How State Excise Taxes Affect Online Alcohol Sales and Shipping

Learn how state excise taxes impact online alcohol sales and shipping. Our guide covers pricing, compliance, and what you need to know to navigate the market.

Cody Y.

Updated on Sep 24, 2025

State excise taxes are a tough but unavoidable reality for anyone selling alcohol online. In a nutshell, they drive up costs for your customers, make shipping a logistical headache, and force sellers to navigate a maze of compliance rules.

Think of it as a hidden 'toll' charged per gallon before sales tax even enters the picture. This makes pricing your products a very tricky balancing act.

Navigating the Complex World of Alcohol E-Commerce and Excise Taxes

For online alcohol retailers, state excise taxes are one of the biggest operational hurdles you'll face. Unlike a simple sales tax that’s a percentage of the final price, an excise tax is a volume-based fee.

This means a state charges a specific dollar amount for every gallon of wine, barrel of beer, or liter of spirits sold within its borders, completely independent of the retail price. This system forces online sellers into a patchwork of state-specific laws, wildly different tax rates, and unique licensing requirements.

Getting a handle on this landscape is the only way to figure out where you can legally ship and how to build a profitable business in the tightly regulated world of alcohol. A critical first step is choosing the right foundation; exploring the best ecommerce platform for small business can give you the tools you need to manage these complex sales rules from the start.

The Financial Impact of Excise Taxes

The financial stakes are huge. Across the United States, state excise tax revenue from alcoholic beverages hit a staggering $11.1 billion in fiscal year 2023. Distilled spirits made up 61% of that total.

This massive revenue stream is exactly why states enforce these regulations so strictly. It also means higher costs that you either have to pass on to the customer or absorb yourself. You can dig into these government revenue findings from the Congressional Research Service.

This tax structure creates a few key challenges that every online seller must confront.

Before we dive into the specifics, the following table summarizes how state excise taxes can affect your day-to-day operations.

Key Ways State Excise Taxes Impact Online Alcohol Sales

| Area of Impact | Description of Effect |

|---|---|

| Pricing Strategy | Forces retailers to calculate and embed volume-based taxes into their pricing, which can vary significantly from state to state. |

| Profit Margins | Directly reduces profit margins if the tax isn't fully passed on to the consumer, especially on lower-priced products. |

| Compliance Costs | Requires meticulous record-keeping, reporting, and tax remittance for each state, often necessitating specialized software and staff time. |

| Shipping Logistics | Limits which states are profitable or even legally viable to ship to, creating a fragmented market and complicating national sales strategies. |

| Customer Experience | Can lead to confusing pricing structures and higher-than-expected final costs at checkout, potentially increasing cart abandonment. |

As you can see, the ripple effects are felt across the entire business. Let’s break down the main challenges.

- Pricing Complexity: You have to accurately calculate and build these hidden taxes into your pricing model. What works for a customer in Florida might not work for one in California.

- Compliance Burden: Every state has its own rulebook for reporting and paying excise taxes. This demands flawless record-keeping and, more often than not, specialized software to keep up.

- Logistical Hurdles: The need to comply with dozens of different tax laws can seriously limit which states you can ship to, throwing a wrench in any plan for a national sales strategy. Our guide on navigating alcohol shipping restrictions offers deeper insights into overcoming these specific hurdles.

Ultimately, state excise taxes are not just a line item on a spreadsheet. They are a fundamental business reality that shapes every single aspect of selling alcohol online—from your pricing and marketing to your shipping and legal compliance. Ignoring their complexity is simply not an option for any serious e-commerce venture in this industry.

What Exactly Is an Alcohol Excise Tax?

Before diving into the complexities of shipping and pricing, we need to get a solid handle on what state excise taxes actually are. The easiest way to think about it is like a "toll ticket" a product needs just to be sold in a particular state. But here's the key: it’s not a fee your customer sees at checkout. This cost is buried deep inside the product's price long before it ever reaches your online store.

