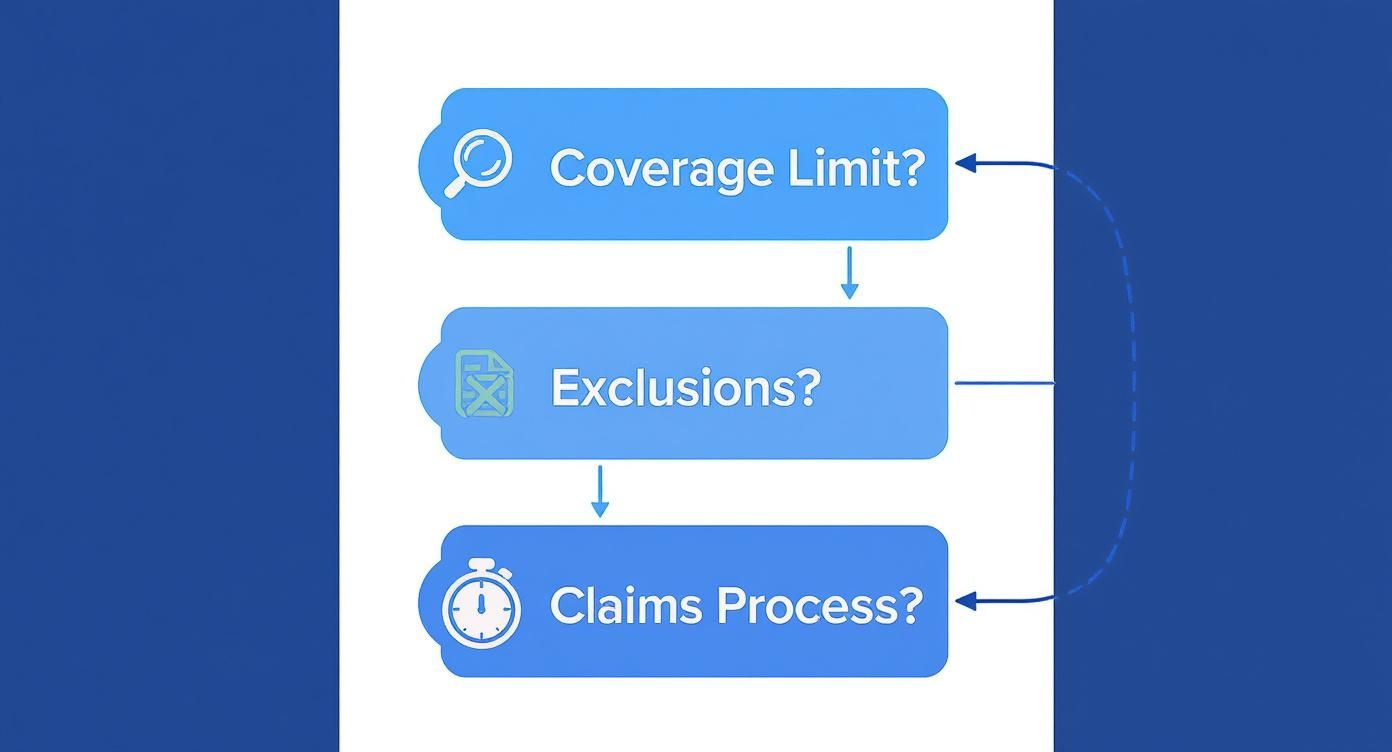

The whole decision boils down to a few critical questions about coverage limits, exclusions, and what happens when you actually need to file a claim. This is the stuff that matters when a $5,000 shipment goes missing.

As the flowchart shows, you have to understand a policy's core strengths and weaknesses before you even think about the price.

Carrier-Provided Coverage (e.g., UPS Capital)

This is the insurance your carrier offers as a quick add-on when you're buying a shipping label. It's undeniably convenient. But that convenience often comes at the price of real protection, especially for anything regulated.

Scenario A: Shipping Artisanal Spirits

Let's say you're shipping a case of small-batch gin worth $500. The carrier's default liability is probably just $100. You can pay extra to declare a higher value, but here's the catch: alcohol is almost always on the restricted or excluded items list in their standard terms. If that package gets lost or broken, your claim will likely get shot down because you shipped a "prohibited" item. You're left with a total loss.

