CBD/Hemp/THCA Shipping Laws Texas: Complete Guide

Learn everything about CBD/Hemp/THCA Shipping Laws Texas. Stay compliant with our expert guide on Texas shipping regulations and legal tips.

Cody Y.

Updated on Oct 9, 2025

Shipping CBD, hemp, and even THCA products to Texas is technically legal, but it’s nowhere near as simple as just following federal law. The Lone Star State plays by its own rulebook, with strict guidelines on THC content that can easily catch uninformed sellers off guard. Getting a handle on the CBD/Hemp/THCA shipping laws Texas enforces is non-negotiable if you want to avoid seized packages and serious legal headaches.

Your Quick Guide to Shipping Cannabinoids in Texas

Trying to untangle cannabinoid shipping regulations can feel like solving a puzzle with pieces from different boxes. On one hand, you have the federal 2018 Farm Bill, which legalized hemp nationwide as long as it contains less than 0.3% Delta-9 THC. But Texas decided to add its own complex layers to that law, creating a tricky dual-compliance challenge for any business shipping into the state.

The Texas Twist on THC Calculation

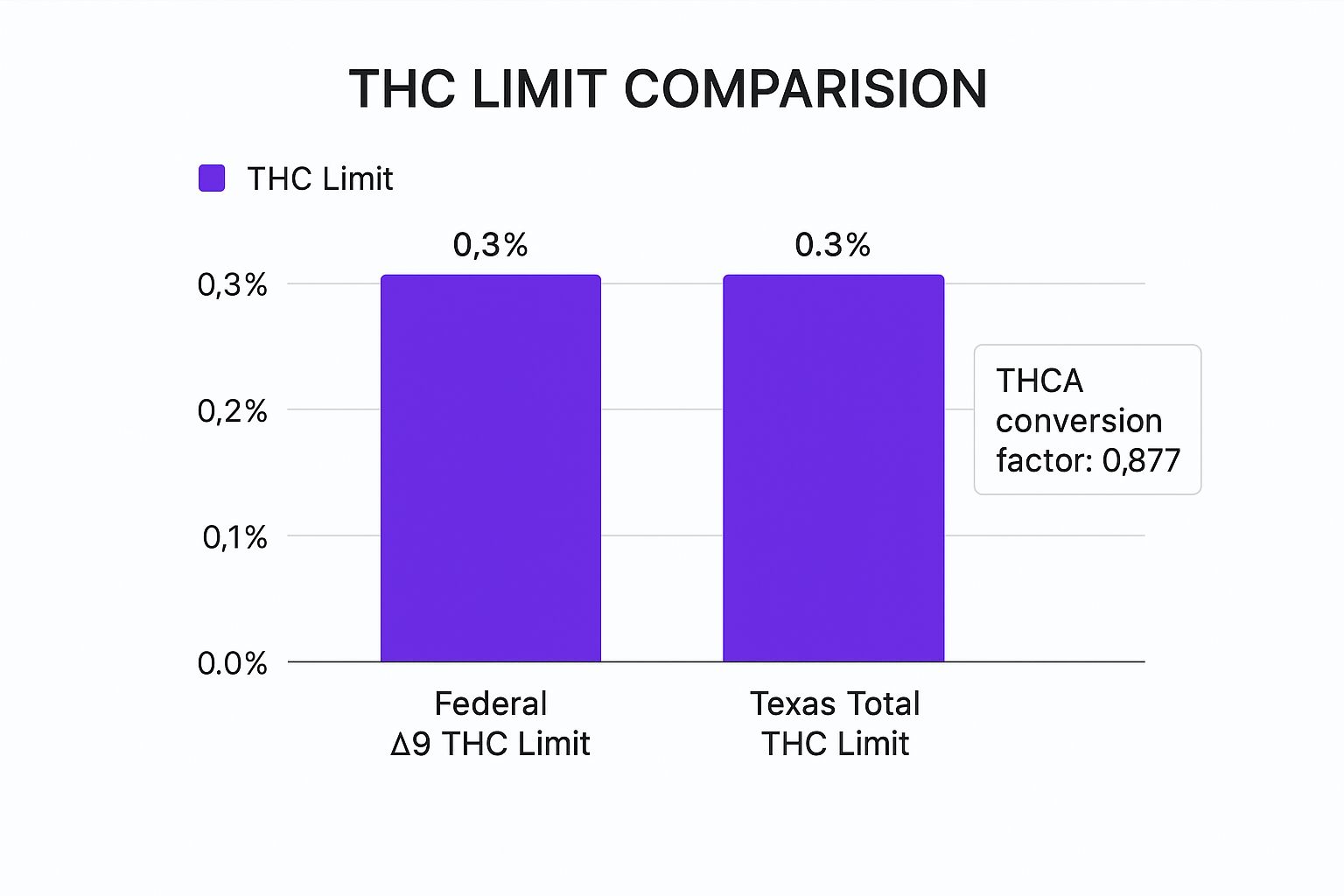

The single biggest difference—and the one that causes the most confusion—is how Texas measures THC. While federal law looks only at Delta-9 THC, Texas requires a "Total THC" calculation. This formula accounts for the potential of THCA to convert into psychoactive Delta-9 THC when heated (a process called decarboxylation).

This Total THC requirement—calculated as (THCA x 0.877) + Delta-9 THC—is the primary reason shipping THCA products into Texas is so legally risky. A product that looks perfectly compliant on a federal level could easily be classified as illegal marijuana under state law.

This means you can't just glance at a Certificate of Analysis (COA) for the Delta-9 THC level and call it a day. Your products must pass the stricter Texas standard to be considered legal.

Key Regulatory Agencies to Know

Two main state agencies are in charge of enforcing these rules, and their decisions directly affect how you operate:

- Texas Department of State Health Services (DSHS): This is the main player. The DSHS manages the state’s consumable hemp program, setting the rules for everything from licensing and testing protocols to what has to be on your product labels.

- Texas Alcoholic Beverage Commission (TABC): A more recent addition to the scene, the TABC has stepped in to enforce certain rules, like the under-21 age restriction for buying consumable hemp products.

Keeping an eye on both agencies is crucial for staying ahead of regulatory changes and keeping your shipments compliant. Before we get into the nitty-gritty details, the table below gives a quick snapshot of where things stand for shipping cannabinoids to Texas.

