Mastering payment gateway restrictions regulated products WooCommerce

Mastering the complexities of payment gateway restrictions regulated products WooCommerce: Learn compliant steps to keep your store selling smoothly.

Cody Y.

Updated on Jan 13, 2026

If you've ever had your WooCommerce store suddenly flagged or shut down by a mainstream payment gateway, the reason usually boils down to one thing: risk. For giants like Stripe or PayPal, regulated products aren't just another product category—they're a huge financial and legal headache.

When your store gets rejected, it's not a technical glitch. It’s a calculated business decision on their part to steer clear of anything that complicates their high-volume, low-margin business model.

Why Mainstream Gateways Reject Regulated Products

It’s an incredibly frustrating experience for merchants selling regulated goods. The core problem isn't your business or your ethics; it's that your products don't fit into the simple, standardized box that big payment processors need.

Think of a mainstream gateway as an insurance company that only wants to cover the safest possible drivers. Their entire business is built on processing millions of tiny, low-risk transactions where they skim a small percentage off the top. As soon as they see items like firearms, ammunition, or certain supplements, their internal risk alarms start blaring.

These products get slapped with a "high-risk" label for a few key reasons:

- Higher Chargeback Rates: Unhappy customers or fraud in regulated industries often leads to chargebacks. Each one is a costly, time-consuming mess for the processor.

- Reputational Risk: Associating their brand with controversial or legally gray products can damage a gateway’s public image and spook their banking partners.

- Complex Legal Compliance: The laws around regulated goods are a constantly shifting nightmare, varying wildly from one state to the next. Keeping up is a massive expense they'd rather avoid. Just one small part of this puzzle, like age verification, is a major undertaking. You can see what that involves in our guide on age verification for online sales.

How Mainstream Gateways View Regulated Products

To give you a clearer picture, here’s a quick summary of where the big players stand on common regulated products. This isn't exhaustive, but it shows the general pattern of risk avoidance.

| Payment Gateway | Policy on Firearms | Policy on CBD/Supplements | Primary Reason for Restriction |

|---|---|---|---|

| Stripe | Prohibited | Prohibited (with rare, pre-approved exceptions) | Reputational risk and complex legal landscape. |

| PayPal | Prohibited | Prohibited | Brand risk and varying legality of products. |

| WooCommerce Payments | Prohibited | Prohibited | Backed by Stripe; inherits the same risk policies. |

As you can see, the default answer is almost always "no." They prefer blanket bans over the complex work of vetting individual merchants in these industries.

The Financial Calculation of Risk

To really get why they do this, you have to look at the unique payment challenges faced by high-risk industries. Big processors operate on razor-thin margins, often just 2-3% per transaction.

This means a single expensive chargeback from a regulated product sale can instantly erase the profit from hundreds of other successful transactions. When you look at it that way, it's simply cheaper for them to ban entire product categories than to deal with the fallout.

This isn't personal; it's purely a business decision based on a risk-versus-reward calculation. For a mainstream gateway, the potential profit from your regulated product store is dwarfed by the potential financial and legal liabilities.

Ultimately, this leaves countless legitimate WooCommerce merchants scrambling for a way to take payments. Understanding this fundamental conflict is the first step toward finding a real, sustainable solution that exists outside the mainstream system.