Unlike the sales tax you’re used to, which is a percentage of the final retail price, an excise tax is a fixed fee paid on the volume of the alcohol. States charge this tax by the gallon, liter, or barrel. It’s paid upstream by the producer or distributor, well before you, the retailer, even purchase the inventory.

This "toll ticket" system does two things for state governments. First, it’s a dependable stream of revenue. Second, by making alcohol more expensive to produce and sell, it acts as a lever to regulate public consumption.

The Key Difference: Sales Tax vs. Excise Tax

It’s incredibly easy to mix these two up, but for an online alcohol retailer, knowing the difference is everything. They're calculated, collected, and paid at completely different points in a product's journey.

Let’s say you’re selling a $20 bottle of wine.

- Sales Tax: This is a simple percentage (we'll use 6% for this example) tacked on at the very end. The customer sees it on the checkout screen as an extra $1.20. It’s a tax on the transaction.

- Excise Tax: This is a flat rate—for instance, Virginia charges about $0.40 per liter for wine—paid by the producer based purely on the wine's volume, not its price. That cost is already baked into the wholesale price you paid for that $20 bottle.

This is a critical distinction. It means a cheap $10 bottle of wine and a premium $100 bottle get hit with the exact same excise tax if they’re the same size. The cost is shouldered higher up the supply chain, but it absolutely trickles down to you, influencing your cost of goods and the final price you set for customers.

The most important takeaway is this: Excise tax is a cost of goods, while sales tax is a transactional tax. This single fact dictates how you must approach your pricing strategy, especially when shipping across state lines where excise rates can vary wildly.

Why Excise Tax Rates Are So Complicated

The complexity doesn't stop at the definition. The real headache for online sellers is the massive variation from one state to the next. There's no national standard to follow. Instead, you're left navigating a patchwork of regulations that can feel like a minefield.

It’s not just that the rates are different state-to-state; they often change depending on the exact type of alcohol you're selling.

- Beer: Usually taxed per barrel or gallon.

- Wine: Typically taxed per gallon, but some states have different rates for still wine versus sparkling wine.

- Spirits: Almost always taxed at the highest rate, usually per gallon, to account for their higher alcohol content.

Just look at the difference for spirits. The excise tax on a gallon of spirits in Washington state is over $36. Hop over the border to Idaho, and it drops to around $12. This enormous gap directly impacts where you can sell profitably. To succeed in this business, you have to adopt a granular, state-by-state approach to both pricing and compliance. It’s the only way to build a sustainable online alcohol business.

How Excise Taxes Drive Up Final Customer Costs

This is where the rubber meets the road—where an abstract tax becomes a real number in your customer's shopping cart. Unlike a simple sales tax tacked on at the end, excise taxes are baked into the supply chain. They quietly inflate a product's base cost long before it ever hits your online store.

This creates a ripple effect that ultimately pushes the final checkout price higher. We call this phenomenon "tax stacking," and it's a huge reason why alcohol pricing online can feel so confusing. It's also why so many retailers struggle with price transparency, leading to sticker shock and abandoned carts.

Let's walk through a real-world example to see exactly how this plays out.

Unpacking the Final Price of a Wine Shipment

Imagine a customer in Virginia orders a case of wine (that's 12 bottles of 750ml each) from your website. You've listed the case for $180. Here’s how a few different taxes pile on top of each other to create the final price they actually pay.

First, we need the total volume in gallons, since that's how excise tax is calculated. A standard 750ml bottle is about 0.198 gallons.

- Total Volume: 12 bottles x 0.198 gallons/bottle = 2.376 gallons

Now, we'll apply Virginia's excise tax rate for wine: $1.51 per gallon.

- Excise Tax Calculation: 2.376 gallons x $1.51/gallon = $3.59

This $3.59 is a cost the producer or distributor has already paid. It's buried inside the $180 price tag you show your customer. They don't see it as a line item, but it's there, pushing up the starting price.

