Navigating Florida Alcohol Shipping Restrictions A Guide for eCommerce

Struggling with Florida alcohol shipping restrictions? This guide breaks down the complex laws, licensing, and compliance steps for eCommerce sellers.

Cody Y.

Updated on Jan 4, 2026

Thinking about shipping alcohol to a customer in Florida? Let's get straight to the point: it's extremely restricted. For most online sellers, shipping beer and spirits directly from out-of-state is a non-starter. Only specific, licensed wineries can legally ship wine directly to consumers in the Sunshine State.

The Essential Rules of Shipping Alcohol to Florida

Trying to figure out Florida's alcohol shipping laws can feel like dealing with a very strict doorman at an exclusive club. The state operates on a three-tier system, a rigid framework put in place after Prohibition to control how alcohol is distributed, taxed, and sold. This system is the main reason you can't just box up your product and send it to a customer in Miami—for most sellers, it's flat-out illegal.

Think of it like getting a special permit for a national park. Certain approved tour guides (licensed wineries) can get a pass to take visitors (wine) directly to a destination. But all other vehicles (beer and spirits shipments) are turned away at the state line. No exceptions.

Before we dive deeper, let's get a quick overview of what's allowed and what isn't.

Florida Alcohol Shipping At a Glance

This table gives you a clear, at-a-glance summary of the direct-to-consumer (DTC) shipping rules in Florida.

| Alcohol Type | Shipper Type | Direct-to-Consumer (DTC) Shipping Legality |

|---|---|---|

| Wine | Licensed Wineries (In-State or Out-of-State) | Legal (with proper Florida permit) |

| Beer | Out-of-State Breweries or Retailers | Illegal |

| Spirits | Out-of-State Distilleries or Retailers | Illegal |

As you can see, the rules are simple but strict. If you're not a licensed winery with a Florida permit, you can't ship alcohol directly to consumers there.

Why Are the Rules So Strict?

This tight structure is all about control and public safety. The three-tier system forces alcohol to flow from the producer to a licensed distributor, and then from that distributor to a licensed retailer. This isn't just bureaucracy for its own sake; the system is designed to:

- Prevent Underage Access: By creating a controlled supply chain, the state can better monitor and enforce age verification where it matters most—at the final point of sale.

- Ensure Tax Collection: Each tier acts as a checkpoint for collecting state and local taxes, which are a major source of revenue.

- Maintain Market Order: It protects local wholesalers and retailers by stopping out-of-state companies from flooding the market and undercutting them.

For an eCommerce store, this means that shipping directly to a consumer is seen as an illegal attempt to bypass this mandatory supply chain. Your online store is essentially trying to jump from the first tier straight to the customer, cutting out the required middlemen.

Florida's laws didn't happen overnight. The state first allowed licensed wineries to ship directly to consumers back in 2006, but even that came with a long list of restrictions. What's never changed, however, is the strict ban on direct shipments of spirits and beer from out-of-state retailers, a testament to the enduring power of the three-tier system. You can learn more about the evolution of Florida's regulatory framework and how it continues to shape the industry.

This guide will give you a clear roadmap for navigating these challenges. We'll break down the laws, explain your compliance duties, and show you how to automate your shipping rules to avoid making expensive mistakes.

Why Florida's Three-Tier System Blocks Most eCommerce Sales

Ever tried to figure out why you can't just box up a six-pack of craft beer and ship it to a customer in Miami? The answer isn't just a simple rule. It's a deep-rooted legal structure known as the three-tier system, a post-Prohibition framework that dictates the entire flow of alcohol in the state.

This system is the single biggest reason for Florida's tough alcohol shipping restrictions. If you can wrap your head around it, you'll understand why most direct-to-consumer (DTC) eCommerce sales are dead on arrival.

Think of it like this: a restaurant, by law, is forbidden from buying vegetables directly from a local farm. Instead, the restaurant must purchase all its produce from a government-approved wholesale market, which in turn buys from the farms. This mandatory supply chain creates checkpoints for control, safety, and—most importantly—taxation.

Deconstructing the Three Tiers

The system forces every drop of alcohol to move through a specific, unskippable sequence. Each tier has a distinct and legally defined role. There's no jumping the line.

- Tier 1 Producers: This is where it all starts—the breweries, wineries, and distilleries that make the alcohol. Their job is manufacturing, plain and simple.

