A Guide to Chargebacks Regulated Product Sellers Prevention

Reduce your risk with our guide to chargebacks regulated product sellers prevention. Learn proven strategies to protect your high-risk eCommerce business.

Cody Y.

Updated on Jan 14, 2026

For anyone selling regulated products, chargebacks aren't just a nuisance that chips away at your profit margin—they're an existential threat. A single dispute can spiral into a compliance nightmare, lost inventory, and a dangerously frayed relationship with your payment processor.

The key to survival is tackling the unique risks of this industry head-on. From confusing shipping laws to the high rate of "friendly fraud," you need a proactive strategy that's built for the realities of your business.

The High Stakes of Chargebacks in Regulated eCommerce

Selling something like a firearm online means navigating a maze of regulations that most eCommerce merchants can't even imagine. A simple shipping mistake isn't just a customer service headache; it can be a straight-up legal violation. When a chargeback hits in this environment, the fallout goes way beyond the lost revenue from that one sale.

Every dispute is a potential compliance failure, a high-value product gone for good, and another black mark on your merchant account. Payment processors already see regulated industries as high-risk. A rising chargeback ratio is often the final straw that gets your account terminated, shutting down your business almost overnight.

Why This Niche Is a Magnet for Disputes

The sheer complexity of selling regulated items creates a perfect storm for chargebacks. You've got state-by-state shipping laws, local ordinances, and mandatory FFL transfers that can easily confuse buyers. That confusion often turns into "item not received" claims or what we call "friendly fraud"—where a customer disputes a perfectly valid charge because of buyer's remorse or a misunderstanding of the delivery process.

The numbers tell a sobering story. In 2023, global chargeback volume hit 238 million disputes, costing merchants a jaw-dropping $117.47 billion. And it's getting worse. Projections show that number surging 41% to 337 million by 2026, with eCommerce chargeback rates having already jumped 222% in just one year.

For regulated sellers, these stats are a flashing red light. The delivery complexities inherent in our industry directly fuel friendly fraud, which already makes up a staggering 75% of all chargebacks.

A chargeback in the regulated goods space is never just about the money. It's a test of your compliance, a drain on your resources, and a direct threat to your ability to process payments. Treating prevention as a core business function is non-negotiable.

Beyond Financial Loss

The true cost digs much deeper than your bank account. Every single chargeback forces you to spend hours gathering evidence and fighting the dispute. That's time you should be spending growing your business, not doing damage control.

On top of that, getting a handle on the broader payment ecosystem is crucial. You can find valuable insights from payments experts who break down these complex financial systems. This knowledge is essential because repeated disputes can land you in a high-risk monitoring program, which means higher fees and intense scrutiny from your processor.

When it comes down to it, a proactive, aggressive approach to chargeback prevention isn't just a good idea—it's your best defense.

2. Build a Chargeback-Proof Checkout Process

Your checkout flow is your first and best line of defense against chargebacks. For anyone selling regulated products, this isn't just about making a sale—it's about building a fortress that stops fraudulent or non-compliant orders cold, long before they become a headache. This requires a lot more than the standard eCommerce setup.

Every single element, from how you display your policies to the way you verify payment, has to be deliberately designed to head off the disputes common in high-risk industries. A flimsy checkout is basically a welcome mat for friendly fraud and compliance-related chargebacks.

