Hidden costs non-compliance regulated product shipping

Hidden costs non-compliance regulated product shipping can cripple budgets. Discover how to assess risks, avoid penalties, and ensure compliant shipments.

Cody Y.

Updated on Nov 16, 2025

The real cost of a shipping mistake isn't the fine. It's the silent killer of otherwise healthy ecommerce businesses. The penalties are just the opening act—the real damage is a slow cascade of seized inventory, operational chaos, legal bills, and a shattered reputation that can be nearly impossible to rebuild.

More Than Just a Fine: The True Cost of a Shipping Mistake

Shipping regulated products without an airtight compliance plan is a gamble you can't afford to take. The government fines are what everyone talks about, but they're honestly just the tip of the iceberg. The real, lasting pain comes from a tangled web of consequences that quietly drains your resources and grinds your growth to a halt.

Think of compliance less as a bureaucratic headache and more as business insurance. One simple mistake—shipping to a restricted zip code or using the wrong carrier service—can set off a catastrophic chain reaction. The penalty you pay upfront is just the first of many hits to your bottom line.

The Domino Effect of One Bad Shipment

A single compliance failure is never just one problem. It triggers a series of expensive, time-consuming issues that ripple through your entire operation. What starts as a simple shipping error quickly snowballs into a full-blown crisis.

It usually starts like this:

- Seized Inventory: Customs or a carrier confiscates your products. That's a 100% loss on the cost of those goods. You're not getting them back.

- Lost Shipping Costs: The money you spent on postage, packing materials, and insurance for that shipment? Gone for good.

- Forced Customer Refunds: Now you have to issue a full refund to a customer whose order vanished. You're out the product, the shipping cost, and the revenue.

A non-compliant shipment isn't just a lost sale. It's a triple-dip loss: you lose the product, you lose the shipping costs, and you lose the revenue from the sale itself.

This immediate financial hit is bad enough. But what happens next is where the real damage is done. Your team has to drop everything to go into damage control mode. Instead of working on marketing campaigns or sourcing new products, they're now burning hours on the phone with carriers, filing appeals, and trying to calm down an angry customer.

From a Quick Loss to a Long-Term Problem

The consequences don't stop at the initial financial sting. The operational strain starts to show immediately as your team scrambles to put out the fire, pulling people and resources away from activities that actually grow the business. This distraction is a massive hidden cost, stalling your momentum and pulling focus from what really matters.

Worse yet, that one mistake can put your business under a microscope. Regulators and carriers might flag your account for increased scrutiny, leading to more frequent inspections and delays for all your future shipments. A one-time error can quickly become a permanent operational handicap, slowing down your entire fulfillment process and putting all future revenue at risk.

How Financial Penalties Spiral Out of Control

When you ship regulated products without airtight compliance, the first and most obvious hit is to your wallet. But we're not talking about small fees here. The financial penalties from regulatory bodies can be staggering, easily crippling a growing WooCommerce store before it ever finds its footing.

Think of an official fine as just the tip of the iceberg—the first sign of a much bigger financial bleed happening below the surface.

A single slip-up can set off a chain reaction of penalties that grows exponentially. For example, a mislabeled package containing a regulated item might first get you a fine from a carrier like UPS or FedEx. But if that same package gets flagged by a government agency like the ATF or FDA, you're suddenly facing a separate, and usually much larger, government penalty on top of it.

From there, a wave of secondary financial losses starts to roll in. These are the true hidden costs, the ones most merchants don't see coming until it’s far too late.