Understanding the Prohibited Products Landscape

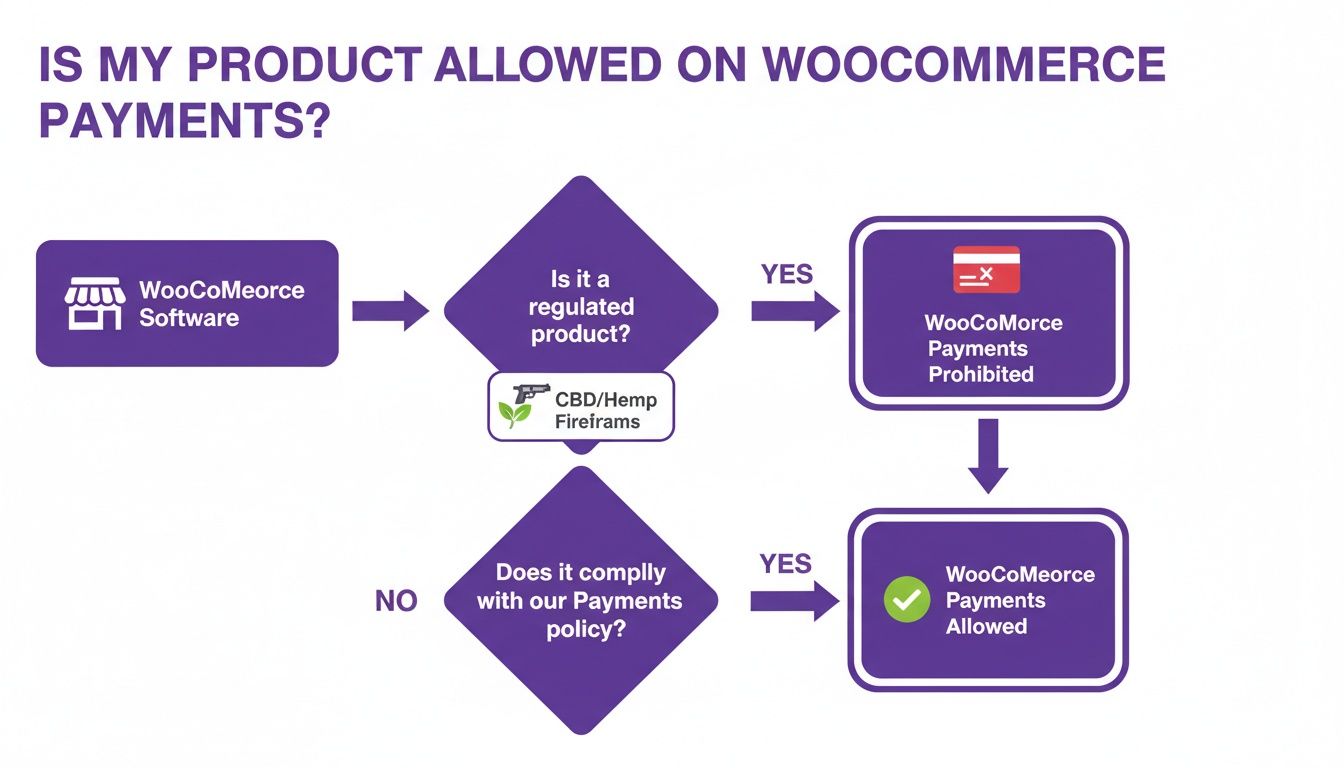

One of the most common—and costly—misunderstandings for new eCommerce store owners is the difference between WooCommerce the software and the services built on top of it. Because WooCommerce is open-source, you can technically build a storefront and list almost anything you can imagine on your own server. This freedom is one of its greatest strengths.

But that flexibility hits a brick wall the moment third-party services get involved. You can spend weeks building a beautiful, functional WooCommerce store for your products, only to find yourself completely blocked when you try to actually get paid. The problem isn't your store; it's the financial plumbing you connect to it.

The Platform vs. The Payment Provider

Think of your WooCommerce store as a physical shop you own outright. You can stock the shelves with absolutely anything you want. But to make a sale, you need a credit card terminal from a bank. If that bank has a policy against processing payments for your specific products, your shiny new terminal is just a paperweight, no matter how full your shelves are.

This is the exact jam many merchants find themselves in. They successfully build their site with the flexible WooCommerce software, only to get a hard "no" from integrated payment services like WooCommerce Payments (which is powered by Stripe) or PayPal. These providers have their own strict rules that completely override the software's flexibility.

A critical distinction to grasp is that your ability to list a product on your self-hosted WooCommerce site has no bearing on your ability to process payments for it. The gateway holds the final say.

WooCommerce Payments, for instance, has one of the most extensive prohibited product lists in the business. It covers firearms, ammunition, tobacco, adult content, counterfeit goods, and a huge category of pseudo-pharmaceuticals. Research suggests that a significant chunk—potentially 15-20%—of all merchants could fall into at least one of these restricted categories, making this a massive issue.

