Vape and E-Cigarette Shipping: PACT Act Compliance for Online Stores

Learn how to ensure Vape and E-Cigarette Shipping: PACT Act Compliance for Online Stores. Stay compliant and avoid penalties with our essential guide.

Cody Y.

Updated on Sep 23, 2025

If you're selling vapes and e-cigarettes online, your shipping process is no longer business as usual. Navigating the PACT Act is now a strict requirement, covering nearly every vaping product you can think of—even those without any nicotine. The single most important change for your WooCommerce store is the complete ban on using the U.S. Postal Service (USPS) for shipping to customers.

This shift also brings incredibly stringent rules for the few private carriers willing to handle these products.

Why Vape Shipping Has Fundamentally Changed

The landscape for selling vapes online has been completely redrawn. If you're running a WooCommerce shop, the days of packing an order and dropping it at the local post office are long gone. The rules are now complex, demanding a new level of diligence from every online retailer in this space.

This massive shift is driven by the Prevent All Cigarette Trafficking (PACT) Act. Originally passed in 2009, the law was dramatically expanded in 2021 to include Electronic Nicotine Delivery Systems (ENDS). This move effectively ended the old way of doing business and introduced major operational hurdles for the entire e-commerce industry.

What "ENDS" Actually Covers (It's More Than You Think)

The term "ENDS" was intentionally made incredibly broad. It doesn't just apply to e-liquids containing nicotine. The law now covers almost any product even remotely related to vaping.

This includes:

- Nicotine-Free E-Liquids: Yep, even your 0mg nicotine products fall under these regulations.

- CBD and Hemp Vape Products: Any device or liquid made for inhalation is included, no matter the active ingredient.

- Components and Accessories: Think batteries, coils, pods, and even empty vape pens sold on their own.

Regulators made the definition this wide to close loopholes. The two core reasons behind these tough rules are simple: preventing underage access to vaping products and making sure all state and local excise taxes get collected.

The Stark Contrast: Before and After the PACT Act

Let's paint a picture. Back in 2019, a customer could order a vape pen online, and it would show up discreetly in their mailbox via USPS a few days later. The process was simple, cheap, and almost entirely unregulated from a shipping perspective.

Now, that same transaction is a different beast entirely. Your online store must first verify the customer's age at checkout using sophisticated software. You can't use USPS at all. Instead, you have to find and use a specialized private carrier that agrees to handle ENDS products, which always comes at a premium.

Then, upon delivery, the driver has to check the recipient's government-issued ID to confirm they're 21 or older and get an in-person signature. This whole ordeal is more expensive, logistically complicated, and creates a detailed paper trail for tax authorities.

For a quick overview, here are the core pillars of the PACT Act that every vape business must now follow.

PACT Act Core Requirements at a Glance

This table breaks down the essential compliance mandates every online vape retailer must implement.

| Requirement Area | Key Mandate | Primary Impact on Business |

|---|---|---|

| Carrier Restrictions | USPS ban on all consumer vape shipments. | Must find and integrate with approved private carriers, often at higher costs. |

| Age Verification | Must verify customer age at time of purchase and upon delivery. | Requires specialized software and adult signature delivery services (21+). |

| Tax Compliance | Register with federal and state tax administrators; collect and remit all applicable excise taxes. | Creates significant administrative overhead and requires tax calculation tools. |

| Reporting | Submit detailed monthly reports to state tax administrators. | Demands meticulous record-keeping of every sale and customer. |

Understanding these requirements isn't just about avoiding fines; it's about building a sustainable business in this new regulatory environment.

The core takeaway is this: compliance isn't a suggestion; it's a foundational requirement for survival. The federal government has made it crystal clear that the casual, unregulated shipping of the past is over.

As of October 2021, the USPS officially banned mailing all vaping products directly to consumers. This includes products containing hemp or CBD and covers any device or component that delivers an inhaled substance, making compliance a critical issue for any online vape or tobacco business. Navigating these rules highlights just how important it is to understand the specific requirements for the tobacco and vape industry.