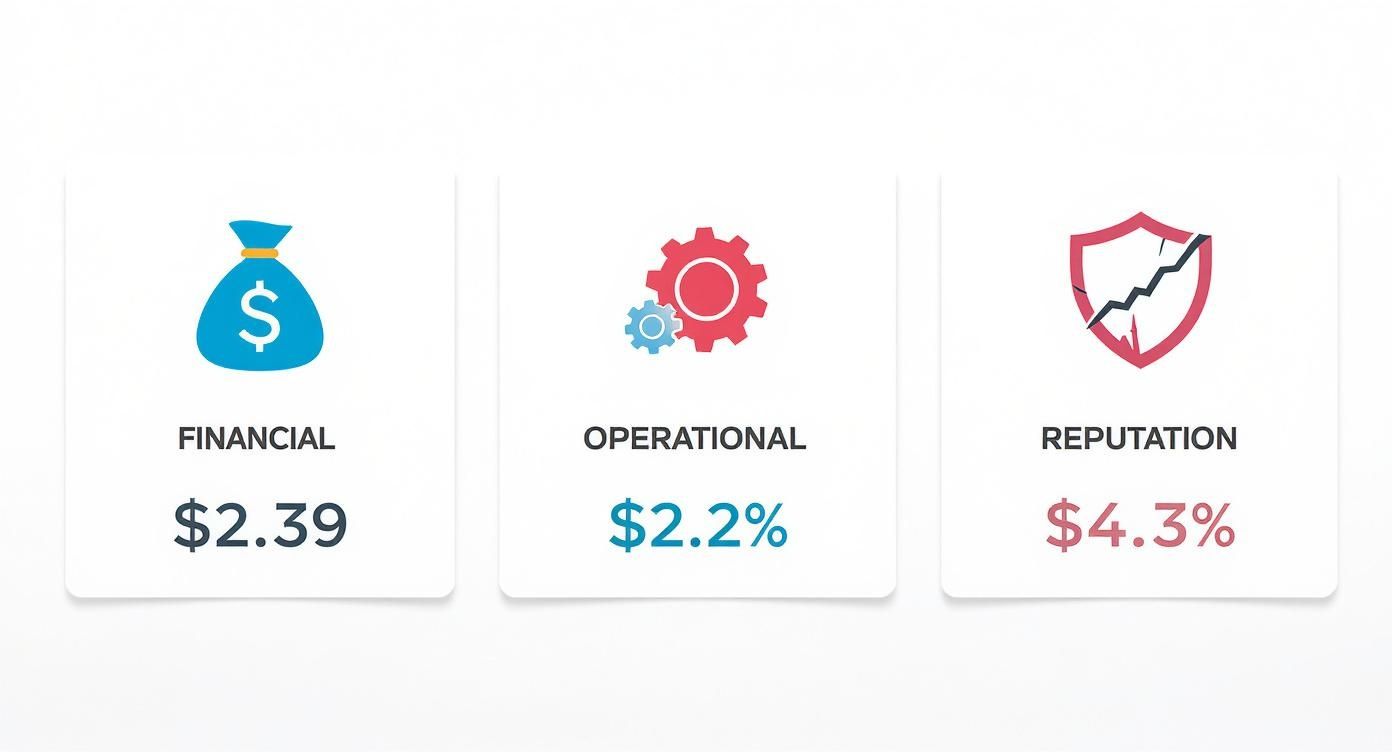

This infographic shows just how deep the rabbit hole goes, with non-compliance costs spreading into your finances, operations, and even your brand's reputation.

As you can see, what starts as a simple fine quickly creates a ripple effect, touching every single part of your business.

From Fines to Total Loss

Let's make this real. Imagine a $5,000 shipment gets seized by customs because of improper documentation. The hit isn't just the lost profit. It's the entire $5,000 worth of inventory, gone. On top of that, you've also lost the non-refundable shipping and insurance fees you already paid.

This is where the financial spiral really kicks in. The table below outlines the direct costs of just one non-compliant shipment.

Direct Financial Costs of Non-Compliance at a Glance

This table breaks down the various direct financial penalties and losses a business can face due to non-compliant shipping.

| Type of Cost | Description | Estimated Financial Impact (Example) |

|---|---|---|

| Government Fines | Penalties levied by agencies like the ATF, FDA, or CBP for each violation. | $10,000 - $100,000+ per incident. |

| Carrier Penalties | Fines imposed by carriers (UPS, FedEx) for violating their terms of service. | $1,000 - $5,000+ per package. |

| Seized Inventory | The complete loss of the product's value when goods are confiscated. | 100% loss of the inventory's cost. |

| Sunk Costs | Permanent loss of all money spent on shipping, handling, and insurance. | $50 - $500+ per shipment, unrecoverable. |

These costs stack up frighteningly fast, turning a minor oversight into a major financial disaster.