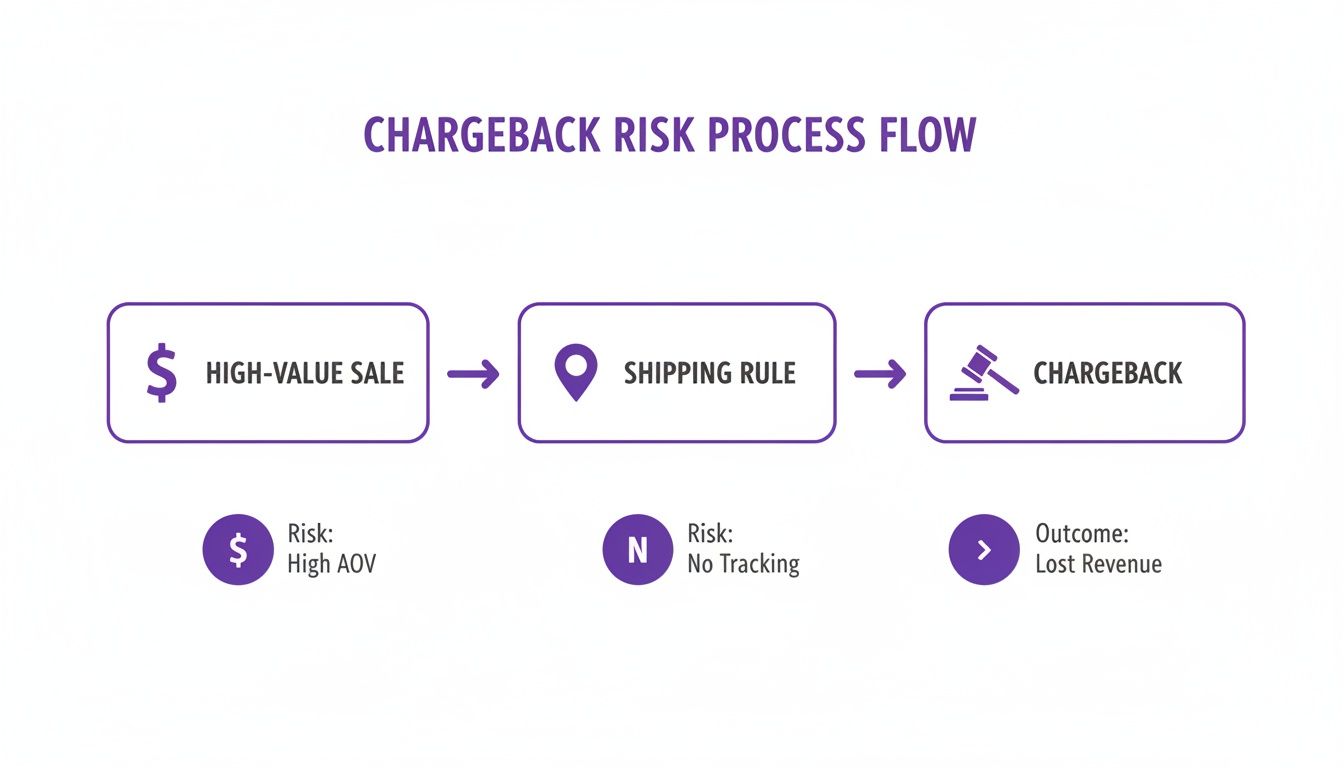

This is a classic—and costly—scenario. A high-value sale slips through the cracks without the right compliance checks, and the result is almost always a chargeback.

As the flow shows, a lack of automated shipping rules turns a big sale into lost revenue in just a few steps. It’s a preventable mistake.

Craft Unmistakable Policies

The first layer of defense is radical transparency. I've seen countless disputes arise simply because policies were vague, buried, or full of legalese. Your return, shipping, and cancellation policies need to be impossible to miss and written in plain English.

- Display Them Everywhere: Don't just link to your policies in the footer and call it a day. Put them right on the product pages. More importantly, force customers to check a box during checkout confirming they’ve read and agreed to your terms.

- Get Specific About Regulated Goods: Your policies must tackle the unique aspects of your products head-on. Clearly explain things like restocking fees for failed background checks, the FFL transfer process, or the fact that you absolutely will not ship to non-compliant areas.

That little policy acknowledgment checkbox? It’s not just a formality. It’s one of your most powerful pieces of evidence in a dispute. When a customer tries to claim they "didn't know," you have a timestamped record proving they did.

Mandate Essential Verifications

Standard fraud detection is just table stakes. For regulated goods, you need multiple layers of verification to confirm both the payment’s legitimacy and the customer’s eligibility.

First, Address Verification Service (AVS) and Card Verification Value (CVV) checks are completely non-negotiable. These are your frontline tools against stolen credit cards. An AVS mismatch, where the billing address doesn't line up with what the bank has on file, is a massive red flag that should halt the order immediately.

Just as critical is robust age and ID verification. Selling a regulated product to someone who isn't legally allowed to own it is a catastrophic compliance failure. You must integrate a third-party service that can verify government-issued IDs in real-time, before the transaction completes. This step alone can wipe out an entire category of fraudulent purchases.