- Tier 2 Distributors (Wholesalers): These are the mandatory middlemen. Producers can only sell their products to licensed distributors within Florida.

- Tier 3 Retailers: This is the final stop before the consumer. Retailers, like your local liquor store, bar, or restaurant, are required to buy their inventory from those licensed distributors—never directly from the producers.

For an online seller, shipping directly to a customer is seen as an illegal attempt to leapfrog from Tier 1 straight to the end consumer, completely bypassing the essential second and third tiers. This act fundamentally breaks the state's control over the entire supply chain.

The Historical Purpose and Modern Impact

This structure wasn't designed by accident. The restrictions are a direct reflection of post-Prohibition policies meant to keep organized crime out of the alcohol business. Today, these old-school state rules work hand-in-hand with federal laws, creating a tangled mess of compliance for any eCommerce retailer. You can get a deeper sense of the history from this overview of Florida's alcohol regulations%20Overview%20(w-020-0266)(1).pdf).

This rigid system has a massive impact on modern business. On one hand, it guarantees the state can collect taxes at each transfer point and holds specific parties accountable for verifying legal drinking age. On the other hand, it creates huge hurdles for small producers and online stores that are built on a direct-to-consumer model.

The core takeaway is this: Florida's laws were never designed to accommodate modern eCommerce logistics for beer and spirits. The system is built on a foundation of in-person, localized sales managed by licensed, in-state retailers.

Given that Florida's three-tier system effectively walls off most direct-to-consumer eCommerce, focusing on your local customers becomes absolutely critical. Since you can't reach a statewide audience online, you have to maximize your visibility to people in your immediate area. This makes optimizing your Google Business Profile for local search an essential strategy for any Florida-based alcohol business. By dominating local search, you can attract customers who can legally buy from you in person or through approved local delivery channels.

Your Compliance Checklist for Every Florida Shipment

For the handful of wineries holding a Florida direct-shipping permit, compliance isn’t a one-time task. It's a strict playbook you have to run for every single order. One mistake on one shipment can put your entire license on the line. Think of it less like a simple sale and more like filing a legal document—every detail has to be perfect, every time.

This checklist breaks down your core obligations into clear, actionable steps. Follow these rules, and you can be confident that every bottle you send is fully compliant from the moment it leaves your winery until it’s in the customer's hands.