The regulatory environment is only getting tougher. Take the Uyghur Forced Labor Prevention Act (UFLPA), a huge enforcement priority. As of August 1, 2025, U.S. Customs and Border Protection had already stopped over 16,700 shipments valued at nearly $3.7 billion under this act alone, with more than 10,000 of them ultimately denied entry. It's a stark reminder of how serious the consequences are.

The Long Tail of Financial Damage

The bleeding doesn't stop with the first round of losses. A history of non-compliance puts your business on a watchlist with both regulators and carriers, which means more scrutiny for all your future shipments. This translates to more frequent inspections, causing delays that jam up your cash flow and frustrate customers.

A compliance violation isn't a one-time event. It's the start of a cycle of increased scrutiny, higher operational costs, and elevated risk that can follow your business for years.

Then come the secondary effects. Your insurance premiums will likely go up, as insurers see you as a higher-risk client. In some cases, carriers might suspend or even terminate your shipping account altogether, forcing you to scramble for a new, and probably more expensive, logistics partner.

For a deeper dive, check out our guide on the full spectrum of shipping compliance violations and their consequences. This escalating cycle of costs is exactly why proactive compliance isn't just an expense—it's one of the most critical investments you can make in your business's long-term health.

When Your Supply Chain Grinds to a Halt

Financial penalties hurt, but they're often just the opening act. The truly devastating costs of shipping regulated products without airtight compliance are operational. A single slip-up can trigger what feels like a supply chain heart attack—a sudden, crippling disruption that paralyzes your entire fulfillment process.

This isn’t just a minor hiccup. We’re talking about a full-blown operational crisis. When a carrier or customs agent seizes a shipment, it doesn’t just vanish. It creates an immediate, painful vacuum in your inventory and kicks off a domino effect that sends shockwaves through every corner of your business.

The Downstream Costs of Operational Chaos

The moment one shipment gets flagged, you're on the back foot. You now have a customer who paid for a product they're never going to receive. This means breaking delivery promises, which is one of the fastest ways to torch customer trust and rack up negative reviews.

The internal chaos is just as bad. Your team, which should be focused on growing the business, gets sucked into a vortex of crisis management. Productive work grinds to a halt as they’re forced to deal with the fallout.

This administrative spiral looks something like this:

- Endless Paperwork: Countless hours are burned filing appeals, re-submitting documentation, and going back and forth with customs brokers and regulatory agents.

- Customer Service Fires: Your support team is stuck managing angry customers, processing refunds, and trying to explain delays they have no control over.

- Emergency Logistics: You might have to pay exorbitant rates for emergency air freight to rush a replacement, completely wiping out the profit margin on that sale.

A seized shipment doesn't just cost you the value of the goods. It forces you to pay for the same order twice—once for the lost product and again for the expensive emergency replacement.

When Regulations Force Your Hand

The operational burden isn't just about cleaning up messes; it's also about adapting to an ever-shifting regulatory landscape. Seemingly small rule changes can force expensive, time-consuming pivots in your entire logistics strategy.

A perfect example is the ongoing evolution of the de minimis rule, which sets the value threshold for duty-free imports. Changes to this rule have fundamentally altered global ecommerce logistics. In response, many companies have been forced into costly new strategies like consolidating shipments, opening regional warehouses, or even shifting to U.S.-only fulfillment. Some have paused direct U.S. shipments altogether—a massive blow to their business. You can read more about how regulatory shifts are impacting global transportation.

This drives home a critical point: a resilient, compliant supply chain isn't a "nice-to-have" anymore. It's a non-negotiable part of staying in business.

The True Cost of Distraction

Perhaps the most insidious operational cost is the distraction. Every hour your team spends dealing with a compliance headache is an hour they aren't spending on growth. This "opportunity cost" is immense.

Think about all the crucial tasks that get shoved to the back burner during a compliance fire drill:

- Launching a new marketing campaign.