Getting Your Business Registered Federally and State by State

Before you can legally ship a single vape product, your business has to get through a mandatory registration maze at both the federal and state levels. This isn't just about filling out forms; it's the bedrock of building a compliant online store and steering clear of some pretty severe penalties.

Getting these registrations right from the start will save you from a world of hurt, including costly delays and potential shutdowns.

Your first stop is the federal government. The PACT Act is crystal clear: any business selling Electronic Nicotine Delivery Systems (ENDS) must register with the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF). This is a non-negotiable step for anyone involved in interstate commerce.

Navigating Your Federal ATF Registration

Registering with the ATF means submitting a detailed profile of your business. This isn't a quick sign-up; it's your official declaration to the federal government that you intend to ship regulated products across state lines.

You'll need to hand over key details, including:

- Business Information: Your legal business name, any trade names (like a "DBA"), and your main place of business.

- Owner Identification: The name and address of the business owner or other key people in the company.

- Shipping Locations: The address of every single location you'll be shipping ENDS products from.

- Website Details: The URL of every website you use to sell these products.

A common trip-up here is failing to list every single website or trade name. If you operate multiple storefronts or brands, each one has to be explicitly included. An incomplete application is one of the quickest ways to get your registration delayed or flat-out rejected, which stalls your ability to operate legally.

The ATF isn't just filing your information away. This registration puts your business on their radar for tax reporting and compliance checks. Think of it as your official entry into a federally regulated marketplace.

Once you get that approval, you’re legally recognized as an ENDS seller. But that's only half the battle. Your federal registration is the ticket you need to tackle the next, far more complex layer of compliance: state-by-state registration.

The Challenge of State-Level Compliance

While federal registration opens the door, state registration is where the real administrative grind begins. The PACT Act forces you to register with the tobacco tax administrator in every single state and locality you ship to. This rule applies even if the state doesn't have a specific vape tax on the books.

This is the requirement that overwhelms most online sellers. If you plan on selling nationwide, you could be looking at dozens of individual registrations. Each one comes with its own unique forms, fees, and processing times. The administrative load multiplies fast with every new market you decide to enter.

Let's walk through a real-world scenario. Say you launch your online store and plan to ship only within your home state of Texas. You’d register with the ATF and the Texas Comptroller of Public Accounts. Pretty manageable.

But after a great first quarter, you want to expand to four nearby states: Louisiana, Oklahoma, Arkansas, and New Mexico. All of a sudden, your compliance workload quintuples. You must now:

- Research the specific registration requirements for each new state's tax authority.

- Complete and submit separate applications for Louisiana, Oklahoma, Arkansas, and New Mexico.

- Track the approval status for four different government agencies.

- Figure out the unique tax collection and reporting rules for each jurisdiction.

This exponential jump in paperwork is a major operational headache. It’s why so many businesses start small, selling to just a handful of states before slowly expanding. Every new state you add to your shipping zones kicks off a new cycle of research, paperwork, and ongoing reporting. Forgetting to register with even one state you ship to is a direct violation of the PACT Act.

Building a Compliant Shipping and Delivery Process

Once you’ve got your federal and state registrations sorted, the real challenge begins: getting products to your customers legally. Thanks to the USPS ban, shipping vape and e-cigarette products isn't just a simple transaction anymore. It’s a tightly controlled process that shifts the focus from paperwork to the physical journey of your products.

This means you’ll be finding the right partners and sticking to a meticulous delivery protocol. The big national carriers you used to rely on, like FedEx and UPS, have mostly bowed out of the consumer vape delivery game. This leaves a small pool of specialized and regional private carriers as your only real options.

Choosing a PACT Act Compliant Carrier

Finding a carrier isn't as simple as just comparing shipping rates. You need a partner who explicitly handles Electronic Nicotine Delivery Systems (ENDS) and has built-in procedures for PACT Act compliance. These are often regional carriers, which means you might need to team up with several providers to get the nationwide coverage you want.