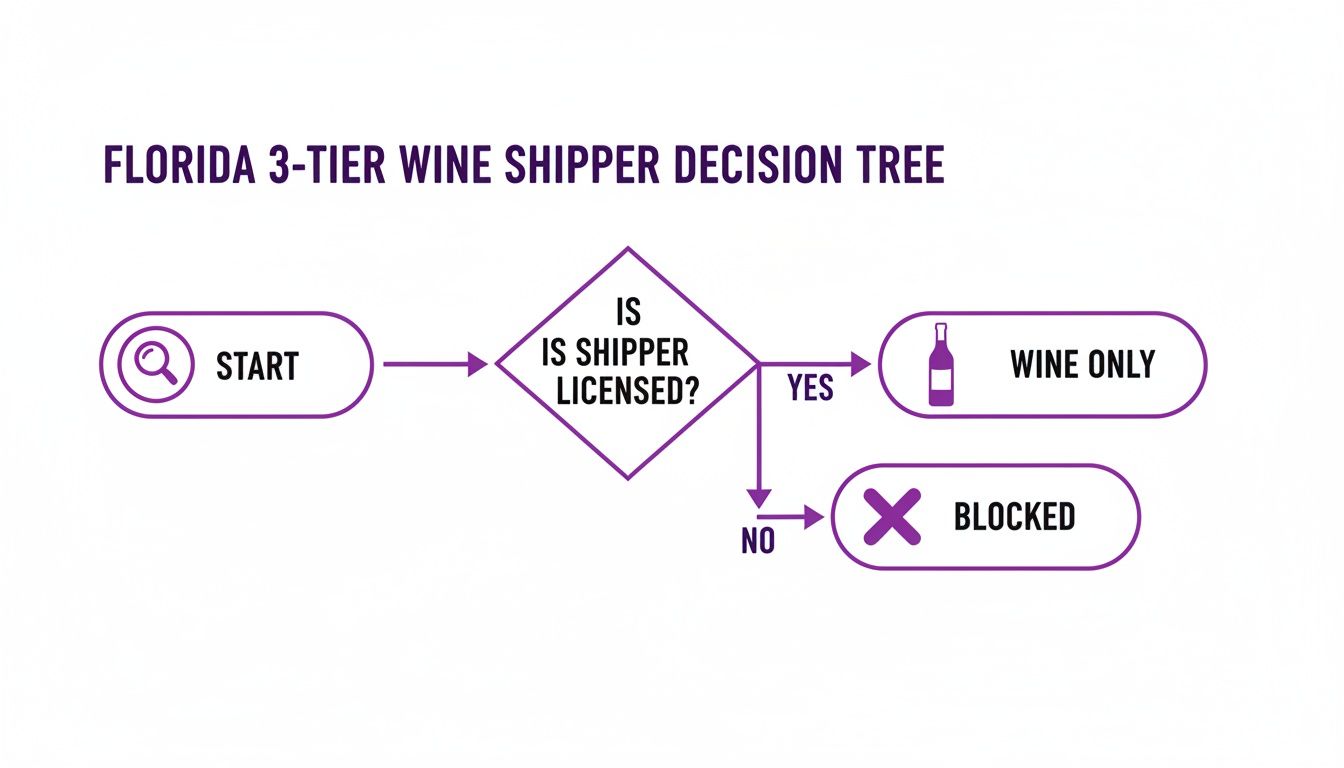

The flowchart below shows the first and most critical decision every shipper has to make before even thinking about sending alcohol to Florida.

As you can see, it's a simple gate: only licensed wineries are allowed through. Everyone else is stopped cold.

The Two-Point Age Verification Mandate

Florida law is crystal clear on this: you need a solid, two-step age verification process to stop sales to minors. This isn't a suggestion—it’s a legal requirement with serious penalties if you fail.

- Verification at Point of Sale: You must confirm the buyer's age before the online transaction goes through. This usually means using a third-party service that checks the customer's info against public records to prove they are at least 21 years old.

- Verification Upon Delivery: The check happens all over again at the customer’s doorstep. Your carrier (like FedEx or UPS) has to get a signature from an adult who is 21 or older. The package can't be left on the porch or handed to a teenager, no exceptions.

This two-gate system is your main line of defense against illegal sales. For a deeper dive, check out our guide on age verification for online sales of regulated products, which offers practical strategies you can use on your own e-commerce site.

Proper Labeling on Every Package

The state is incredibly specific about how your boxes must be labeled. This isn't about your branding; it's about making the contents obvious to carriers and regulators. Every single box shipped to a Florida address has to have a label that says:

CONTAINS ALCOHOLIC BEVERAGES. SIGNATURE OF PERSON 21 YEARS OF AGE OR OLDER REQUIRED FOR DELIVERY.

This exact phrase, or something very close to it, needs to be easy to spot and read. Forgetting to label a shipment is a rookie mistake and a clear violation that’s easily caught by carriers or state auditors. It’s a simple step that’s easy to get right but painful to get wrong.

Navigating Florida's Tax Requirements

As a licensed shipper, you are on the hook for collecting and sending two different taxes to the state for every sale. This is a non-negotiable part of your permit obligations.

- Florida Sales Tax: You have to collect the state sales tax, which is currently 6%, plus any local sales taxes that apply based on the delivery address.

- Florida Excise Tax: You also have to pay Florida's excise tax on wine. Right now, that’s $2.25 per gallon. This tax is usually paid to the state monthly or quarterly, depending on your assigned schedule.

These tax duties mean you need a system that can accurately calculate, collect, and remit the right amounts for every single order. Keep your records straight, because the Florida Department of Revenue can audit your sales anytime. Your permit to ship into the state is directly tied to how faithfully you handle these taxes.

The High Cost of Ignoring Florida Shipping Laws

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/Q1clmrluwRY" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>Thinking about just risking it and shipping illegally into Florida? You wouldn't be the first. Many online retailers see a massive, untapped market and wonder if they can just fly under the radar.

But this isn't about bending a minor rule. It's about stepping into a minefield of severe, business-ending consequences. The penalties for non-compliance go far beyond a simple slap on the wrist.