- Onboarding a new wholesale partner.

- Improving your website's customer experience.

- Sourcing new and innovative products.

When your most valuable asset—your team's time and focus—is constantly diverted to putting out fires, your business can't move forward. This operational stagnation is one of the biggest hidden costs of non-compliance, slowly eating away at your competitive edge and stalling your growth indefinitely. Without a proactive strategy, you’re always just one mistake away from grinding your entire business to a halt.

The Slow Bleed of Administrative and Legal Burdens

A compliance failure isn't some big, loud explosion. It’s more like a slow, steady bleed that silently drains your resources for months—sometimes years. This is the "compliance debt" that piles up long after you've paid the initial fine. The real pain of non-compliant shipping shows up in the administrative and legal headaches that follow, creating a constant, unpredictable drain on your budget and your team.

When a shipment gets flagged, the immediate crisis kicks off a frantic scramble. Your team is instantly pulled away from tasks that actually make money and thrown into a chaotic cycle of damage control. This isn't a quick fix; it's the start of a long and expensive administrative nightmare.

The Immediate Crisis and the Paperwork Avalanche

The first wave of this slow bleed is the sheer mountain of administrative work. Suddenly, your logistics team isn't fulfilling orders anymore. They're buried in paperwork, desperately trying to untangle the mess.

This process involves:

- Hours on the phone: Your staff will burn countless hours talking to customs brokers, carrier reps, and regulatory agents, often spinning their wheels with little to show for it.

- Re-filing documentation: Correcting and resubmitting complex customs forms and shipping declarations becomes someone’s full-time job.

- Internal investigations: You’ll have to figure out exactly what went wrong. That means pulling sales records, checking fulfillment logs, and interviewing staff—all while your normal operations grind to a halt.

These administrative tasks are a huge resource suck. Instead of focusing on growth, your most valuable people are stuck cleaning up a mess that was entirely preventable. The manual effort needed for this reactive cleanup is immense, and it really drives home the true cost of manual order screening versus the efficiency of an automated system. We break down the numbers in our guide on the true cost of manual order screening.

When Legal Counsel Becomes a Necessity

If the problem escalates, you're not just dealing with paperwork anymore. Now you're facing formal disputes with customs or other regulatory bodies, and this is where the legal bills start to skyrocket. Hiring specialized legal counsel isn't optional at this point, and their expertise comes at a premium.

Legal fees can quickly climb into the tens of thousands of dollars as lawyers navigate complex trade laws, negotiate penalties, and represent your business in formal proceedings. These aren't just one-off costs, either. A single complicated case can drag on for months, racking up billable hours and turning into a major financial liability.

A compliance violation transforms your focus from proactive growth to expensive, reactive defense. The money you should be investing in marketing or product development is instead diverted to legal retainers and administrative overtime.

The Long-Term Cost of Catching Up

Even after you've resolved a specific incident, the damage keeps coming. The violation acts as a wake-up call, forcing you to invest heavily just to get your operations up to standard. This "catch-up" phase is where that compliance debt really comes due.

The investments required often include:

- Implementing New Software: You’ll need to buy and integrate new compliance management tools to prevent future mistakes.

- Retraining Your Entire Team: Your whole logistics and fulfillment staff will need extensive retraining on new procedures and regulations, which means downtime and lost productivity.

- Conducting Costly Audits: You might have to hire external consultants to perform a full audit of your shipping processes, find weak spots, and help you build a new compliance framework.

These aren't just business improvements; they are expensive, forced investments made under pressure. This kind of reactive spending is far less efficient than having a proactive compliance strategy from the start.

These hidden burdens are especially severe in complex sectors. For instance, the U.S. manufacturing sector faces an estimated annual burden between $39 billion and $71 billion just from trade compliance complexities—a cost that goes far beyond direct tariffs. To see a detailed breakdown, you can discover more insights about these hidden trade compliance costs. This ongoing cycle of crisis and correction is simply unsustainable, guaranteeing a continuous drain on your resources.