Key Differentiator: The fatal flaw with carrier coverage is its massive list of exclusions for regulated products. Their main business is logistics, not underwriting specialized risk, making them a terrible choice for anything beyond general merchandise.

This option is really only for low-risk, low-value goods where the convenience is worth more than the minimal coverage. For anything regulated, you're taking a huge gamble.

Specialized Third-Party Parcel Insurers (e.g., Shipsurance)

Third-party insurers do one thing, and they do it well: provide actual insurance for parcels. They plug right into shipping software and platforms like WooCommerce, offering much broader coverage and a claims process that doesn't feel like pulling teeth.

Scenario B: Shipping High-Value Electronics

Imagine you're sending out a custom-built computer part valued at $2,500. A third-party insurer will offer a policy that specifically covers electronics, often with limits of $10,000 or more per package. And their premiums are usually much lower than what you'd pay a carrier to declare the same value.

More importantly, their claims process is built for merchants. When a package is damaged, you just upload photos and an invoice to their online portal. Since their entire business is insurance, they have a real incentive to process claims quickly to keep you as a customer. Payouts often happen within a week.

These providers are the sweet spot for many eCommerce stores, striking a great balance between cost, ease of use, and solid coverage for moderately high-value products.

Comprehensive Freight and Cargo Insurers

When you're dealing with extremely high-value goods, large quantities, or complex international shipments, you need to call in the specialists. Comprehensive freight and cargo insurers are the ones who handle intricate supply chains and unique, high-stakes risks. Think about the institutions that have been doing this for centuries; it's worth understanding Lloyd's of London's approach to high-value coverage.

This part of the market is built on stability and meticulous risk assessment. In fact, the global marine insurance market has grown steadily, with premiums reaching $39.92 billion. That stability comes from careful underwriting of high-risk cargo—a practice that directly benefits businesses needing bulletproof protection.

Scenario C: A Pallet of Rare Firearms

Picture an FFL dealer shipping a pallet of collectible firearms valued at $75,000 to another dealer. This is way outside the scope of a standard parcel insurer. A freight insurer, on the other hand, can write a specific policy just for this shipment.

- Custom Underwriting: They'll evaluate the specific risk factors, from the origin and destination to the security protocols in place.

- Regulatory Expertise: They know the compliance landscape for items like firearms and can even insure against seizure if all proper protocols were followed.

- High-Limit Coverage: They can easily cover values that run into the six or even seven figures.

Sure, this level of service costs more. But for inventory that is irreplaceable or carries immense value, it’s the only real option. It allows you to completely transfer that massive financial risk to an entity built to handle it, giving you true peace of mind.

How Compliance Automation Lowers Your Insurance Risk

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/m6RPjjuLjJA" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>The smartest way to handle shipping insurance is to stop claims from ever happening. Proactive compliance automation is what gets you there, moving your strategy from reactive damage control to proactive risk elimination. This doesn't just protect your bottom line—it makes your business a much more attractive, lower-risk client for insurers.

When you install an automated system, you're showing verifiable, consistent proof that you're serious about managing risk. This isn't just about saving time; it's about building a case that you're a responsible partner, which can directly help you lock in better insurance terms and lower premiums.

Preventing Prohibited Shipments at the Source

Your single biggest risk when shipping regulated products is sending something to a place where it's illegal. A manual address check is an accident waiting to happen. A tired employee, an old spreadsheet, or a complex local ordinance are all easy to miss. The results are ugly, ranging from seized packages and costly returns to massive fines.

Compliance automation tools, like ShipRestrict for WooCommerce, kill this risk at the earliest possible moment: the customer's shopping cart.

- Real-Time Cart Validation: These tools check a customer’s shipping address against a database of rules before they can even finish the purchase.

- Granular Rule-Making: You can set restrictions by state, county, city, or even down to specific ZIP codes, giving you pinpoint accuracy for tricky regulations.

- Automatic Order Blocking: If a product is restricted at that address, the system simply prevents the order from going through. It stops a non-compliant shipment before it's even created.

By automating these checks, you turn compliance from a manual, error-prone chore into a systematic, reliable safeguard. This drastically cuts the chances of filing claims for seized or rejected goods—which are often the toughest and most expensive to sort out.