Automate Shipping Compliance to Stop Chargebacks in Their Tracks

Now for your most powerful weapon: automation. Manually checking every single order's shipping address against a tangled mess of state, county, and local laws is a recipe for disaster. It’s slow, tedious, and one human error can lead to a non-compliant shipment that’s a guaranteed chargeback.

This is exactly why we built tools like Ship Restrict for WooCommerce. Instead of reacting to bad orders after the fact, you proactively block them. You can set up incredibly specific rules that physically stop a customer from completing checkout if their shipping address is in a restricted zone.

Here’s how it plays out in the real world:

- A customer in Chicago tries to buy an item that's illegal within Cook County.

- They enter their shipping ZIP code at checkout.

- Ship Restrict instantly cross-references it with your rules.

- The system blocks the checkout and shows a custom message explaining exactly why the order can't be completed.

This immediate feedback stops the sale dead. No non-compliant order is placed, which means there’s zero chance of an "item not received" or compliance-related chargeback later on.

To get a feel for how this works, check out our guide on how to block non-compliant orders before checkout in WooCommerce. Automating this piece transforms your checkout from a weak point into an active shield, truly solidifying your strategy to prevent chargebacks.

Here's a quick summary of the essential safeguards every regulated seller should have in place.

Key Checkout Safeguards for Regulated Sellers

| Safeguard | Primary Goal | Implementation Tip |

|---|---|---|

| Policy Acknowledgment | Prevent "friendly fraud" | Require a mandatory, unchecked checkbox before payment. |

| AVS & CVV Checks | Block stolen credit cards | Set your payment gateway to automatically decline transactions with AVS/CVV mismatches. |

| Age/ID Verification | Ensure customer eligibility | Integrate a real-time, third-party ID verification service before the final "buy" button. |

| Automated Shipping Rules | Stop non-compliant orders | Use a tool like Ship Restrict to block checkout based on the customer's shipping address. |

Implementing these safeguards isn't optional for high-risk merchants; it's the foundation of a resilient and profitable business.

Keep Customers in the Loop to Head Off Disputes

An ironclad checkout is your first line of defense, but what happens after a customer hits "buy"? This is where proactive, transparent communication becomes your best tool for preventing chargebacks. So many disputes, especially those related to "friendly fraud," don't start with bad intentions. They start with simple confusion, anxiety, or a lack of information.

When you manage customer expectations from the moment an order is placed, you can defuse potential problems long before they turn into a costly chargeback. A smart communication strategy builds trust and reassures buyers that their high-value, regulated purchase is being handled like a pro.

Reinforce Policies in Your Order Confirmation

Think of your order confirmation email as more than just a receipt. It's your first real chance to reinforce the terms the customer just agreed to. Never assume they read the fine print during checkout. Use this touchpoint to clearly and concisely repeat the most critical info.

This is especially vital for regulated products, where the delivery process isn't always straightforward. Your confirmation email should be a mini-guide to what happens next, setting solid expectations right away.

Make sure you include:

- A shipping policy reminder. Briefly restate any unique requirements, like the need for an FFL transfer or that an adult signature is mandatory upon delivery.

- An estimated processing time. Let them know how long it will take before the item even ships. This stops impatient customers from thinking their order fell into a black hole.

- A link back to your full policies. Give them an easy way to review the details again if they need to.

Deliver Crystal-Clear Shipping Notifications

The second that order ships, your communication needs to be immediate and precise. Vague shipping updates are a massive driver of "item not received" chargebacks. The goal here is to give the customer so much information that they never have a reason to question the shipment's status.

Your shipping notification must include a direct link to a reliable tracking number. But you can go a step further. Explain the shipping method used, especially if it's one that requires special handling or signature confirmation. It’s a small detail that can prevent a lot of confusion when the package arrives.

Pro Tip: Ditch generic phrases like "Your order is on its way." Instead, use direct, actionable language: "Your order has shipped via UPS Ground with Adult Signature Required. Track its progress here: [Tracking Link]." That kind of specificity builds confidence and gives you a clear record of fulfillment.

This proactive approach doesn't just help the customer; it builds your evidence locker. If a dispute ever comes up, these timestamped communications with detailed tracking info are powerful proof that you held up your end of the deal.