Losing Customer Trust and Damaging Your Brand

Fines sting and operational chaos is exhausting, but the most painful hidden costs of non-compliance are the ones you can't see on a balance sheet. You can pay a fine. You can fix a supply chain. But a shattered brand reputation? That can take years to rebuild—if you can rebuild it at all.

When an order gets unexpectedly delayed, canceled at the last minute, or seized by customs because of a compliance failure, you don't just lose a sale. You break a promise. In the world of ecommerce, that broken promise is a direct assault on customer trust, the very foundation of your brand.

The Ripple Effect of a Single Bad Experience

Picture this: a customer is eagerly awaiting their order, only to get a vague email saying it's "held up in transit" with no clear fix in sight. Their frustration quickly boils over into a one-star review, a blast on social media, or a complaint on a community forum.

That single negative experience creates a powerful ripple effect:

- Negative Social Proof: A scathing review can scare off dozens of potential new customers. Research shows that 93% of consumers say online reviews sway their purchasing decisions.

- Poor Word-of-Mouth: That frustrated customer is going to tell their friends and family, poisoning the well for future sales.

- Increased Customer Service Costs: Your team ends up spending valuable time and resources trying to manage the fallout from one preventable mistake.

Beyond the immediate financial hit, non-compliance can inflict serious damage on your brand's credibility. While strategies for online reputation management offer ways to mitigate the harm, a proactive compliance strategy is one of the strongest forms of brand protection you can have.

Eroding Trust with Partners and Distributors

The damage doesn't stop with your retail customers. Your B2B relationships are just as vulnerable. Distributors, wholesalers, and retail partners are counting on you to deliver compliant products on time. A single compliance slip-up can make them see you as a liability.

Partners might cut ties just to avoid being associated with your compliance risks, fearing your mistakes could tarnish their own reputation or land them in legal trouble. Losing a key distribution channel over a preventable shipping error is a devastating and entirely self-inflicted blow.

A compliance failure sends a clear signal to the market: your business is unreliable. This perception can permanently tarnish your brand image, making it difficult to attract customers, partners, and even top talent.

When a Scandal Undoes Years of Hard Work

In today's market, consumers care deeply about where their products come from. They value ethical sourcing, environmental standards, and lawful business practices. A public compliance scandal—like getting fined for illegally shipping regulated items or having products seized for violating labor laws—can undo years of brand-building overnight.

The public fallout can be swift and brutal. Your brand can become synonymous with cutting corners and carelessness, a label that is incredibly difficult to shake. This is especially true for merchants selling regulated products, where following the law is a fundamental expectation. Protecting your brand’s integrity isn't just good marketing; it's a core business imperative that starts with an unwavering commitment to shipping compliance.

Building Your Proactive Compliance Strategy

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/TguXpmot7IA" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>Playing defense and reacting to disasters is a losing game. To really protect your business from the hidden costs of shipping regulated products, you have to get out of reactive mode and build a proactive strategy. It's about creating a tough compliance framework that stops problems before they ever start.

This isn't just about dodging fines. It's about building a stable, scalable foundation for your business. When you're proactive, compliance shifts from a source of constant anxiety to a real competitive advantage, protecting both your revenue and your reputation.

Conduct a Thorough Risk Assessment

First things first: you need to understand your own unique risk profile. You can’t guard against threats you haven’t even identified. Start by mapping out every product in your catalog and every single place you ship to, asking some tough questions along the way.

- Product Classification: Are your products categorized with the right commodity codes? A simple mistake here can set off immediate red flags with carriers and regulators.

- Location-Based Rules: Which states, counties, or even specific ZIP codes have restrictions on what you sell? These rules can and do change constantly.

- Carrier Policies: Does your shipping carrier have its own set of rules or outright prohibitions for your products? Breaking their terms of service can get your account suspended overnight.

This initial audit will give you a brutally honest picture of your compliance weak spots. It can also help to see how other regulated industries tackle these challenges. For example, this compliance-driven guide to high-risk credit card processing shows how payment processors navigate similarly complex rules.