When you're vetting a potential shipping partner, ask them directly about their experience with vape and e-cigarette shipping. You will almost certainly have to sign a specialized service agreement. This contract lays out your responsibilities as the shipper and their duties upon delivery, giving you assurance that they know the rules and will follow them.

That brings us to the most critical part of the whole delivery process: the final handoff to your customer.

The Non-Negotiable Adult Signature Requirement

Every single shipment containing vape products must be delivered using an adult signature (21+) service. This isn't an optional upgrade; it's a federal mandate. The delivery driver is legally required to check a government-issued ID in person to verify the recipient's age before they can hand over the package.

This one rule eliminates options like leaving packages on the porch, in a mailbox, or with an underage family member. If an adult with a valid ID isn't there to sign, the package goes back. For WooCommerce store owners, it's absolutely crucial to communicate this requirement to customers at checkout. Managing those expectations upfront is key to avoiding failed deliveries and frustrated customers. You can find more practical tips in our guide on setting up shipping controls in WooCommerce for age-restricted products.

Remember, the responsibility for ensuring a compliant delivery ultimately falls on you, the seller. If your chosen carrier fails to perform the ID check, your business is the one that will face the penalties.

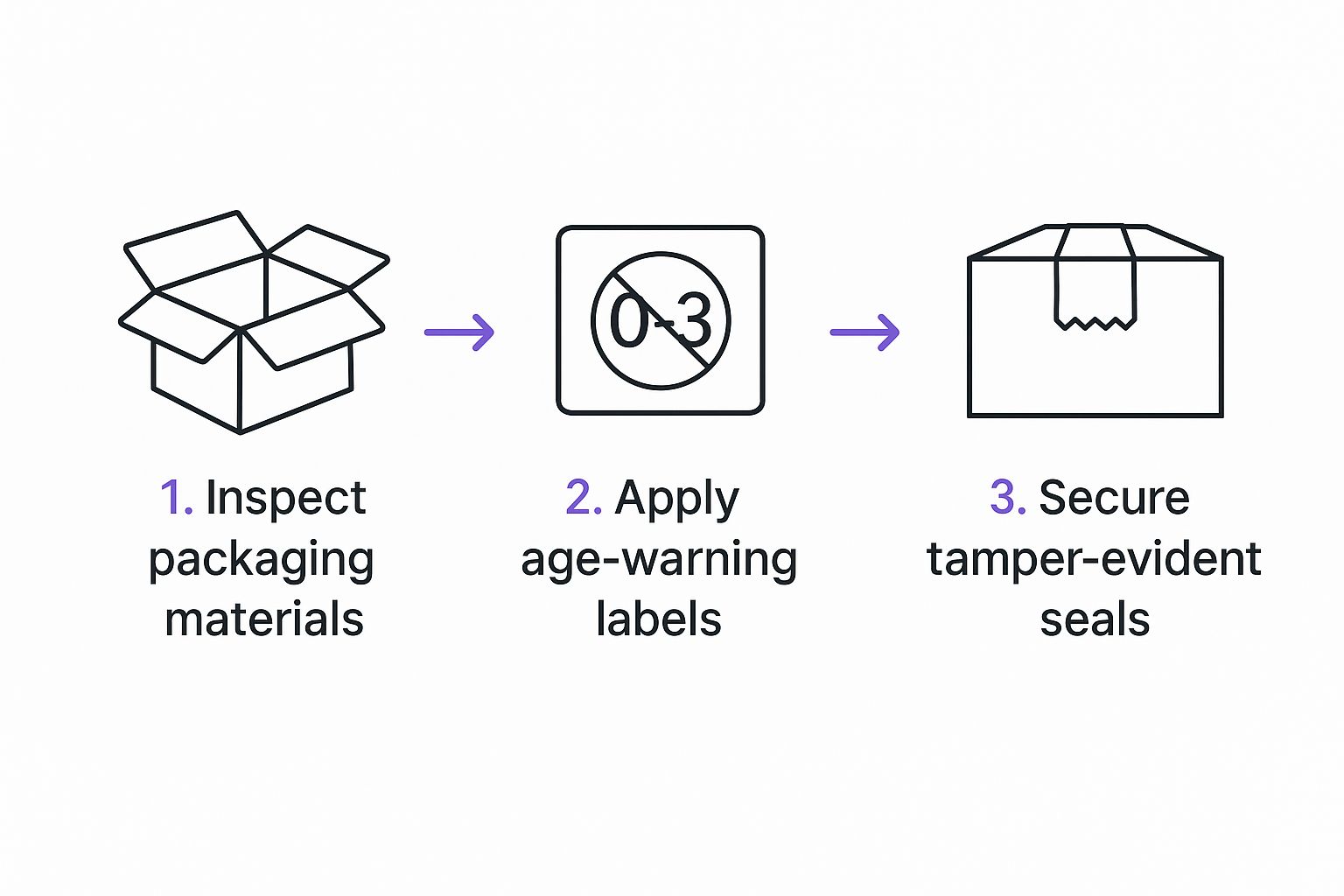

Getting Your Package Labeling Right

Before a package even leaves your warehouse, it has to be labeled according to strict federal guidelines. This goes beyond the standard shipping label. It involves specific warnings and identifiers that clearly mark the contents as regulated products.

Your package must display:

- A statement that reads: "CIGARETTES/NICOTINE/SMOKELESS TOBACCO: FEDERAL LAW REQUIREQUIRES THE PAYMENT OF ALL APPLICABLE EXCISE TAXES, AND COMPLIANCE WITH APPLICABLE LICENSING AND TAX-STAMPING OBLIGATIONS."

- The full name, address, and PACT Act registration number of your business.

- The name and address of the recipient.