What Is Considered a Prohibited Product?

While things like firearms, ammunition, and illegal substances are obvious no-gos, the list of items that trigger payment gateway restrictions regulated products WooCommerce is far longer and often catches sellers by surprise. These policies are all about protecting the payment processor from financial, legal, and reputational damage.

Here are some of the most common categories that get flagged:

- CBD and Nutraceuticals: Products that make any kind of health claim without FDA approval are almost universally banned by mainstream processors.

- Adult Products and Content: Due to reputational risk and historically higher chargeback rates, this category is off-limits for most standard gateways.

- Tobacco and Vaping Products: Complicated age verification rules and a messy patchwork of state laws make this a high-risk category processors avoid.

- Certain Digital Goods: This can include anything related to online gambling, get-rich-quick schemes, or content that steps on intellectual property rights.

To really get a handle on what's considered high-risk, it helps to look at the legal frameworks that shape these policies, like Anti-Money Laundering (AML) regulations. These laws create a massive compliance burden that most processors would rather avoid entirely by just banning whole product classes. It's a proactive de-risking strategy that is core to their business model, leaving many legitimate merchants stuck and searching for a way forward.

How to Spot Your Store’s Risk Triggers

It’s one thing to know that mainstream payment gateways don't like regulated products. It's another thing entirely to understand exactly why your specific store might get flagged for shutdown. Payment processors aren’t just looking at a product category; they’re analyzing a complete risk profile built from a few key triggers.

Learning to spot these vulnerabilities ahead of time is the difference between running a stable business and waking up to a frozen merchant account.

Think of it like a home security system. A single unlocked window might not set off the alarm. But combine that with a faulty motion detector and a dead camera battery, and the whole system is basically useless. Payment processors look at your store the same way, weighing multiple factors at once to decide if you’re too risky to work with.

This flowchart shows the simple, frustrating dead-end that many merchants hit when they try to sell regulated goods using standard WooCommerce tools.

As you can see, while the open-source WooCommerce software itself lets you list anything you want, the built-in payment solutions like WooCommerce Payments will slam the door shut. This forces you down a more specialized—and often more complex—path.

The Three Pillars of Processor Risk

Your store’s risk profile is built on three core pillars. A red flag in just one of these areas is enough to make an underwriter nervous. Problems across multiple pillars? That’s an almost guaranteed rejection from any standard processor, leaving you in need of a high-risk specialist.

-

Product Type: This is the most obvious one. If you’re selling anything on a prohibited list—firearms, ammo, CBD, certain supplements, or adult products—you’re automatically in a higher risk tier. With mainstream gateways like Stripe or PayPal, there’s simply no way around this.

-

Merchant History: Processors dig into your business’s track record. A history of high chargeback rates—typically anything over 0.9%—is a massive red flag. It screams customer disputes, dissatisfaction, or even fraud. They’ll also look at your personal credit history and the overall financial health of your business.

-

Geographic Location: This trigger cuts two ways. First, there’s your business’s physical location, as some countries are flagged for higher rates of fraud. But for regulated goods, the bigger issue is where you sell to. Shipping into states or cities with their own strict local laws adds a layer of compliance risk that most processors want absolutely no part of.

High-Risk Merchant Trigger Assessment

Before you even think about applying for a merchant account, you need to be honest about where you stand. The table below is a simple checklist to help you self-assess your risk level based on the three pillars we just covered. This isn't just an academic exercise; it helps you anticipate the questions and documentation you'll need, saving you from wasting time with processors who will never approve you.

| Risk Factor | Low Risk (Example) | Medium Risk (Example) | High Risk (Example) |

|---|---|---|---|

| Product | T-shirts, books, or home goods with no legal restrictions. | Nutritional supplements, smoking accessories, or digital goods. | Firearms, ammunition, CBD/hemp products, or adult novelties. |

| Merchant | Established business with a clear credit history and chargeback rate below 0.5%. | New business with no processing history, or a history with occasional chargeback spikes. | History of high chargebacks (above 0.9%), a terminated merchant account, or poor credit. |

| Geography | Selling only within a single state or country with straightforward laws. | Shipping nationwide to a mix of regulated and unregulated states. | Selling internationally or into jurisdictions with complex and shifting legal restrictions. |

Seeing "High Risk" in one or more columns doesn't mean you can't run your business. It just means you need a different strategy.