Leverage Automation as Your Safety Net

Let's be real: manual checks are a recipe for human error. Expecting your team to memorize hundreds of ever-changing shipping rules isn't just unsustainable—it’s a massive liability. This is exactly where automation becomes your most valuable player.

Modern tools can build an automated safety net that works for you 24/7. By setting up a rules-based system, you can automatically block high-risk orders before a payment is even processed. This takes compliance from a tedious, error-prone chore to a streamlined, automatic process.

For anyone running on WooCommerce, a plugin like Ship Restrict is built for this exact purpose. You can set up incredibly specific rules that automatically check a customer's shipping address against your restrictions right at checkout.

The screenshot above shows just how simple it is to block an entire state. The block is clear, immediate, and stops a prohibited sale in its tracks. This kind of automated enforcement is the heart of a proactive defense.

Create a Clear and Enforceable Audit Trail

One of the biggest wins with automation is the digital audit trail it creates. When an order gets blocked, the system logs exactly why it was stopped—a state law, a local ordinance, or a carrier policy. This documentation is worth its weight in gold if you ever face a regulatory audit.

A proactive compliance strategy doesn't just prevent mistakes. It provides concrete proof that you have systems in place to enforce the law, protecting you from accusations of negligence.

This clear record-keeping proves you're doing your due diligence and can dramatically lower your legal exposure. For merchants ready to lock down their process, our guide on automated shipping compliance for Woo-commerce stores dives deeper into building these workflows.

By building a strategy on assessment, automation, and accountability, you can finally get ahead of the risks and focus on what actually matters: growing your business with confidence.

Answers to Your Toughest Shipping Compliance Questions

If you’re selling regulated products, you’ve probably got questions. The world of shipping compliance can feel like a maze of legalese and shifting rules, but it doesn't have to be intimidating. Let's break down some of the most common questions merchants ask, with straight answers from someone who's been in the trenches.

What's the Biggest Misconception About Compliance?

The most dangerous myth is that compliance is just about dodging fines. It's not. While the financial penalties are real and can be steep, the true hidden costs of non-compliance are the operational meltdowns, administrative chaos, and permanent scars on your brand that come after a violation.

Think about it. A single mistake can trigger seized inventory, canceled merchant accounts, and a complete loss of customer trust that you can never really buy back. Viewing compliance as just another line item on a spreadsheet misses the entire point. It’s the bedrock of a resilient business.

How Can I Possibly Keep Up With All the Rule Changes?

You can't—not manually, anyway. Regulations are constantly in flux, tweaked by new laws and court decisions. Trying to track every local, state, and federal shipping rule by hand isn't just inefficient; it's a guaranteed way to fail.

This is where smart automation becomes non-negotiable. A dedicated compliance tool does the heavy lifting for you by:

- Centralizing all your shipping rules in one place.

- Letting you update a rule instantly the moment a law changes.

- Automatically blocking prohibited orders at checkout, taking human error out of the equation.

Relying on memory or a dusty checklist is a gamble you can’t afford to take in this business.

The goal isn't just being compliant today. It's having a system that keeps you compliant tomorrow and every day after. Proactive automation is the only way to scale your business without scaling your risk.

Is My Business Too Small to Worry About This?

No business is too small to be held accountable. In fact, it's often the smaller stores that are most vulnerable to the hidden costs of non-compliance. Why? Because they don't have the cash reserves or operational depth to absorb a major fine or a sudden supply chain shutdown.

For a small or medium-sized shop, a single big penalty or a suspended shipping account isn't a setback; it can be a death blow. Proactive compliance isn't some luxury for big-box retailers. It's a critical survival tactic that lets you build your company on a solid, lawful foundation from day one. Investing in an affordable, automated solution early is one of the smartest moves a growing merchant can make.

Stop gambling with your business. Ship Restrict automates your shipping rules, blocks prohibited orders before they happen, and gives you the peace of mind to focus on growth. See how you can build a smarter, safer WooCommerce store at https://shiprestrict.com.

Cody Yurk

Founder and Lead Developer of ShipRestrict, helping e-commerce businesses navigate complex shipping regulations for regulated products. Ecommerce store owner turned developer.