Texas Cannabinoid Shipping Legality at a Glance

Here’s a quick summary of the legal status for popular cannabinoid products being shipped into Texas and the key rules you need to follow.

| Product Type | Legal Status | Key Shipping Requirement |

|---|---|---|

| CBD Products | Legal | Must contain less than 0.3% Total THC and follow all state labeling laws. |

| Hemp Flower | Legal | Subject to the same 0.3% Total THC limit and must be shipped with a valid COA. |

| THCA Products | High-Risk | Legality is murky. Must pass the strict Texas Total THC calculation to avoid being classified as marijuana. |

| Hemp Vapes | Banned (Retail) | Retail sale of hemp-derived vapes is banned as of Sept. 1, 2025, but online sales may still be permitted. |

This table provides a high-level overview, but as you can see, the devil is in the details—especially when it comes to that Total THC calculation.

Decoding Federal vs. Texas State Hemp Regulations

If you want to ship hemp products into Texas without any headaches, you have to understand the two different layers of law you’re dealing with. It’s a lot like a two-step verification process—just because you clear the first step doesn’t mean you’ll get through the second.

Everything starts at the national level. The 2018 Farm Bill was the piece of legislation that changed the game, making industrial hemp federally legal. It defined hemp as any part of the Cannabis sativa L. plant with less than 0.3% Delta-9 THC on a dry weight basis. This bill kicked the door open for a national CBD and hemp market, setting a baseline for legal sales across the country.

But the Farm Bill also gave states the power to create their own rules. Texas didn't just copy the federal guidelines; it built a much stricter set of rules right on top of them. Just meeting that 0.3% Delta-9 THC limit isn't nearly enough to stay compliant in the Lone Star State.

The Critical Total THC Calculation in Texas

The biggest difference between federal and Texas law is how the state measures THC content. While the feds only look at the existing Delta-9 THC in a product, Texas law demands a “Total THC” test. This creates a much higher bar for businesses to clear.

This calculation is designed to account for a chemical reality: THCA, a non-psychoactive cannabinoid, turns into psychoactive Delta-9 THC when it's heated. So, Texas requires a product’s Total THC level—calculated as (THCA x 0.877) + Delta-9 THC—to stay below the 0.3% line. This is a massive distinction that makes many high-THCA products illegal here, even if they’re perfectly fine elsewhere. Understanding the nuances of these general hemp shipping rules and restrictions is the first step to shipping successfully.