Get Ahead of Delays and Problems

Nothing creates buyer anxiety faster than silence. If a shipment gets delayed by weather, a carrier issue, or a stock problem, you have to be the one to break the news. Waiting for an angry customer to contact you is a losing game.

A simple, honest email explaining the delay and providing a new estimated delivery date can turn a bad experience into a good one. It shows you're on top of their order and that you value their business. That transparency is crucial for preventing chargebacks for regulated products, as it maintains trust even when things go wrong.

The same goes for post-purchase issues with an FFL transfer or ID verification. Communicate immediately. Explain the problem clearly and give the customer straightforward steps to fix it. An informed customer is far less likely to file a chargeback out of pure frustration.

Use Dynamic On-Site Messaging

Finally, your communication strategy should extend to your website itself. Tools like Ship Restrict for WooCommerce let you display custom messages right on product and checkout pages for customers in restricted areas. Instead of letting them add an item to their cart only to be shot down at the last step, a clear message can inform them upfront.

For example, a customer from a restricted ZIP code might see a banner that says, "Sorry, this item cannot be shipped to your location due to local regulations." This simple, automated message prevents a terrible user experience and stops a non-compliant order before it even starts. That alone eliminates a huge source of potential disputes and customer service headaches.

Winning Disputes with Airtight Evidence

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/Fl-aHVtK8cE" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>Even with the best prevention strategies in place, some chargebacks are just the cost of doing business. When a dispute lands in your lap, your ability to fight back—and win—boils down to one thing: the quality of the evidence you've collected.

This isn't just about forwarding a receipt and hoping for the best. It's about building a rock-solid narrative that proves you did everything right. For anyone selling regulated products, where every sale is already under a microscope, having an airtight representment case ready to go is non-negotiable. A reactive, disorganized approach is a fast track to lost revenue.

Building Your Compelling Evidence File

Think of every dispute as a mini court case. You have to present a clear, logical, and undeniable story to the issuing bank. Vague claims and missing pieces of information won't cut it; you need documented proof for every single step of the transaction.

Your evidence file should be a comprehensive record that leaves zero room for doubt. The key is to start gathering these items the moment an order is placed, not scrambling after a dispute is filed.

Your essential evidence checklist should include:

- Customer Communications: Save every email, chat log, and note from phone calls. These are gold for proving you were transparent about policies, shipping times, or any other issues that came up.

- Payment Verification Proof: This is your first line of defense against "unauthorized transaction" claims. Document the AVS and CVV match results from your payment gateway.

- Policy Acceptance: Get a timestamped screenshot or a system log showing the customer physically checked the box to agree to your terms of service, shipping rules, and return policy at checkout.

- Delivery Confirmation: This is an absolute must. You need tracking information showing the package was delivered to the correct address. Even better? Proof of a signature confirmation from an adult.

This proactive documentation is critical. On average, sellers of physical goods win just 53.42% of their disputes—a much lower rate than digital sellers, mostly because proving delivery can be tough. Keeping meticulous records directly counters this weakness.

Tailoring Your Response to the Reason Code

Not all chargebacks are created equal. Each one comes with a specific "reason code" that explains why the customer is challenging the charge. If you send a generic, one-size-fits-all response, you're almost guaranteed to lose. You have to tailor your evidence to directly shut down the specific claim being made.

For example:

- Reason Code 'Credit Not Processed': The customer says they returned the item but never got their money back. Your evidence needs to prove one of two things: either they never actually returned it (show your return logs) or their return violated your stated policy (e.g., it was way outside the return window).

- Reason Code 'Product Not Received': This one is common in our world. Your key evidence is the shipping confirmation with a tracking number and, most importantly, the delivery confirmation showing the date, time, and signature.

The single biggest mistake merchants make is submitting irrelevant evidence. If the claim is about a product not being received, the bank doesn't care about your marketing emails. Focus laser-like on providing proof that directly counters the customer's specific reason for the dispute.

The Role of Detailed Record-Keeping

The strength of your evidence is directly tied to how good your records are. This is where many businesses drop the ball, especially when juggling complex shipping regulations. Maintaining a clear log of every order—including which specific shipping rules were applied—can be an absolute lifesaver. You can get into the nitty-gritty in our guide to shipping restriction record-keeping requirements.