Ignoring Florida's alcohol shipping laws is a high-stakes gamble where the house always wins. The state doesn't take kindly to businesses that bypass its mandatory three-tier system, and the enforcement measures in place are designed to make illicit shipping a painful and expensive mistake.

Penalties Ranging From Fines to Felonies

The consequences for illegally shipping alcohol into Florida are severe and they escalate quickly. Depending on the volume and frequency of the violations, you could face a range of penalties that can absolutely cripple your business.

- Crippling Fines: Financial penalties can be substantial, often calculated per illegal shipment. These fines pile up fast, turning any potential profit into a staggering loss.

- License Revocation: If you hold any alcohol-related licenses in your home state, a violation in Florida could put them in jeopardy. State agencies talk to each other, meaning a felony charge elsewhere can impact your ability to operate legally anywhere.

- Felony Charges: This is where it gets serious. In Florida, knowingly shipping alcohol without the proper permits isn't just a civil infraction—it's often classified as a third-degree felony. That carries the risk of prison time and permanently tanks your business's reputation.

Make no mistake: state agencies are not turning a blind eye. The sheer amount of lost tax revenue provides a powerful financial incentive for aggressive enforcement. Trying to "fly under the radar" isn't a business strategy; it's a countdown to getting caught.

Understanding these risks is just smart business. The financial and legal exposure from even a single mistake can be immense. For a broader look, check out our detailed breakdown of the true cost of shipping compliance violations, which covers fines, fees, and other consequences nationwide.

How Illicit Shippers Are Caught

If you think your little package will just blend in with the millions shipped daily, think again. State agencies have surprisingly sophisticated methods for tracking and flagging illegal alcohol shipments. Their secret weapon? The shipping carriers themselves.

Common carriers like FedEx and UPS are required by law to report shipping data to state regulators. This means every single package you send is logged, and specialized enforcement units can easily spot suspicious activity. They look for patterns like:

- Unlicensed shippers sending multiple packages to residential addresses.

- Shipments coming from businesses known to sell alcohol.

- Packages with incorrect or deliberately misleading labels.

These data-driven "sting" operations make it incredibly difficult to operate in the shadows for long. The carrier data provides a clear, undeniable paper trail that leads directly back to you, making their case a slam dunk.

The Staggering Scale of Lost Tax Revenue

To really understand Florida’s motivation for cracking down, you just have to follow the money. Look at what other states have found.

When Illinois dug into carrier shipping reports, they estimated the state was losing around $20 million in tax revenue every year from illegal shipments. Michigan's story is just as stark: in 2019 alone, 734,365 bottles—a full 33 percent of all shipments—were shipped illegally into the state. You can discover more about these findings on illegal alcohol shipping and see the financial impact for yourself.

These numbers highlight the immense pressure states are under to capture that lost revenue. For Florida, every illegal shipment of beer, wine, or spirits represents uncollected excise and sales taxes. This financial reality turns enforcement from a simple regulatory duty into a critical revenue-generating activity, ensuring that non-compliant sellers are actively hunted down. The risk simply isn't worth the reward.

How to Automate Shipping Compliance in WooCommerce

Manually checking every single order against Florida's maze of alcohol shipping laws isn't just a drain on your time—it's a recipe for expensive mistakes. The legal theory is dense, but the solution is actually pretty simple: turn those regulations into an automated, foolproof process. With the right tools, you can transform compliance from a constant headache into a background task that just works.