Imagine this scenario: A product has just 0.1% Delta-9 THC, making it federally legal. But it also contains 0.5% THCA. Under the Texas formula, its Total THC would be about 0.54%, which classifies it as illegal marijuana and puts your shipment in jeopardy.

This one detail is the core of the complexity behind the CBD/Hemp/THCA shipping laws Texas enforces. It’s exactly why relying on federal compliance alone gives sellers a false sense of security.

How State Agencies Add More Layers

On top of the Total THC rule, Texas agencies are constantly adding more restrictions that affect how you do business. A perfect example comes from the Texas Alcoholic Beverage Commission (TABC), which recently put emergency rules in place that hit retailers directly.

These TABC rules ban the sale of consumable hemp products to anyone under 21 and require mandatory ID checks at the point of sale. This shows a clear state-level push to keep these products away from minors. The regulatory landscape here is always shifting, and you have to stay vigilant to make sure your shipping practices are compliant with both federal and state mandates.

Ignoring these Texas-specific nuances isn’t a small mistake. It’s a direct path to seized products, lost revenue, and potential legal trouble.

Navigating the Legal Minefield of Shipping THCA

When it comes to shipping cannabinoids, Tetrahydrocannabinolic acid, or THCA, is where the rules get incredibly tricky. This is the compound that creates the most significant legal headaches for businesses shipping to Texas, turning what seems like a simple sale into a high-stakes gamble.

At its core, THCA is the non-psychoactive precursor to the famous Delta-9 THC. In its raw form, it won't produce a "high." This chemical quirk is why some sellers argue that THCA products are federally legal under the 2018 Farm Bill, as long as they come from hemp with less than 0.3% Delta-9 THC.

But here's the catch: that federal argument completely falls apart the moment a package crosses into the Lone Star State.

The Texas Total THC Loophole Closure

Texas law slams the door on the federal "THCA loophole" with its mandatory Total THC calculation. As we've covered, this formula—(THCA x 0.877) + Delta-9 THC—is designed to measure a product's full psychoactive potential after it's heated.

This single legislative detail is a game-changer.

A THCA-rich product that's perfectly compliant at the federal level can instantly become illegal contraband under Texas's stricter standard. This fundamental difference is the primary source of confusion and risk when you're trying to understand the CBD/Hemp/THCA shipping laws Texas has on the books.

The infographic below shows just how different these two standards really are.

It's clear that while both limits are set at 0.3%, the way Texas gets to that number—by including THCA's potential conversion—drastically narrows what counts as a legal hemp product.

The Real-World Risks of Shipping THCA

Shipping THCA to Texas isn't just a compliance headache; it's a major business risk. The legal gray area surrounding its status can lead to some pretty severe consequences for unprepared sellers.

These potential risks include:

- Package Seizures: Law enforcement can intercept and seize any package they suspect contains illegal substances. If the contents test above the 0.3% Total THC limit, your product is gone for good.

- Financial Loss: A seized shipment means lost product, lost revenue, and an unhappy customer. A few of those in a row can seriously damage your company's bottom line and reputation.

- Legal Action: In a worst-case scenario, shipping products classified as marijuana under state law could lead to serious legal trouble for both you and your customer.

Getting through this complex environment requires more than just crossing your fingers; it demands a proactive and meticulous approach to compliance. Distinguishing between federally defined hemp and what Texas considers marijuana is absolutely critical. To get a better handle on this, check out our guide on the critical shipping law differences between hemp vs. marijuana products.

A Practical Playbook for Mitigating THCA Shipping Risks

While the legal landscape is challenging, you can take concrete steps to protect your business. The key is to operate with extreme caution and leave absolutely no room for interpretation.

Here’s an actionable checklist to minimize your risk:

- Always Include Current COAs: Every single shipment must contain a valid and recent Certificate of Analysis (COA) from a third-party lab. This document is your primary evidence that the product meets Texas's Total THC requirement. Make sure it's packed inside and easy to find.

- Use Discreet and Secure Packaging: Avoid any branding or labeling on the outside of your package that hints at its contents. Plain, professional packaging is your best bet to reduce unwanted scrutiny during transit.

- Adhere to Texas Labeling Laws Perfectly: Your product labels have to follow all DSHS requirements to the letter. This includes scannable QR codes linking to the COA, batch numbers, and all necessary warnings. Non-compliant labeling is an immediate red flag for regulators.

By treating every THCA shipment as a high-risk delivery and having your documentation in perfect order, you can build a strong defense against potential seizures and legal trouble.