The Stacking Effect in Action

Next, let's say you charge a flat $25 for shipping and handling. Here's a critical detail many people miss: in most states, shipping and handling charges for taxable goods are also taxable. The sales tax isn't just on the wine; it's on the wine plus the service to get it there.

This brings our new subtotal to:

- Product Price: $180.00

- Shipping & Handling: $25.00

- Taxable Subtotal: $205.00

Finally, we apply Virginia’s statewide sales tax of 5.3% to this bigger, combined subtotal.

- Final Sales Tax: $205.00 x 0.053 = $10.87

So, the grand total isn't just wine + shipping + tax. It's a compounded figure where each layer builds on the last.

Final Customer Price Calculation

- Product Price (with embedded excise tax): $180.00

- Shipping Fee: $25.00

- Sales Tax (on product + shipping): $10.87

- Grand Total: $215.87

See what happened? The hidden $3.59 excise tax inflated the initial price, which then made the base for the sales tax calculation even higher. This is a perfect illustration of how state excise taxes affect online alcohol sales and shipping—they directly drive up costs for the person clicking "buy."

Why This Matters for Your Online Business

This tax-stacking puzzle creates massive headaches for online sellers. If you don't account for these layers correctly, you're either undercharging and losing money or overcharging and losing customers. To see just how much these taxes change things, look at duty-free retail experiences, where the absence of these duties completely transforms the pricing model.

For anyone selling alcohol online, mastering this complicated math isn't optional. You have to know the rules for every single state, not just for the excise tax rates but also for whether shipping and handling are taxable. This is exactly why automated compliance tools have become a necessity, not a luxury. Without them, you're just guessing, risking constant pricing errors, compliance violations, and a checkout experience that sends customers running.

Navigating the Maze of Shipping Licenses

Excise taxes are one piece of the puzzle, but they're tangled up with an even bigger headache for online alcohol retailers: shipping licenses. Your ability to sell a bottle of wine to a customer in another state isn't a given. It's a privilege you only earn after getting a Direct-to-Consumer (DTC) shipping license for that specific state.

Excise taxes are one piece of the puzzle, but they're tangled up with an even bigger headache for online alcohol retailers: shipping licenses. Your ability to sell a bottle of wine to a customer in another state isn't a given. It's a privilege you only earn after getting a Direct-to-Consumer (DTC) shipping license for that specific state.

Think of it like this: you need a different passport for every single state you want your products to enter. Each state is its own little country with its own rulebook, application fees, renewal dates, and reporting demands. There's no such thing as a national DTC license, which forces retailers into a fragmented and often infuriating process.

Getting the license is just the starting line. Once you hold a DTC license in a state, you're on the hook for collecting and sending in all their taxes—not just sales tax, but also the excise taxes based on how much you ship. This is the crucial link: the license is the tool states use to enforce your tax collection duties, tying excise taxes directly to your shipping logistics.

The Role of Direct-to-Consumer Licenses

A DTC license is the legal permit a state issues that allows an out-of-state producer (like a winery or distillery) or sometimes a retailer to ship alcohol straight to a consumer's doorstep. If you ship without one, you're breaking the law. That can lead to stiff penalties, including hefty fines and even losing your other licenses.

These licenses are how states control the booze flowing across their borders. They make sure any business profiting from sales to their residents also pays into the state’s tax revenue through both sales and excise taxes. For small businesses trying to build a national customer base, this system can be a major barrier.

Obtaining a DTC shipping license isn't just about getting permission to ship. It's about formally agreeing to play by that state's specific tax and reporting rules, turning your business into a remote tax collector on their behalf.

This whole setup makes crafting a national sales strategy a real challenge. The cost and paperwork just to get licensed in every available state can be overwhelming. As a result, most online sellers have to pick their battles, choosing to operate only in states where the market potential is worth the compliance nightmare.