These labels act as a clear red flag for carriers and regulators, ensuring the package is handled correctly every step of the way. Forgetting a label or using the wrong text is a simple mistake that can get your shipment seized and your business flagged for an audit. This visual breaks down the essential flow for preparing compliant packaging.

This process shows that compliance starts before the box is even sealed—attention to detail is everything. In 2025, federal carriers really ramped up their enforcement of these rules, especially for products derived from hemp or containing THC. They started yanking shipping privileges from distributors who weren't meticulously following these mandates, causing major supply chain headaches for retailers who weren't prepared.

Getting a Handle on Cross-State Tax and Reporting

For many new online vape retailers, the sheer complexity of tax collection is the biggest shock to the system. The PACT Act essentially deputizes your business, making you a tax collection agent for every single state and city you ship to. This isn't just about your local sales tax; it's a knotted mess of federal, state, and local excise taxes that creates a huge administrative headache.

These are special taxes levied just on tobacco and vape products, and the rates are all over the map. You are now legally on the hook for calculating, collecting, and paying the correct tax for every transaction, right down to the customer's specific street address.

The Wild West of Vape Excise Taxes

Trying to calculate vape taxes manually is a fool's errand. The rates and rules change so dramatically from one place to the next that keeping up is nearly impossible.

One state might tack on a simple percentage of the wholesale cost. Another might tax you per milliliter of e-liquid. Then, just to make things interesting, a city or county might slap its own local tax right on top of the state's.

Let's walk through a real-world scenario to see how this plays out.

- Example 1 (Low-Tax State): You sell a $20 disposable vape to a customer where there's no specific vape excise tax. You'd just collect the standard sales tax, which might be around $1.60.

- Example 2 (High-Tax State): Now, you sell that exact same $20 vape to someone in a state with a hefty 40% retail excise tax plus a high local sales tax. Suddenly, the total tax could shoot past $9.50, almost doubling the price for your customer.