Your Checklist for Compliant Texas Shipments

Let's get practical. Proper documentation isn’t just about checking boxes; it's your frontline defense against seized packages and legal headaches. Think of it as a passport for your product. Without the right paperwork, your shipment is going nowhere fast in Texas.

This checklist breaks down exactly what you need for every single hemp shipment, starting with the most important piece of the puzzle.

That piece is the Certificate of Analysis (COA). This isn't optional. Issued by an accredited third-party lab, the COA is your non-negotiable proof that your product is legal under Texas law. It's the official report card that tells regulators, law enforcement, and even your customers what's inside.

Every single shipment destined for Texas must include a copy of its corresponding COA. This is a hard-and-fast rule under the state’s consumable hemp program.

Decoding the Certificate of Analysis

Just having a lab report isn't enough—it has to be the right kind of lab report. Texas regulators are looking for specific, detailed information presented in a clear format.

A compliant COA must explicitly show:

- Cannabinoid Potency: A clear breakdown of all major cannabinoids, including CBD, CBG, and all forms of THC.

- Total THC Calculation: The report must show a "Total THC" concentration that is below 0.3%. This number has to be calculated using the state-mandated formula: (THCA x 0.877) + Delta-9 THC.

- Batch Information: The COA must be tied to the specific product batch being shipped to ensure full traceability.

- Lab Accreditation: The name and credentials of the testing lab must be clearly visible.

A COA is your shipment’s best advocate. It speaks the language of compliance and can be the single thing that prevents a routine inspection from turning into a costly seizure. Don't even think about shipping without it.

And remember, beyond these specific hemp rules, it's smart to ensure your overall business practices follow general legal compliance and terms. A solid legal foundation protects your entire operation.

Texas Product Labeling Requirements

Once your product’s contents are verified with a COA, the label on the outside of the package has to tell the same story and meet a bunch of other Texas-specific rules. The Texas Department of State Health Services (DSHS) has strict mandates designed for consumer safety and total transparency.

Your product label absolutely must include:

- A Scannable QR Code: This code needs to link directly to the COA for that specific product batch. It's an instant verification tool for anyone, from a customer to a state regulator.

- Batch Identification Number: This unique number is what connects the physical product to its COA and your internal manufacturing records.

- Product Name and Manufacturer: Simple, clear identification of the product and the company behind it.

- Required Warnings: Texas mandates specific warnings, including advisories for pregnant or nursing women and a clear statement that the product could cause a positive drug test.

For online sellers, trying to manage all these rules at scale is a huge operational drag. Figuring out how to navigate CBD and hemp shipping restrictions in WooCommerce can automate these complex checks and save you a ton of time and stress.

To make it crystal clear, the table below shows the difference between a label that will sail through inspection and one that's guaranteed to get flagged.

Compliant vs. Non-Compliant Hemp Product Labeling for Texas

This comparison shines a light on the common, seemingly small mistakes that can make an otherwise legal product non-compliant the moment it hits Texas soil.

| Labeling Element | Compliant Example | Non-Compliant Mistake |

|---|---|---|

| QR Code | A scannable code linking directly to the product's batch-specific COA. | A broken link, a link to the company's homepage, or no QR code at all. |

| THC Content | States "Total THC: <0.3%" or similar compliant language. | Only lists Delta-9 THC, ignoring the Total THC requirement, or makes false claims. |

| Required Warnings | Includes all DSHS-mandated health and safety warnings. | Missing key warnings, such as the drug test advisory. |

| Batch Number | A unique, clearly printed batch number that matches the COA. | No batch number, or a generic number that doesn't correspond to a lab report. |

Getting these documentary and labeling details right is what separates the successful shippers from those constantly fighting compliance fires in the Texas market. It’s all about attention to detail.

The Money and Politics Shaping Texas Hemp Laws

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/9Zgn3r/9AVR8" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>To really understand the "why" behind Texas's tangled hemp laws, you have to follow the money and the politics. These regulations aren't just about public safety; they're the result of a high-stakes tug-of-war between powerful economic interests and shifting political views.

This constant tension provides the critical context for why the CBD/Hemp/THCA shipping laws Texas enforces are so complex and always seem to be on shaky ground.

On one side of this fight, you have a booming, multi-billion-dollar industry. Hemp and its derivatives have exploded in popularity, creating a massive economic footprint in the state. This isn't some tiny niche market—it's a major player in the Texas economy.