State-Specific Rules and Tax Obligations

The requirements for a DTC license can vary wildly from one state to another. One state might have a simple online form and a small annual fee. The next might demand a mountain of paperwork, in-person notarization, and a massive bond.

And once you get the license, your work has just begun. Here are some of the compliance duties you’ll likely face:

- Volume Limits: Many states put a cap on how much alcohol you can ship to one person or household each year. Go over that limit, and your license could be in jeopardy.

- Regular Reporting: You’ll have to send detailed reports to the state's alcohol beverage control (ABC) board, usually every month or quarter. These reports break down all your sales by volume and product.

- Excise Tax Remittance: Using those reports, you have to calculate and pay the correct excise taxes. A simple math error can trigger an audit and penalties.

- Sales Tax Collection: On top of everything else, you’re also required to collect and remit state and local sales taxes, which often apply to both the product and the shipping fees.

Take New York, for example. The state requires an Alcoholic Beverages Tax (ABT) on all alcohol sold within its borders. This tax has different tiers, with higher rates for liquor and wine with more alcohol content. A licensed shipper has to get all those calculations right. You can dig into the specifics on the New York State Department of Taxation and Finance website.

This state-by-state patchwork means that scaling an online alcohol business takes more than just slick marketing and a good shipping partner. It demands a rock-solid, dedicated compliance strategy from day one.

A Look at Real-World State Shipping Rules

Understanding the theory behind excise taxes and licensing is one thing; seeing how it plays out on the ground is something else entirely. The United States isn’t a single market for alcohol. It's a patchwork of 50 different regulatory landscapes, forcing online retailers to completely abandon any hope of a one-size-fits-all shipping strategy.

To really get a feel for how state excise taxes affect online alcohol sales and shipping, you have to compare the rules state by state. We’ll look at three distinct models: a state with permissive laws, one with complex but manageable rules, and one that’s highly restrictive. This comparison will throw the dramatic differences in tax rates, licensing, and compliance duties into sharp relief.