Demonstrating a Low-Risk Profile to Insurers

When you sit down with an insurance underwriter, they're sizing up your business's risk. They need to see that you have solid processes in place to minimize losses. An automated compliance system is the strongest evidence you can bring to the table.

You can show an insurer that you have a system that verifiably blocks 100% of prohibited orders. That's a much more powerful position than just promising that your team is "careful." It gives them concrete proof that you are actively reducing their exposure, which puts you in the driver's seat when negotiating for better rates.

This screenshot from ShipRestrict shows just how easy it is to configure rules that block specific products from being shipped to certain states.

This kind of interface allows merchants to build and manage precise shipping rules, providing a clear audit trail of their compliance efforts.

The Impact on Insurance Claims and Costs

The link between automation and insurance is direct and easy to measure. Just look at the global shipping industry for comparison. While total vessel losses have plunged by 75% over the last decade thanks to better safety tech, the number of individual shipping incidents has actually gone up. This shows that managing lots of small risks is just as important as preventing the big disasters.

For an eCommerce store, every non-compliant order you block is a potential claim you've avoided. This not only keeps your claims history clean—a huge factor in how premiums are calculated—but it also cuts down on hidden operational costs. Manually dealing with a returned, seized, or damaged shipment is incredibly expensive. You can see just how much in this true cost comparison between manual and automated screening.

To further cut down your risk and keep things running smoothly, it's worth brushing up on insurance industry regulatory compliance. At the end of the day, when you integrate compliance automation into your workflow, you aren't just buying a tool. You're investing in a lower-risk business model that makes your operation more efficient, resilient, and insurable.

Integrating Your Insurance and Compliance Workflow

Picking the right insurance policy is a huge step, but the job isn't done. The final piece of the puzzle is weaving your new insurance and compliance tools into a single, bulletproof workflow. The goal here is a synchronized system where every high-risk shipment is automatically validated and protected—from the moment a customer clicks "buy" to the second it's delivered.

This integration is what turns your strategy into a real-world operational advantage. A disconnected process is just an open invitation for manual errors, which are the number one cause of costly compliance breaches and denied insurance claims. By linking your insurance provider’s platform with a compliance tool like ShipRestrict, you create a powerful, automated shield for your business.

Setting Up Your Integrated System

Getting everything connected involves configuring rules and settings across a few different platforms so they talk to each other perfectly. It usually follows a pretty straightforward path from initial setup to getting your team up to speed.

- Configure Your Insurance Portal: First, log in to your third-party insurer’s platform. This is where you'll define default settings for package types, declare values based on your product categories, and set up any specific rules needed for international shipments.

- Install and Configure Your Compliance Tool: Next, head to your WooCommerce dashboard and install your chosen compliance automation plugin. This tool is where you’ll build the guardrails that stop prohibited orders before they can even be processed.

- Create Granular Shipping Rules: Using a tool like ShipRestrict, meticulously create rules that block shipments of specific products to restricted states, counties, or even individual ZIP codes. This is the foundational step that prevents the most common—and expensive—compliance failures. For a deeper dive, check out our guide on automated shipping compliance for WooCommerce stores.

- Align Insurance Rules with Compliance Logic: Finally, make sure your insurance settings mirror your compliance rules. For example, if you only insure shipments up to $5,000 for a particular product, your compliance tool should be set to flag any order exceeding that value for special handling.

This alignment is non-negotiable. A truly integrated workflow guarantees that any order validated by your compliance tool is automatically eligible for coverage under your insurance policy. It completely eliminates any gaps in your protection.

Training Your Team and Going Live

With the tech side handled, the focus shifts to your people. A well-designed system is only as good as the team using it. Clear protocols are essential for a smooth operation, especially when exceptions pop up.

Your training should cover how the automated system works, what to do with orders that get flagged for manual review, and the exact procedure for initiating an insurance claim through the new portal. The main objective is to build confidence and ensure everyone follows the same process, every time.

Pre-Launch Integration Checklist

Before you officially flip the switch on your new workflow, run through this final checklist. A quick but thorough test run is the best way to catch any potential snags and confirm every part of the system is in sync.

- [ ] Test Scenarios: Place test orders for restricted products to confirm they are correctly blocked at checkout.

- [ ] Value Thresholds: Process a high-value test order to ensure the correct insurance coverage is applied automatically.

- [ ] Customer Messaging: Verify that customers in restricted zones see clear, helpful messages explaining why they can't complete the order.