Proactively identifying your own risk triggers allows you to build a stronger case for your business. It shows a potential high-risk partner that you understand the compliance landscape and have measures in place to mitigate their exposure.

Think of it this way: by doing your homework, you’re not just a merchant asking for an account—you’re a serious business partner who understands the stakes. This positions you to find the right payment partner who is equipped to handle your specific business model from day one.

A Proven Strategy for Payment and Shipping Compliance

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/DGwW62f0b78" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>If you're selling regulated products on WooCommerce, you know the drill. Facing account freezes and gateway rejections can feel like a frustrating, never-ending battle. But there is a clear, sustainable way forward. The secret isn't trying to trick mainstream payment systems; it's about building a fundamentally stronger, more compliant business from the ground up.

A truly resilient strategy has two parts that have to work together. First, you need a specialized payment processor that actually understands and accepts the risks of your industry. Second—and this is just as crucial—you must use automated tools that prove you have complete control over every single sale.

Adopting a Dual-Layered Approach

Think of it like securing a high-value building. A high-risk payment gateway is your specialized, heavy-duty lock on the front door. It’s built to handle the unique pressures of your industry. But a tough lock isn't enough on its own. You also need a sophisticated security system inside that monitors every door and window, stopping intruders before they get in.

That's exactly what automated compliance tools do. They act as your internal security, actively enforcing your sales rules and stopping illegal or non-compliant orders before they ever hit the payment gateway. This two-part approach doesn't just lower your risk; it actively demonstrates your commitment to running a responsible business.

Simply getting a high-risk merchant account is only half the battle. To keep it, you have to prove you're a low-risk partner. You do that by proactively stopping prohibited sales, not just reacting to them after the fact.

This combination creates a powerful synergy. The gateway gives you the financial plumbing, and the compliance tool provides the operational proof that you're using it responsibly.