The challenge of "friendly fraud" makes this even more important, as it now accounts for over 70% of all chargebacks. A staggering 79% of merchants reported a spike in this behavior in 2024, a huge jump from just 34% in 2023. According to data from Justt.ai's blog, this surge is mostly driven by delivery disputes and simple buyer's remorse.

For regulated sellers, having undeniable proof of delivery and policy agreement is your most powerful weapon against these claims. Winning a dispute really comes down to preparation. When you treat every sale as a potential chargeback, you build the habits and systems needed to defend your revenue when it counts.

How Automation Slashes Your Chargeback Risk

If you’re still doing manual compliance checks, you’re sitting on a ticking time bomb. Every time an employee has to pull up a spreadsheet to cross-reference a shipping address with a tangled web of state, county, and city ordinances, you’re just one human error away from a non-compliant shipment. That means a lost product, a guaranteed chargeback, and a massive headache.

This manual process isn't just slow; it's a huge financial risk.

Automation flips this entire script. Instead of reacting to problems, you get ahead of them with a foolproof defense. By plugging in tools that automatically enforce your shipping rules at the point of sale, you make it impossible to ship a restricted item to a prohibited location. This one move can wipe out a huge percentage of your compliance-related chargebacks overnight.

From Manual Mayhem to Automated Precision

Picture your current workflow. A new order comes in, and someone on your team has to drop everything to play detective. They're digging through multiple sources, trying to confirm if a specific ZIP code in some obscure county has a local ordinance against your product. This can eat up several minutes per order, adding up to dozens of lost hours every single week.

Now, let's look at the automated alternative. A customer enters their address at checkout. In the blink of an eye, a system like Ship Restrict checks that address against your entire set of rules. If it’s a no-go zone, the checkout is instantly blocked. The customer sees a clear message explaining why.

The problem order is stopped before it’s even placed. No product gets shipped by mistake, no inventory vanishes, and no chargeback gets filed. This is what effective chargebacks regulated product sellers prevention looks like in the real world—you stop the problem at its source.

The Operational Wins Beyond Chargeback Reduction

While the hit to your chargeback ratio is the main event, the operational benefits are just as powerful. Investing in shipping automation isn't just a defensive play; it’s a smart business decision that frees up your most valuable resource: your team.

Here are the immediate wins:

- Drastically Reduced Labor Costs: The hours your team wasted on manual address checks can now be poured into customer service, marketing, or other activities that actually grow the business.

- Elimination of Costly Shipping Errors: Shipping a high-value regulated product to the wrong place can cost thousands in lost revenue and potential fines. Automation makes this kind of mistake a thing of the past.

- Improved Customer Experience: Instead of frustrating a customer by canceling their order after they’ve paid, you give them instant, clear feedback. No confusion, no anger.

By 2025, eCommerce chargebacks are projected to cost merchants a staggering $33.79 billion globally. Merchants only win about 45% of their disputes on average, but the smart ones use automation to kill bad orders before they ever become disputes. While an ambitious 40% of companies aim for a 0.1% chargeback ratio, only 20% get there without robust automation—proving just how critical these tools are.

Investing in automation isn't an expense; it's an investment in operational sanity and financial stability. It future-proofs your business against both human error and the ever-changing mess of shipping regulations.

Building a Resilient Compliance Workflow

Implementing automation tools allows you to build a compliance system that’s both scalable and totally reliable. For merchants on WooCommerce, this means using plugins to create a seamless, hands-off workflow. We break down the exact steps in our guide on automated shipping compliance for WooCommerce stores. It’s a setup that doesn't just prevent chargebacks but strengthens your entire fulfillment operation.

Ultimately, automation creates a powerful feedback loop. It protects your revenue, frees up your team, and gives legitimate customers a better experience. To tighten your defenses even further, you should also learn how to automate customer service for faster support and more efficient dispute resolution. It's a comprehensive approach that makes your business more resilient, profitable, and ready to grow.

Your Toughest Chargeback Questions, Answered

Even with the best strategy, the world of chargebacks is full of tricky situations and gray areas, especially when you’re selling regulated products. We've compiled some of the most common and complex questions we hear from merchants like you. Here are direct, actionable answers to help you handle these challenges.