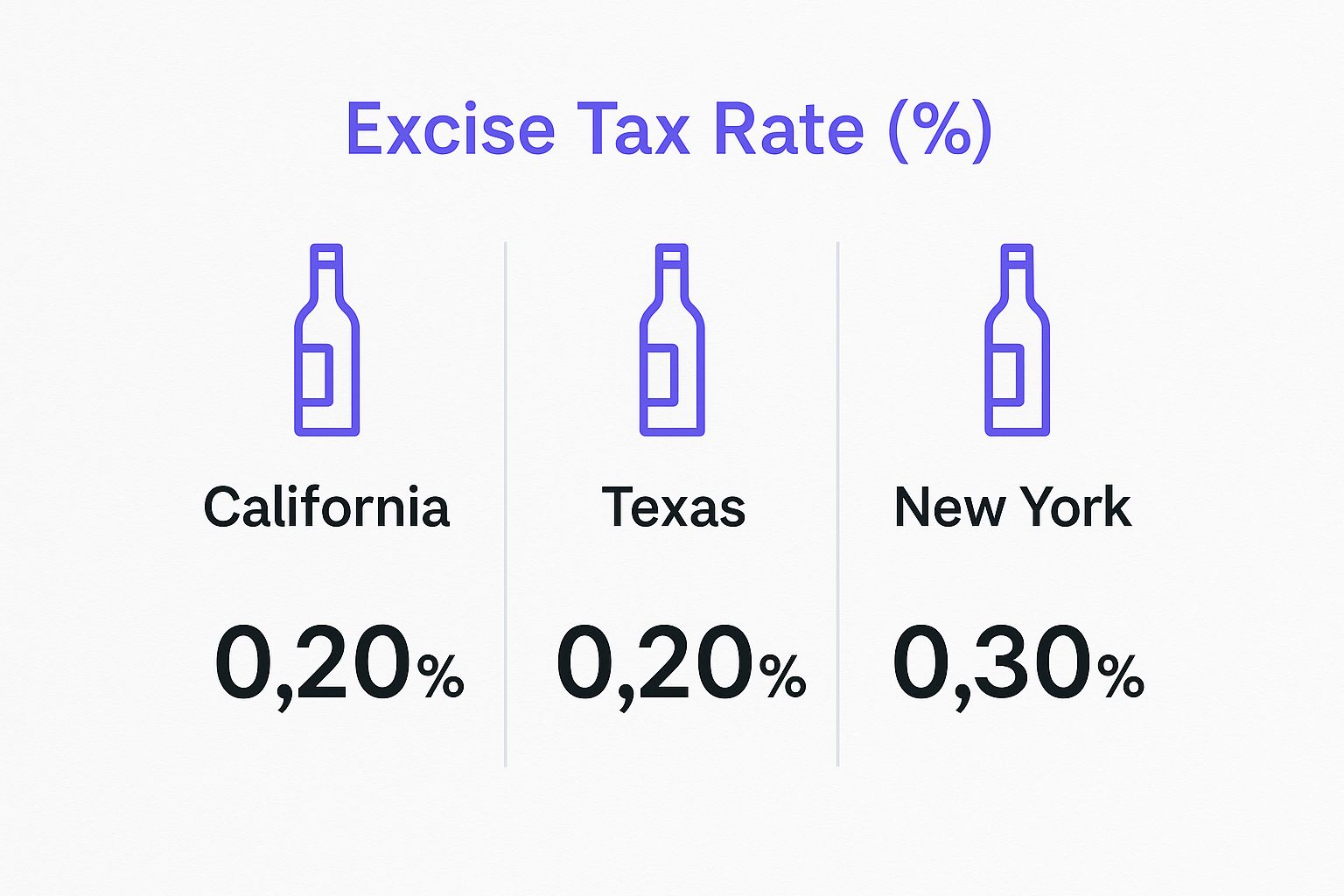

The chart below visualizes the stark contrast in wine excise tax rates for three major states, offering a quick glimpse into the financial side of this regulatory puzzle.

This simple chart immediately shows that a retailer shipping to New York pays a much higher excise tax per gallon than one shipping to California. That difference directly impacts pricing and profit margins.

To give you a clearer picture of just how different state-level regulations can be, let's take a look at a side-by-side comparison.

Comparison of State Approaches to DTC Alcohol Shipping

This table breaks down how three states with very different models handle the key aspects of direct-to-consumer alcohol sales, from licensing to taxes.

| Regulatory Aspect | Permissive State (e.g., California) | Complex State (e.g., New York) | Restrictive State (e.g., Utah) |

|---|---|---|---|

| DTC Licensing | Requires a Type 82 license with a moderate annual fee. Relatively straightforward for out-of-state wineries. | Requires a direct shipper's license with a higher fee and more stringent application process. | Prohibits out-of-state DTC shipping for wine and spirits. Only in-state wineries may ship. |

| Excise Tax | Low excise tax of $0.20 per gallon on still wine, keeping embedded costs minimal. | Higher excise tax of $0.30 per gallon on wine, plus additional local taxes in places like NYC. | Excise tax is replaced by a massive state-controlled markup built directly into the retail price. |

| Shipping & Volume Limits | No specific volume limits for DTC shipments from licensed wineries. | Strict limit of no more than 36 cases of wine per year to any single resident. | Effectively no DTC shipping allowed from out-of-state private retailers. |

| Compliance Burden | Requires regular reports on shipping volume and remittance of both excise and sales taxes. Manageable burden. | More demanding reporting, requiring detailed breakdowns to account for state and city taxes. High burden. | The primary compliance duty for private sellers is to not ship to Utah at all. |

As you can see, the operational reality for an online alcohol seller changes dramatically depending on which state line a package crosses. Now, let's dig into the details of each model.