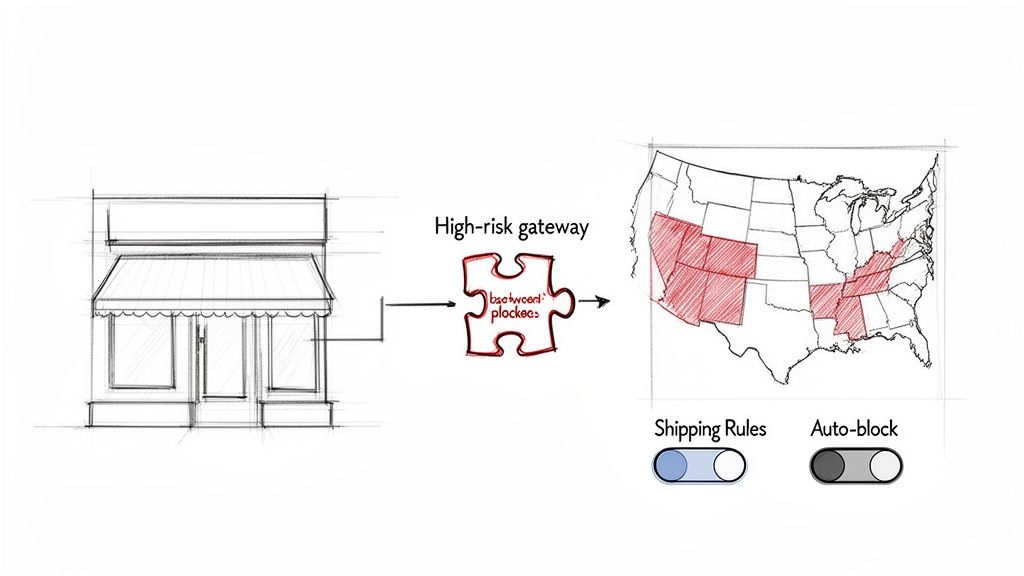

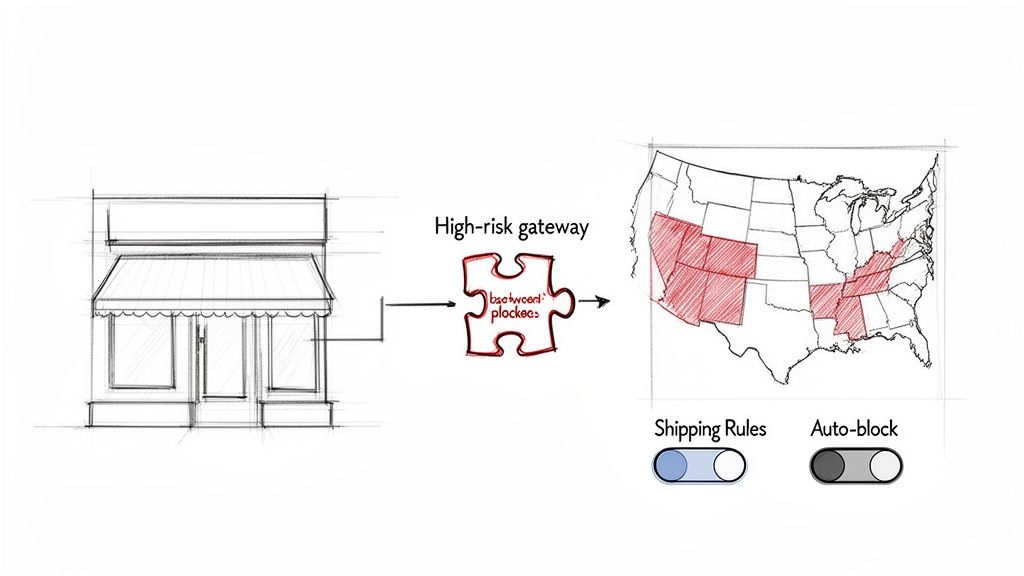

How Shipping Rules Protect Your Payment Gateway

At first glance, a shipping restriction tool might not seem like a payment security feature, but it's one of the most effective risk-mitigation tools you can have. When your high-risk processor underwrites your account, one of their biggest worries is your ability to navigate the tangled web of state and local laws. An accidental sale to a prohibited area can trigger costly chargebacks and legal headaches—for them.

By using an automated tool to enforce shipping rules, you’re giving them concrete evidence that you have this risk under control. You're not just promising to follow the law; you're showing them the exact machine you use to enforce it, 24/7.

This proactive stance completely changes your relationship with your processor. You're no longer just another merchant in a high-risk bucket; you are a sophisticated operator with tight internal controls. This is critical because the high-risk market is brutal. For industries like nutraceuticals, CBD, and firearms, approval rates with traditional gateways can be as low as 20-30%. Even when a high-risk provider approves you, merchants often face rolling reserves where 5-10% of their monthly revenue is held for up to 180 days to cover potential chargebacks.

The Role of Automated Compliance Tools

Tools like Ship Restrict are designed to be your first line of defense. By setting up granular rules based on state, county, or even specific ZIP codes, you essentially create a digital fence around your business.

Here’s how this directly shores up your payment processing stability:

- Prevents Illegal Transactions: The system automatically blocks an order if the customer's address is in a restricted zone. This means the illegal transaction is never even sent to the payment gateway for authorization.

- Lowers Chargeback Risk: A huge number of chargebacks in regulated industries come from "friendly fraud," where a customer claims an order was illegal or shouldn't have been shipped to them. By blocking these sales from the start, you eliminate this entire category of disputes.

- Demonstrates Proactive Control: This shows underwriters that you are a responsible partner who takes compliance seriously, making your merchant account far more stable for the long haul.

Ultimately, integrating automated shipping rules is a core part of managing payment gateway restrictions regulated products WooCommerce. It builds a foundation of trust with your payment partner and protects your revenue from the constant threat of account termination. You can learn more about how to get started with automated shipping compliance for WooCommerce stores and build a more defensible business.