This massive swing isn't just a logistical problem; it's a financial one. It impacts your pricing strategy, your profit margins, and your checkout experience. If you get it wrong, you’re facing back taxes and penalties. If you get it right but the customer gets sticker shock, you're dealing with abandoned carts. This is exactly why automated tax software is non-negotiable for anyone shipping vapes and e-cigarettes.

The regulatory patchwork for vape products often mirrors what we see in other industries. For a deeper dive into how wildly state laws can differ, our complete 2025 compliance guide on CBD shipping laws offers a great parallel.

Demystifying Monthly Jenkins Act Reports

Collecting the right taxes is only half the battle. The PACT Act also forces you to file incredibly detailed monthly reports under the Jenkins Act. For every single state you ship to, a report must be sent to that state's tax administrator by the 10th of the following month.

And these aren't your typical sales summaries. Each report has to break down every single shipment you made into that state during the previous month.

This intense level of reporting is no accident. It’s designed to give states total visibility into every vape product crossing their borders, ensuring they can track and claim every last tax dollar. Think of it as the PACT Act's primary enforcement tool.

So, what exactly do you have to report for every order?

- Customer Details: The full name and address of each person who bought something.

- Product Information: The exact quantities and types of ENDS products sold in that order.

- Invoice Details: The invoice number and sale date for every single shipment.

You are required to keep these meticulous records for a minimum of four years. Can you imagine manually pulling this data for hundreds of orders across dozens of states every month? It’s a recipe for mistakes. Using software to automatically generate these reports is the only practical way to stay compliant, file on time, and protect your business from serious penalties.

The True Cost of PACT Act Compliance

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/fVb4438VCPg" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>Navigating the PACT Act isn't just about learning the rules; it's a serious investment in technology and operational overhead. These costs will absolutely reshape your business model, from how you price your products to your actual profit margins. If you want to build a sustainable online vape store, ignoring them simply isn't an option.

The expenses start piling up with direct, tangible costs. While the federal registration with the ATF might seem minor, the real financial hit comes from specialized shipping. With giants like USPS, FedEx, and UPS out of the game for consumer vape deliveries, you're forced into a much smaller pool of private couriers. These carriers charge a premium for their required adult signature (21+) delivery services.

On top of that, any modern compliance strategy depends on a "tech stack" of subscription-based software. These aren't one-and-done purchases—they are ongoing monthly expenses that you have to bake into your operational budget.

Your Essential Compliance Toolkit

To operate legally, you’ll need to wire several key software solutions into your WooCommerce store. Each tool handles a different piece of the PACT Act puzzle, and they all have to work together perfectly to keep your business protected.

- Age Verification Plugins: Robust systems that check a customer’s ID against public records at checkout are completely non-negotiable.

- Automated Tax Calculators: You need software that can calculate and apply the correct federal, state, and local excise taxes for every single order. This is your best defense against audits and crippling fines.

- Compliant Shipping Integrations: You'll need a platform that connects your store to an approved private carrier and enforces all the specific shipping rules.

- Record-Keeping Systems: A bulletproof system for storing sales and shipping data for the legally required four-year period is critical for generating your monthly Jenkins Act reports.

The truth is, trying to handle compliance manually is a losing game. Smart businesses automate these tedious tasks not just for efficiency, but to slash the risk of human error—the kind of error that can lead to catastrophic fines.

Beyond the software subscriptions, the day-to-day operational drag is a huge hurdle. The administrative overhead is right up there with other major ecommerce pain points that can sink a small business. The time you'll burn managing state registrations, pulling reports, and dealing with customer service headaches from failed deliveries adds up fast.

The Financial Impact on Your Business

When you add it all up, the cumulative effect is significant. Industry reports show that compliance-related logistics costs for shipping vape products have jumped by roughly 15-20%. This forces online sellers into a tough spot: either raise prices and risk losing customers or swallow the hit to their margins.

The penalties for getting it wrong are even worse. You could face civil fines up to $10,000 per violation or 2% of your gross sales.