The Permissive Model: California

California is often held up as one of the most open states for Direct-to-Consumer (DTC) alcohol shipping. Its massive wine industry has heavily influenced regulations to be friendly to online sellers, but "permissive" definitely doesn't mean "no rules."

- DTC License: Out-of-state wineries must get a Type 82 license, which comes with a moderate annual fee. This license is their ticket to ship directly to California consumers.

- Excise Tax Rate: The state keeps things simple with a low excise tax on still wine—just $0.20 per gallon. This minimal rate helps keep the final price down for everyone.

- Compliance Duties: Licensed shippers still have to file regular reports detailing the volume of wine shipped and pay the collected excise taxes. They're also on the hook for collecting and remitting California sales tax.

The California model shows how a state can balance market access with revenue collection. The barriers to entry and ongoing tax costs are manageable for most businesses, but you still have to do your homework.

The Complex Model: New York

New York represents the middle ground. It allows DTC shipping but wraps it in more complex regulations and higher taxes, making it a much more challenging state to navigate.

- DTC License: An out-of-state direct shipper's license is required, and it comes with a higher fee and a tougher application process than California's.

- Excise Tax Rate: New York’s excise tax on wine is about $0.30 per gallon—a full 50% higher than California's rate. And that’s before New York City adds its own local excise taxes on top.

- Volume Limits: The state imposes strict caps. A shipper can send no more than 36 cases of wine per year to a single New York resident.

- Compliance Duties: Reporting is much more demanding. You'll need detailed breakdowns of sales and have to carefully adhere to both state and city tax laws.

New York is a perfect example of a state that is technically "open" but requires a serious investment in compliance to access its market. For many businesses, setting up the right shipping controls can be a major hurdle. You can learn more about managing these complexities in our guide to WooCommerce alcohol shipping restrictions.

The Restrictive Model: Utah

At the far end of the spectrum is Utah, a "control state." Here, the state government itself—through its Department of Alcoholic Beverage Services (DABS)—directly controls the wholesaling and retailing of most alcoholic beverages.

In a control state like Utah, the state is the primary buyer and seller of alcohol. This model severely limits or entirely prohibits private online retailers from shipping directly to consumers, making the DTC market virtually nonexistent.

- DTC License: Forget about it. Utah flat-out prohibits DTC shipping of spirits and wine from out-of-state retailers. Only licensed Utah wineries can ship to residents.

- Excise Tax Rate: Because the state controls all sales, the idea of a simple excise tax goes out the window. It’s replaced by a massive state-controlled markup that's folded directly into the retail price.

- Compliance Duties: For private sellers, the primary compliance duty is simple: do not ship to Utah. The state's monopoly effectively slams the door on most online alcohol sales.

This comparison makes one thing crystal clear: a successful online alcohol business must be built on a flexible, state-specific compliance foundation. There is no other way.

Essential Strategies for Staying Compliant

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/bAKN1WH9MEk" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>Trying to keep up with the maze of state excise taxes, sales taxes, and shipping licenses is a massive headache. If you're manually tracking dozens of different tax rates, volume limits, and reporting deadlines, you're not just being inefficient—you're setting yourself up for costly mistakes that can put your entire business on the line.

Let's be clear: a proactive, tech-driven approach to compliance isn't just a legal chore. It's a core strategy for survival and growth in the online alcohol market. The right tools and partners can turn this tangled mess into a real competitive edge.

Leverage Automated Compliance Software

The sheer variety of rules across state lines makes automation a must-have for any serious online alcohol retailer. Trying to calculate taxes and file reports by hand is a recipe for disaster, and it simply won't work as your business grows.

Automated compliance software plugs directly into your e-commerce platform, handling all the complex calculations in real time. These systems are built to:

- Calculate Accurate Taxes: Instantly apply the correct state and local excise taxes, sales taxes, and any other weird fees at checkout, all based on the customer’s shipping address.