How to Configure Your WooCommerce Store for Compliance

Alright, let's move from theory to action. This is where many merchants get bogged down. You know you need a high-risk gateway and compliance tools, but actually setting them up correctly is a whole different ballgame. This is your blueprint for getting your WooCommerce store configured to be defensible and ready for business from day one.

The goal here is simple: build a system that automatically enforces your rules. It needs to protect your merchant account by stopping illegal sales before they can even be attempted. Think of it as hiring a digital bouncer for your store—one that's on duty 24/7 and never makes a mistake.

Step 1: Install Your High-Risk Payment Gateway

First things first. Your journey starts with partnering with a payment processor that actually understands and supports your industry. Once you get approved, they'll usually hand you a dedicated WooCommerce plugin. This isn't just another add-on; it's the secure bridge connecting your storefront to your merchant account.

Getting it installed is typically a breeze:

- Download the Plugin: Your processor will give you a ZIP file containing their custom gateway plugin.

- Upload to WordPress: In your dashboard, head to

Plugins > Add New > Upload Pluginand select that file. - Activate and Configure: Once it's active, find your way to

WooCommerce > Settings > Payments. You'll see your new gateway in the list. Click to manage it and plug in the API keys or merchant credentials your processor provided.

This step gets the financial plumbing in place. But without the next layer of protection, you're still leaving the door wide open to non-compliant orders and a world of hurt.

Step 2: Implement Granular Shipping Restrictions

This is the most critical move you'll make to deal with payment gateway restrictions regulated products WooCommerce. You absolutely need a tool that can enforce a complex web of shipping laws automatically. This is where a plugin like Ship Restrict becomes your first and best line of defense.

Its job is to stop a customer in a prohibited location from ever reaching the checkout page with a restricted item in their cart. By killing the sale at the source, the transaction never even gets a chance to hit your payment gateway. No illegal transaction, no risk.

Your ability to demonstrate proactive, automated compliance is what separates a stable merchant account from one that's constantly on the brink of termination. Manual checks just aren't a scalable or defensible solution.

This screenshot shows the rule creation interface where you can build specific restrictions.

The interface lets you get incredibly precise, like blocking specific product categories from being shipped to certain states, counties, or even down to individual ZIP codes.

Step 3: Build Your Core Compliance Rules

With your tool installed, it's time to translate the legal landscape into actual rules. The smart way to do this is to start broad and then dial in the specifics where needed.

-

State-Level Rules: This is your starting point. Can't ship a product to California or New York? Easy. Create a rule that blocks that product category for any customer with a shipping address in those states.

-

County and City Rules: Some jurisdictions love to create their own local ordinances. A classic example is Cook County, Illinois, which often has tighter regulations than the rest of the state. You'll need to create specific rules that target these smaller geographic zones.

-

ZIP Code Exclusions: For those hyper-local restrictions, you can block sales right down to the ZIP code. This is perfect for cities or districts with their own unique laws.

By layering these rules, you create a comprehensive compliance net that catches everything. You can dig deeper into setting up these kinds of controls in our guide on how to restrict Cash on Delivery for regulated WooCommerce products, since many of the same principles apply.

Step 4: Craft Clear Customer-Facing Messages

Let's be real: a blocked sale can be a frustrating experience if you don't handle it well. Instead of hitting your customer with a generic error, your restriction tool should let you display a custom message that explains why the order can't go through.

This is a bad message: "Shipping not available."

This is a good message: "Due to state regulations, we are unable to ship this item to your selected address. Please remove it from your cart to proceed."

That small bit of transparency turns a potential complaint into a moment of education. It shows you're a responsible, law-abiding business, which builds trust even when you can't close the sale. This simple step can slash customer service tickets and cut down on abandoned carts from confused shoppers.

Your Path to Secure and Compliant Sales

Navigating the world of payment gateway restrictions on WooCommerce can feel like walking a tightrope. But there's a clear, sustainable path forward, and it starts with a critical realization: you can't bend the rules of mainstream payment systems and expect to win. The only lasting solution is to step outside that system and build your business on a foundation of compliance.