The Economic Powerhouse of Texas Hemp

The sheer scale of the hemp industry gives it a powerful defense against legislative efforts to ban or severely restrict its products. From an economic standpoint, hemp and its derivatives represent a huge market, with annual sales estimated at a staggering $5.5 billion.

This vibrant industry supports roughly 53,000 jobs statewide. It also pumps about $268 million into state coffers through crucial tax revenues.

On top of that, retail revenues for hemp-derived THC products have surged, climbing from $3.3 billion in 2023 to a projected $4.3 billion. A huge chunk of that growth comes from sales in convenience stores, grocery outlets, and gas stations—tapping into Texas’s status as one of the largest convenience store markets in the country. You can dive deeper into how hemp-THC sales remain largely unrestricted in Texas on cspdailynews.com.

This kind of economic impact makes a compelling argument for lawmakers to choose regulation over outright prohibition. When the legislature debates the future of hemp, these numbers—jobs, sales, and taxes—do the talking, making it politically tough to shut down such a profitable sector.

The Political Tug-of-War

Despite the economic upside, the industry faces constant heat from politicians who see hemp-derived products as a public health risk or a back door to legalizing marijuana. This dynamic creates a never-ending political battle.

On one side, you have legislators pushing for stricter controls, lower THC limits, and even outright bans. On the other, you have a coalition of business owners, consumers, and pro-market lawmakers who argue for a lighter touch focused on consumer safety, clear labeling, and age verification.

This ongoing fight is exactly why Texas hemp law can feel so contradictory. For instance, while repeated efforts to ban most hemp-THC products have failed in legislative sessions, lawmakers did manage to pass a ban on the retail sale of hemp-derived vape products, which kicks in in 2025.

This volatile environment means the legal landscape is never really settled. For any business shipping into Texas, this political reality is just as important as the letter of the law. Keeping an eye on legislative trends is essential for seeing what’s coming next and making smart, proactive moves in a market that's anything but predictable.

Common Questions on Texas Hemp Shipping

Even after breaking down the regulations, you're probably left with a few practical questions. Let's walk through some of the most common concerns we hear from both businesses and customers, so you can navigate the Texas hemp market with confidence.

Can I Legally Receive THCA Products by Mail?

Ordering THCA products for delivery in Texas is a huge gamble. While a product might be perfectly legal under federal law, Texas authorities use a "Total THC" standard for testing. This means that a federally compliant THCA flower could easily be classified as illegal marijuana once it's tested here.

If you're going to take the risk, only order from reputable vendors who provide a detailed, batch-specific Certificate of Analysis (COA). That document isn't just a suggestion—it must show that the product's Total THC level is safely under the 0.3% state threshold.

What Happens If My CBD Shipment Gets Seized?

If your package is seized by law enforcement, it's going straight to a lab for testing. If it fails the state's strict "Total THC" test, the product will be destroyed. Worse, both the sender and the receiver could potentially face legal trouble.

On the other hand, if your product is fully compliant and all the right paperwork is included (like a valid COA), it will most likely be released after a delay. This is exactly why perfect documentation is non-negotiable for anyone dealing with the CBD/Hemp/THCA shipping laws Texas enforces. It's your best line of defense.

Are Any Hemp Products Banned from Texas Shipments?

Yes, and every shipper needs to know these rules by heart. Texas law explicitly bans the manufacturing and processing of any consumable hemp product designed for smoking.

There's also a major recent development: a ban on all vape products containing any hemp-derived cannabinoids. Shipping these specific items into Texas is flat-out illegal and comes with a high risk of seizure and enforcement action.

Does an Out-of-State Company Need a Texas License?

Absolutely. Any business, regardless of where they are located, that sells and ships consumable hemp products to Texas customers must be licensed through the state's official program.

As a consumer, it's on you to check that you're buying from a licensed and reputable company. A legitimate seller will have no problem following all of Texas's testing and labeling laws. Doing that little bit of homework is the best way to protect yourself and ensure you're getting a product that is both legal and safe.

Trying to keep up with the tangled web of state hemp laws can feel like a full-time job, but automation makes it simple. Ship Restrict lets you create precise shipping rules by state, county, or even ZIP code, so you never accidentally ship a restricted product where it doesn't belong. Stop wasting time with manual checks and let Ship Restrict handle your compliance automatically. Learn more at ShipRestrict.com.

Cody Yurk

Founder and Lead Developer of ShipRestrict, helping e-commerce businesses navigate complex shipping regulations for regulated products. Ecommerce store owner turned developer.