Ultimately, these investments are the cost of entry into the online vape market. The initial setup can feel overwhelming, but plugging in the right technology automates the most painful parts of compliance. It frees you up to focus on growing your business, giving you the confidence that you’re operating on solid legal ground.

Common Questions About Vape Shipping Compliance

Diving into vape shipping compliance can feel like walking through a minefield. Even when you think you have a handle on the big picture, specific questions always pop up, leaving you wondering if you're making a critical mistake. Let's clear the air and tackle the most common questions we hear from store owners.

Getting these details right is everything. A simple misunderstanding of the law isn't an excuse, and the consequences can be brutal.

Does the PACT Act Apply to Nicotine-Free Vapes?

Yes, absolutely. This is one of the most common—and most dangerous—misconceptions out there. When lawmakers wrote the PACT Act, they defined an "Electronic Nicotine Delivery System" (ENDS) in the broadest possible terms.

The law covers any device, liquid, or component that can be used to deliver an inhaled substance, regardless of whether it actually contains nicotine. This means your entire product line of CBD, hemp, or even simple flavor-only vapes falls under the exact same shipping, registration, and tax rules as traditional nicotine e-liquids.

Assuming "nicotine-free" means you're exempt from the PACT Act is a costly mistake. Federal regulators don't see a difference, and treating these products any other way puts your business in immediate jeopardy.

Can I Ship Vape Products to Another Business Using USPS?

For almost any situation you'll encounter, the answer is a hard no. While a few incredibly narrow exceptions exist for things like government agencies or public health research, they simply don't apply to standard business-to-business (B2B) sales.

You have to operate under the firm assumption that all vape-related shipments are banned from the USPS network, whether they're going to a customer or another licensed business. Trying to find a B2B loophole is a huge compliance gamble that can get you blacklisted by every major carrier and flagged by the ATF. It's a risk that massively outweighs any potential convenience.

What Happens If My Business Violates the PACT Act?

The penalties for non-compliance are severe enough to put a company out of business for good. They aren't just a slap on the wrist; they're designed to hit your business from every possible angle—financial, legal, and operational.

If you're caught breaking the rules, you could be facing:

- Heavy Civil Fines: These can run up to $10,000 per violation. A single order shipped incorrectly could trigger this penalty.

- Criminal Charges: In more serious cases, violations can lead to criminal prosecution and potential prison sentences of up to three years.

- Blacklisting: Violators are often added to a public non-compliance list, which effectively cuts them off from all legitimate shipping carriers and payment processors.

When you add it all up—financial ruin, legal trouble, and being shut out of the industry—it's clear that strict compliance is the only viable path forward.

Is There a Single Software That Handles All PACT Act Requirements?

Unfortunately, there's no "magic bullet" software that can do it all. To manage PACT Act compliance, you need to build what's often called a "compliance tech stack" by integrating a few different specialized tools into your WooCommerce store.

This stack almost always involves three key services working together:

- A solid age verification service to confirm your customer's identity before the sale is finalized.

- Specialized shipping software that connects directly with an approved private carrier and enforces adult signature requirements on every delivery.

- An automated tax platform that calculates, collects, and helps you file the right sales and excise taxes for every single jurisdiction you sell into.

Putting this integrated system in place is the only realistic way to automate your vape shipping compliance and ensure every single order meets federal and state law without needing constant manual review.

At Ship Restrict, we know just how overwhelming it can be to manage these complex rules in WooCommerce. Our plugin is built to automate shipping restrictions by state, county, or even down to the ZIP code, ensuring you never accidentally ship a regulated product where it doesn't belong. Stop worrying about costly compliance mistakes and start focusing on growth. Visit https://shiprestrict.com to see how we can help.

Cody Yurk

Founder and Lead Developer of ShipRestrict, helping e-commerce businesses navigate complex shipping regulations for regulated products. Ecommerce store owner turned developer.