The old way of doing things—manually checking orders or just hoping to fly under the radar—is a ticking time bomb. Proactive risk management isn't just a buzzword; it's the new standard that separates thriving stores from those getting shut down overnight. Landing a high-risk merchant account is only the first step. Keeping it means proving you're a responsible partner.

The Foundation of a Defensible Business

This is where automated compliance tools become absolutely essential. When you implement a solution like Ship Restrict to automatically block non-compliant sales before they even hit the payment processor, you're sending a powerful message. You're providing concrete proof that you take the law seriously.

This single action directly addresses the core fears of every high-risk underwriter: chargebacks, legal blowback, and damage to their reputation.

A proactive compliance strategy is your most valuable asset. It transforms your business from a perceived liability into a trustworthy, well-managed operation in the eyes of your payment processor, creating a stable foundation for long-term growth.

This automated enforcement isn't just about getting approved. It's the key to keeping that critical merchant relationship healthy for years to come.

Your Next Steps for Sustainable Growth

Protecting your ability to process payments is the same as protecting the future of your business. Don't wait for a nasty compliance letter or a frozen account to force your hand. The time to audit your setup and implement automated controls is now.

Take an honest look at your current workflow. Are you still manually verifying addresses? Is "hope" your primary compliance strategy? If so, you're operating on borrowed time. By embracing the right tools, you can build a truly resilient business that's ready for the complexities of selling regulated goods, letting you focus on growth instead of constantly worrying about getting shut down.

Frequently Asked Questions

Even with a solid compliance plan, you're bound to run into some specific questions when selling regulated products on WooCommerce. Let's tackle a few of the most common ones we hear from merchants.

Can I Use Multiple Payment Gateways on My WooCommerce Store?

Absolutely—and for stores with mixed inventory, it’s a game-changer. A smart approach is to use a gateway management plugin to route your everyday, low-risk products through a standard processor like Stripe.

At the same time, you can direct all your regulated product sales to a specialized high-risk gateway. This hybrid setup lets you lock in the lowest possible transaction fees for most of your catalog while keeping your high-risk sales compliant. Just be aware that this requires meticulous setup to make sure the right orders go to the right processor.

What Is a Rolling Reserve and Why Do High-Risk Processors Use It?

A rolling reserve is a standard practice where your processor holds back a small percentage of your revenue—usually 5-10%—for a set period, often 90 to 180 days. Think of it as a security deposit. It creates a cash buffer for the processor to cover any potential chargebacks, refunds, or fraud tied to your account.

While it definitely impacts your short-term cash flow, a rolling reserve is a non-negotiable part of doing business in most high-risk industries. It protects the processor from taking a huge financial hit if your business suddenly gets slammed with chargebacks, which is ultimately what makes it possible for them to support your industry in the first place.

This is one of the biggest financial differences between standard and high-risk merchant accounts, so be sure to factor it into your financial planning from day one.

Will a Compliance Plugin Guarantee My Account Won't Be Shut Down?

No tool can give you a 100% guarantee against an account shutdown. Processors can change their policies or their appetite for risk at any moment. But using a robust compliance plugin makes your account dramatically more stable and significantly lowers your risk profile.

By automatically blocking illegal sales before they even hit the payment gateway, you’re tackling the two main reasons accounts get terminated: excessive chargebacks and processing illegal transactions. This kind of automated enforcement shows your payment partner that you have strong internal controls, turning your store from a potential liability into a much more attractive, low-risk client. It's a fundamental step toward ensuring the long-term health of your merchant account.

Ready to automate your shipping compliance and protect your payment gateway? Ship Restrict provides the granular control you need to block restricted sales by state, county, or ZIP code, giving your payment processor the confidence to support your business. Learn more and secure your store today at Ship Restrict.

Cody Yurk

Founder and Lead Developer of ShipRestrict, helping e-commerce businesses navigate complex shipping regulations for regulated products. Ecommerce store owner turned developer.