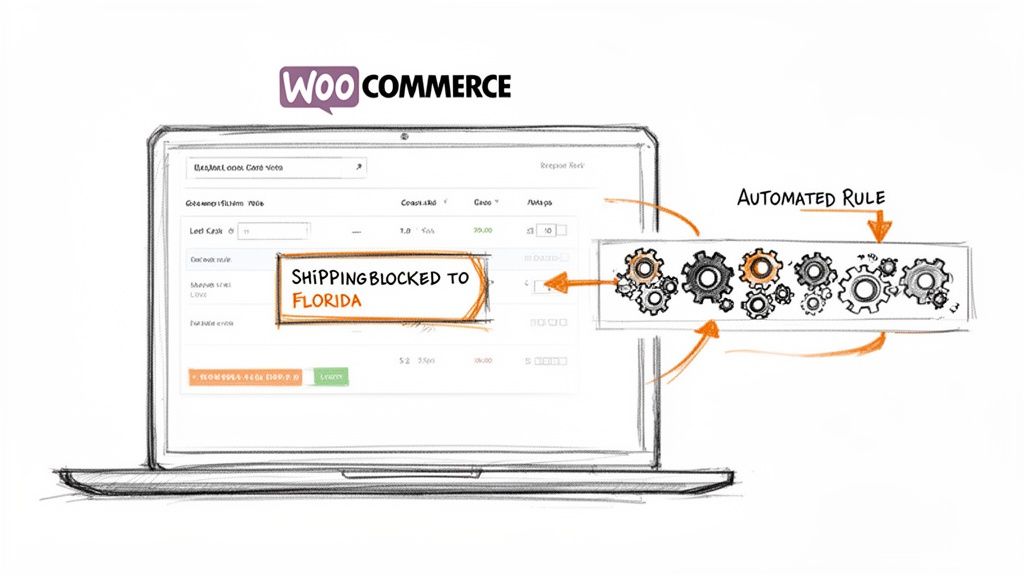

Instead of asking your team to memorize which spirits can't ship to Miami-Dade or that a specific ZIP code is off-limits, you build those rules directly into your WooCommerce store. This approach stops illegal orders before they’re even placed, saving you from the logistical mess of cancellations, angry customer emails, and costly shipping errors.

Think of it less like adding another complicated tool and more like hiring a digital bouncer who works 24/7 to protect your business.

From Manual Checks to Automated Rules

Imagine a customer in Orlando adds a bottle of craft gin to their cart. Without automation, that order might slip through, only getting flagged when your team is packing the box. Now you have to contact the customer, explain the law, process a refund, and hope they don't leave a one-star review. It’s a terrible experience for everyone.

Now, picture this: the moment that customer enters their Florida shipping address, the checkout is instantly blocked. But it doesn't just stop them. A clear, customized message appears explaining why the sale can't be completed due to state law. You've just turned a potential compliance failure into a moment of transparent customer education.

Key Takeaway: Automation flips your compliance strategy from reactive to proactive. Instead of catching mistakes after they happen, you prevent them from ever occurring, ensuring every single order you receive is one you can legally fulfill.

Creating Your First Shipping Rule

Getting these automated guardrails set up in WooCommerce is surprisingly straightforward with a tool like Ship Restrict. You can translate Florida's strict laws into simple, logical rules right inside your store’s dashboard.

Here’s a quick look at how you’d create a rule to block all spirit sales to Florida, a common hurdle for out-of-state sellers:

- Define the Restriction: Give your rule a clear name, like "Block Spirits to Florida."

- Select the Restricted Location: Choose "Florida" as the state where this rule applies.

- Specify the Product Category: Apply the rule to your "Spirits" product category. This ensures it only triggers for the right items.

- Set the Action: Configure the rule to "Prevent checkout" if all conditions are met.

This setup creates a digital fence around Florida for your spirits, automatically enforcing one of the most important Florida alcohol shipping restrictions without any manual effort.

Beyond State-Level Blocking

While blocking an entire state is a good start, true compliance often lives in the details. Regulations can vary by county or even by ZIP code, especially in states with "dry" or "damp" areas. A powerful automation tool lets you get that specific.

- County-Level Rules: Block shipments to specific counties where local ordinances are tougher than state law.

- ZIP Code Exclusions: Target individual ZIP codes that might be part of a dry town or municipality.

- Product-Specific Rules: Apply restrictions to a single product that has unique shipping constraints.

This level of control is where the real power lies. Automating your store's shipping logic not only frees up countless hours of manual work but also builds a rock-solid defense against accidental violations. For a deeper dive, check out our guide on automated shipping compliance for WooCommerce stores, which covers more advanced rule-building techniques.

As you streamline your operations, it's worth looking at the full picture. Integrating tools like a WooCommerce crypto payment guide can help you automate payment processing alongside logistics. When your shipping rules and payment options work together seamlessly, you create a more efficient, error-proof system from cart to checkout. That means more time to focus on growing your business and less time tangled up in admin tasks.

Florida Alcohol Shipping: Your Questions Answered

Even with a solid grasp of the big picture, the devil is always in the details. Merchants often bump into specific scenarios that the main regulations don't spell out clearly. Let's tackle the most common questions we hear from e-commerce sellers about shipping alcohol to Florida.