- [ ] Team Protocol Review: Walk through a hypothetical lost package scenario with your team, from the first customer email to filing the claim.

- [ ] Data Synchronization: Confirm that order data flows seamlessly between WooCommerce, your compliance tool, and your insurance portal.

By methodically integrating these systems, you create a robust, automated process that minimizes risk, protects your revenue, and frees up your team to focus on growing the business.

Frequently Asked Questions

When you're selling high-risk or regulated products, navigating shipping insurance can feel like a maze. Getting straight answers is critical to protecting your business. Let's tackle some of the most common questions merchants have when they start comparing their options.

We'll break down the key differences between insurance types, share some strategies for managing costs, and clarify what you should really expect when it's time to file a claim.

Is Standard Carrier Coverage Enough for High-Risk Products?

Almost never. What carriers call "coverage" is usually just "declared value," which isn't true insurance. It's just an agreement on the carrier's maximum liability, and it's typically capped at something low like $100.

Worse, the fine print is loaded with exclusions for things like alcohol, firearms, jewelry, and certain electronics. These policies are simply not designed to cover losses from a regulatory seizure, theft of a high-value item, or damage from specialized handling failures. Relying on basic carrier coverage for regulated goods is a huge financial gamble.

How Can I Reduce My Shipping Insurance Premiums?

Insurers love seeing proactive, verifiable risk management. The single best way to lower your premiums is to prove you have a solid system in place to minimize losses before they happen. When you can show an underwriter you’re a low-risk partner, you suddenly have real leverage to negotiate better rates.

Here are a few strategies that actually work:

- Use Compliance Automation: Tools that automatically block prohibited shipments at checkout give you undeniable proof that you're stopping regulatory mistakes before they can even become a problem.

- Enforce Strict Packaging Standards: Better packaging means fewer damage claims. A clean claims history is your best friend when it comes to rates.

- Require Adult Signatures: For products like alcohol or firearms, this is a non-negotiable step. It deters theft and is often a key part of staying compliant.

- Maintain a Low Claims History: Nothing speaks louder than a track record. A consistent history of few to no claims is the strongest evidence you can bring to the negotiating table.

What Is the Main Difference Between Carrier and Third-Party Claims?

The claims experience is where you find out what your policy is really worth. Filing a claim with a major shipping carrier can be a slow, bureaucratic nightmare. You often have to prove the carrier was directly at fault, and denials are incredibly common. Their main business is logistics, not paying out insurance claims.

In contrast, third-party insurers build their entire business on providing a superior, merchant-friendly claims service. Their product is the insurance, so they have a vested interest in making the process smooth to keep you as a customer.

This difference translates into a much better experience for you. Third-party providers usually offer streamlined online portals, ask for less documentation, and pay out much faster—sometimes in just a few days. That speed is vital for keeping your cash flow healthy after a loss.

Should I Use Different Insurers for Different Products?

Yes, absolutely. In many cases, a blended or multi-carrier insurance strategy is the smartest way to go. Not every product in your catalog carries the same risk or has the same value, so paying for a one-size-fits-all policy doesn't make much financial sense.

Here’s what a smart, tiered approach could look like:

- Low-Risk, Low-Value Goods: For these items, the carrier's basic declared value coverage might be perfectly fine. The risk is tiny, and the cost savings are worth it.

- Moderately Valuable Items: For products that are worth a bit more but aren't heavily regulated, a standard third-party parcel insurer strikes a great balance between solid coverage and affordable premiums.

- High-Value or Regulated Products: This is where you need a specialist. For your most valuable or regulated inventory, a dedicated high-risk insurer is essential. The premium will be higher, but their policies are designed to cover the specific, catastrophic risks you face.

This strategy ensures you're not overpaying for insurance on your low-risk items while guaranteeing your most critical assets are fully protected. It’s a nuanced way to manage risk and a key part of any serious high-risk insurance comparison.

Stop losing money on shipping mistakes and protect your business from compliance risks. Ship Restrict automates your shipping rules, blocking prohibited orders before checkout and giving you complete peace of mind. Learn more and get started with Ship Restrict today.

Cody Yurk

Founder and Lead Developer of ShipRestrict, helping e-commerce businesses navigate complex shipping regulations for regulated products. Ecommerce store owner turned developer.