Can I Refuse a Refund If a Customer Fails a Background Check?

Yes, you absolutely can—and should—as long as this policy is crystal clear and the customer agrees to it before checking out. This is a classic scenario in the firearms industry. A customer orders a firearm, it ships to their local Federal Firearms License (FFL) holder, but then they fail the mandatory background check.

The sale is dead in the water. Legally, you can't complete it. But the customer might still demand a full refund, even though you've already paid for shipping and the product is now technically "used" inventory that has to be returned.

To protect yourself, your terms and conditions need to be ironclad. Customers must agree to them via a mandatory checkbox at checkout, and the terms must spell out exactly what happens in this scenario:

- A failed background check is not grounds for a full, unconditional refund.

- The customer is responsible for all return shipping costs.

- A specific restocking fee (e.g., 15-25%) will be deducted from their refund to cover your administrative and handling costs.

Without this explicit, pre-agreed policy, a customer could file a "product not received" chargeback and probably win, since they never legally took possession. Your clear, agreed-upon terms are the key evidence that will win you this dispute.

Your checkout process is your contract. Define the financial consequences of a failed background check in your terms, and make acceptance mandatory. This turns a likely loss into a winnable dispute backed by solid proof.

What If a Customer Claims a Package Was Stolen After Delivery?

This is one of the most maddening forms of "friendly fraud" and a huge pain for anyone selling high-value regulated goods. The tracking shows the package was delivered. The photo from the carrier shows it on their porch. But the customer swears it was stolen and files an "item not received" chargeback.

Winning this kind of dispute is nearly impossible without one critical piece of evidence: adult signature confirmation.

Standard delivery confirmation simply isn't enough proof anymore. You need undeniable evidence that a living, breathing person at the correct address physically received and signed for that package. Without a signature, it's just your word against theirs, and banks almost always side with their cardholder.

For any regulated or high-value product, making adult signature required on delivery is non-negotiable. It's the single most powerful tool you have to shut down bogus post-delivery claims.

Is It Really Worth Fighting Small-Dollar Chargebacks?

It's tempting to just write off a small chargeback—say, for a $40 accessory—rather than spend time and energy fighting it. This is a strategic mistake. While the loss on a single dispute is minor, your overall chargeback ratio is what really matters.

Payment processors like Visa and Mastercard watch your chargeback-to-transaction ratio like a hawk. Every single chargeback you accept, no matter the dollar amount, nudges that ratio higher. If it crosses certain thresholds (often as low as 0.9%), you can be thrown into a high-risk monitoring program. These programs come with steep monthly fines and intense scrutiny that can threaten your ability to process payments at all.

So, while it feels counterintuitive, fighting and winning even small disputes is critical for the long-term health of your business. It keeps your ratio in a safe zone and signals to processors that you're actively managing fraud, not just letting it slide.

How Do I Handle Chargebacks for Special Orders or Custom Products?

Customized products, which often can't be resold, carry a unique chargeback risk. A customer gets buyer's remorse after their custom-engraved item is already in production and files a dispute to get their money back. You're left with a personalized, unsellable product and zero revenue.

Your defense here, much like the background check scenario, lies entirely in your upfront, explicit policies.

Your policy for custom orders must be completely unambiguous:

- All sales are final once production or customization begins.

- No cancellations or refunds are permitted after the work has started.

- The customer must agree to a non-refundable deposit or pay the full price before you begin.

Once again, a mandatory checkbox at checkout is your proof. It shows the customer understood and accepted these terms before they paid. When you respond to the chargeback, you'll provide the timestamped log of their agreement and a screenshot of the policy itself. This proves they knowingly waived their right to a standard refund, making your case much, much stronger. This is a vital part of chargebacks regulated product sellers prevention when you’re dealing with one-of-a-kind inventory.

Don't let shipping compliance errors open the door to chargebacks. With Ship Restrict, you can automate your shipping rules by state, county, or ZIP code, blocking non-compliant orders before they ever become a problem. Protect your revenue and your merchant account by visiting https://shiprestrict.com to see how it works.

Cody Yurk

Founder and Lead Developer of ShipRestrict, helping e-commerce businesses navigate complex shipping regulations for regulated products. Ecommerce store owner turned developer.