Think of this as the final check-in to clear up any lingering confusion. By addressing these tricky situations head-on, you can navigate Florida's laws with a lot more confidence.

Can I Ship a Bottle of Wine as a Gift to My Friend in Florida?

This is probably the number one question we get, and the answer is a hard no—at least, not if you're an unlicensed individual. You are strictly forbidden from shipping any alcohol yourself using carriers like USPS, FedEx, or UPS. Slapping a "gift" label on the box doesn't give you a pass.

The only legal way for alcohol to get shipped to a Florida resident is if it comes from a business with the right permits. That means a winery holding a valid Florida direct-shipping permit has to be the one sending the package. The rules for big retailers also apply to individuals, and trying to ship a bottle on your own will likely get the package seized and could land you in hot water.

Are the Rules Different for Shipping from Inside Florida?

Yes, they're completely different. The regulations for shipping within Florida (intrastate) are a whole different ballgame from shipping into Florida from another state (interstate). Most of the strict rules we've discussed are designed to stop out-of-state sellers from sidestepping Florida's three-tier system.

A licensed liquor store in Miami shipping to a customer in Orlando operates under a separate set of state laws. These local businesses can often use their own delivery vans or approved local courier services. This is exactly why a local shop can offer same-day delivery, while your out-of-state e-commerce store can't legally send the same bottle to that same customer.

Key Takeaway: The line between intrastate and interstate shipping is critical. Florida’s laws are built to protect its local, three-tier distribution system from outside competition. Local delivery is a separate, state-regulated world.

Do Small Craft Distilleries Get Any Shipping Exceptions?

Unfortunately, no. Florida's laws don't carve out any special exceptions for small-batch or craft spirit producers shipping from another state. The ban on direct-to-consumer (DTC) spirits shipments is absolute and applies to everyone, no matter how small their operation or unique their story.

This "one-size-fits-all" approach is a massive hurdle for independent distilleries. To legally sell in the Florida market, a craft producer has to play by the traditional three-tier rules:

- First, they must sign a deal with a licensed Florida distributor.

- That distributor then sells their product to licensed Florida retailers (liquor stores, bars, etc.).

- Finally, a consumer can walk into one of those local retailers and buy the bottle.

This system forces small producers into a crowded and competitive distribution network, making it incredibly difficult to connect with customers directly.

How Can Automation Handle Other Regulated Products?

A smart shipping rules engine isn't a one-trick pony for alcohol. The same powerful logic that blocks illegal liquor shipments can be applied to any product with location-based restrictions, making it an essential tool for stores with diverse catalogs.

With a good system, you can easily set up rules to manage all sorts of complex scenarios. For example, you can block the sale of:

- Vaping Products: Restrict sales to states, counties, or even specific cities where they're banned.

- Firearm Accessories: Stop shipments of certain components to places with magazine capacity limits.

- Agricultural Items: Prevent the sale of specific seeds or plants to states with laws against invasive species.

This kind of flexibility lets you manage your entire store's compliance from one place.

What if I Sell Both Regulated and Unregulated Items?

This is where a truly capable system proves its worth. You can configure rules based on product categories, tags, or even individual SKUs, ensuring restrictions only apply to the items that actually need them.

Picture this: a customer in Florida adds a prohibited bottle of bourbon and a branded t-shirt to their cart. A well-configured system won't just block the entire sale. Instead, it will:

- Instantly identify the restricted item (the bourbon).

- Display a clear message explaining why that specific item can't be shipped to Florida.

- Allow the customer to simply remove the bourbon and check out with the t-shirt.

This granular control is the key to preventing lost sales. It stops you from frustrating customers who are trying to buy perfectly legal items, protecting your business without killing your revenue from unrestricted products.

Ready to stop worrying about complex shipping laws and start automating your compliance? Ship Restrict is the powerful WooCommerce plugin that lets you create granular shipping rules in minutes. Block sales by state, county, or ZIP code, and provide clear, automated messages to your customers.

Protect your business, save time, and eliminate costly shipping errors. Get Ship Restrict today!

Cody Yurk

Founder and Lead Developer of ShipRestrict, helping e-commerce businesses navigate complex shipping regulations for regulated products. Ecommerce store owner turned developer.