- Manage Reporting: Automatically generate the detailed sales and volume reports that each state’s alcohol beverage control (ABC) board demands, saving you countless hours of mind-numbing admin work.

- Monitor Volume Limits: Keep a running tally of how much you're shipping to individual customers and states, making sure you never accidentally blow past those strict annual limits.

Investing in a solid compliance platform is the single best move you can make to reduce risk. It takes the burden off your shoulders and puts it onto reliable, automated systems, freeing you up to actually focus on growing your business.

Prioritize Customer Transparency

Nothing kills a sale faster than a bunch of unexpected fees popping up at checkout. The "tax stacking" effect, where excise and sales taxes pile on top of each other, can give customers serious sticker shock if you're not upfront about it.

Being crystal clear on your website is the key to managing expectations and cutting down on abandoned carts. Your product pages and checkout process should plainly state where you can and cannot ship. Even better, consider offering an "all-in" price that bundles in the estimated taxes from the start. This builds trust and can seriously boost your conversion rates.

For a deeper dive, our guide on setting up shipping controls for age-restricted products offers practical steps for putting these kinds of rules in place.

Partner with Specialized 3PL Providers

For a lot of online sellers, just managing the physical side of things—storing, packing, and shipping alcohol—is as tough as the tax compliance. This is where a specialized third-party logistics (3PL) partner becomes a game-changer.

A 3PL that knows the beverage alcohol industry does more than just move boxes. They get the unique packaging requirements, know the carrier restrictions inside and out, and understand the state-specific labeling needed to ship booze legally. By taking on the fulfillment and logistics, they let you run a leaner, more focused operation while making sure every single package that leaves the warehouse is fully compliant.

Common Questions About Alcohol Excise Taxes

Diving into alcohol e-commerce always brings up a few tricky questions. Let's clear up some of the most common points of confusion around state excise taxes and online shipping.

Are Shipping and Handling Fees Taxable?

This is easily one of the most frequent—and complicated—questions we hear. The short answer? It depends entirely on the state.

Some states, like New York and Tennessee, consider shipping and handling part of the total sales price. If the booze is taxable, so is the shipping fee. Simple enough.

But then you have states like Virginia, where the rules get more granular. A separately stated shipping charge is generally exempt from sales tax, but a handling fee is always taxable. This tiny difference is a perfect example of why you absolutely have to know the specific rules for every single state you ship to.

Key Takeaway: Never assume shipping fees are tax-exempt. Whether or not shipping is taxed is a state-specific rule that can completely change the final price at checkout. This is exactly where automated tax calculation becomes a must-have, not a nice-to-have.

Is Excise Tax the Same as Sales Tax?

Nope. They're two completely different animals.

Excise tax is a volume-based tax paid by the producer or distributor. It’s baked into the product’s price long before it ever hits your digital shelf. In contrast, sales tax is a percentage-based tax slapped on the final retail price at checkout.

The easiest way to think about it is this: excise tax is a cost of goods, while sales tax is a fee on the transaction.

Why Do Tax Rates Vary So Much?

Every state government sets its own tax policies, using them as tools to generate revenue and, in many cases, to regulate alcohol consumption. It's a patchwork quilt of local history and policy.

States with strong temperance movement roots, like Utah, often have some of the most restrictive rules and highest taxes. On the flip side, states with huge beverage industries of their own, like California, tend to keep rates lower. This is precisely what creates the dizzying maze of laws that online sellers have to navigate.

Ready to stop guessing and start automating your shipping compliance? Ship Restrict for WooCommerce gives you the power to create precise shipping rules for any state, county, or ZIP code, ensuring you never make a costly mistake.

Take control of your shipping restrictions and protect your business. Get Ship Restrict today.

Cody Yurk

Founder and Lead Developer of ShipRestrict, helping e-commerce businesses navigate complex shipping regulations for regulated products. Ecommerce store owner turned developer.